Blockchain technology is a disruptive solution with the potential to solve some of the world’s biggest problems by introducing a never-experienced layer of transparency, accountability, and consensus. Bitcoin brought the idea of Blockchain technology to the limelight and it remains the most popular application of Blockchain.

Bitcoin was launched in 2009 by Satoshi Nakamoto as a “purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”. In the last 10 years, Bitcoin has changed the world, triggered paradigm shifts in how people think about the concept of money, and it birthed an industry valued at more than $200B.

Nonetheless, the Bitcoin network is not perfect, and it has huge technical limitations that could prevent it from being the future of money. Bitcoin’s ability to co-exist with (or replace) fiat currencies is currently being hampered by its scalability challenges. This piece provides insight on sidechains as technical workarounds that might help Bitcoin achieve the decentralization of money at scale.

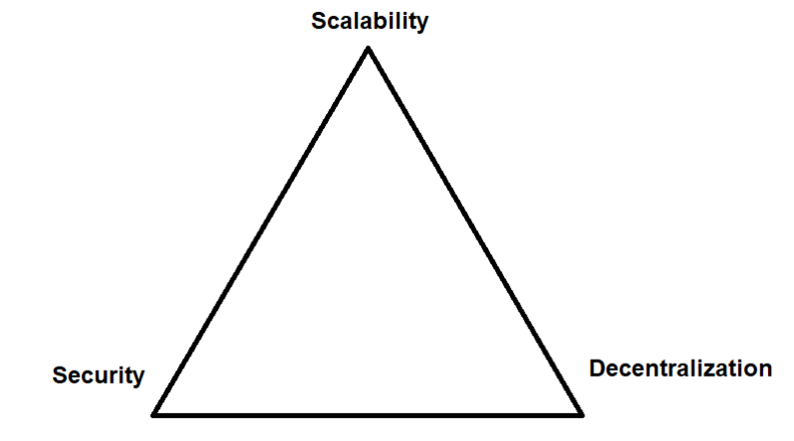

The Scalability Trilemma of Blockchain

Blockchain networks are designed to be decentralized, it needs to be scalable to propagate an extensive network, and the network, in turn, ensures its security. Unfortunately, the current crop of Blockchain networks can only have at most two of the core features of scalability, security, and decentralization.

A critical look at the current Blockchain networks shows interesting tradeoffs. A Blockchain might be decentralized and secure but it won’t be scalable. It might be decentralized and scalable but there’ll be concerns about its security. You might find a secure and scalable Blockchain but it would probably not be centralized in the expected sense of Blockchains. Bitcoin is not an exception; the Bitcoin network is highly decentralized and secure (Bitcoin has never been hacked) but its ability to scale fast enough to meet the growing industry interest is an elusive goal.

Blockchain scalability can be measured along the lines of Maximum throughput, Latency, Bootstrap time, and Cost per confirmed transaction among other key points.

- Maximum Throughput refers to the maximum number of transactions that a Blockchain can confirm each second. The maximum throughput on the Bitcoin network is currently 3.3 to t transactions per second. The reason for this TP/S is that transactions on the Bitcoin network are verified through the Proof-of-Work consensus which is a secure but slow and cumbersome process. The low throughput also serves as one of the biggest arguments against Bitcoin as the future of money when you consider the fact that PayPal manages about 193 transactions per second and VISA processes as much as 1,700. transactions per second.

- Latency refers to how much time it takes for a transaction to be confirmed on a Blockchain. Confirmed transactions are transactions that have been included in a block. On the Bitcoin network, it could take as much as 10 minutes for a transaction to be confirmed. During sudden transaction peaks, the latency could extend into hours.

- Bootstrap Time refers to how much time it takes for a new node to download the network history and process the data to the point of being validated in sync with the current system state. On the Bitcoin network, bootstrap time typically takes about four days.

- Cost per Confirmed Transaction refers to the fiat (USD, EUR, etc.) price expended by the entire Blockchain network to confirm a single transaction. To calculate the Cost per Confirmed Transaction on the Bitcoin network, you’ll need to account for operational costs such as electricity and capital equipment costs such as miners, bandwidth, and storage.

Sidechains to the rescue

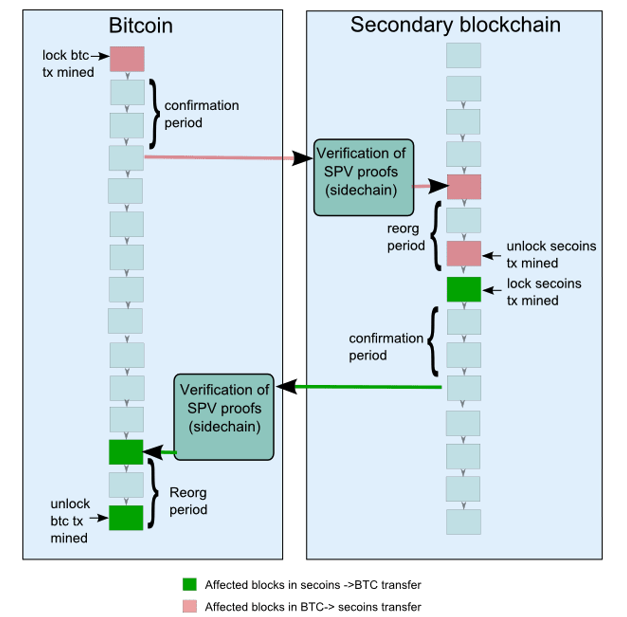

Sidechains simply refer to relatively smaller blockchains that exist alongside an older established Blockchain. The older master chain is regarded as the “parent chain” and the sidechain can be seen as a “child chain” of sorts. Another way to explain sidechains is to refer to a Blockchain as a highway where vehicles can be driven at full speed while sidechains refer to a network of roads built adjacent to the highway for traffic that doesn’t necessarily need to move at full speed to decongest the highway.

Sidechains, not to be confused with hardforks function relative to the parent chain through a delegation of trust medium that enables the sidechain to take on some network activities. Sidechains are independent of the main chain; hence, security challenges or problems on the one chain doesn’t affect the other chain. Sidechains also have their tokens and their tokens interact with the tokens of the parent chain through two-way pegs that stabilize the price of the tokens.

Some of the most popular sidechains on the Bitcoin network include Rootstock (RSK), which is the first open-source smart contract platform with a 2-way peg to Bitcoin through its RBTC token. Elements is a protocol-level project that is looking for ways to extend the functionalities of Bitcoin by empowering developers to create their sidechains. Alpha is designed to be a sidechain to Bitcoin’s Testnet to help developers make different security tradeoffs when exploring new chain possibilities.

Will Sidechains succeed in helping Bitcoin scale?

On the plus side, sidechains are permanent, and developers are not required to create new sidechains every time they need to test new functionalities. Also, sidechains allow interaction between different cryptocurrencies. This interaction could hasten the mass-market of crypto by setting the foundation for uniform industry standards. Sidechains also empower blockchain developers to beta test coin releases and software upgrades before releasing them on the main chain

On the downside, however, miners will need to make huge investments to create and ensure the security of sidechains. Unless miners are adequately incentivized, sidechain projects might be abandoned and network activities that might have been migrated to such chains might be jeopardized.

Also, sidechains are dependent on Federations, which are groups of serves that serve an intermediate function between the main chain and a sidechain. The problem, however, is that the Federation could be a potential weak link that brings the conversation back to the scalability trilemma in terms of tradeoffs.

In the final analysis, it remains to be seen how fast and how well sidechains will help the Bitcoin network to solve its scalability challenges. Nonetheless, many people agree that the conversations about the role of sidechains are positive for the Bitcoin network and the Blockchain industry at large. It will be interesting to see how sidechains strengthen the Blockchain ecosystem within the next decade.

Forbes Hedge Fund Wisdom

Forbes Hedge Fund Wisdom Major Economic Indicators

Major Economic Indicators