Margin Trading and Market Timing – High Risk Investing A margin trading account is a type of investment account offered by brokerages that allow investors to borrow money to buy securities. With a margin account, an investor can borrow funds from the brokerage firm against the value of the securities in their account. This allows Read More…

In an ever-changing world of for sale financial courses and gurus, it has become increasingly difficult for student investors to find and utilize the best free tools on the market. At How the Market Works, we focus on giving high school students the tools and resources to start investing in the stock market. But where Read More…

When looking for investment ideas and tips, stock screeners are a really great idea. The best screeners available provide a large array of different information based on unique criteria, such as P/E ratios or 12-month trailing EPS (earnings per share), and allow you to identify potential winners. But since there are so many of them Read More…

You may have heard a lot about hedge funds on television and perhaps, in newspapers. What exactly is a hedge fund, and what do they do? Hedge funds have been in existence for several decades since the launch of the very first ever fund in 1949 by A.W Jones & Co. Since then, their popularity Read More…

A short stock is an expression used when you sold shares of a company that you did not own beforehand. Let’s say you expect a stock’s price to drop. Shorting a stock would involve a strategy where you borrow shares from another party (usually a broker) and sell it on the market. Borrowing from a Read More…

Long Stock What is a long stock? A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Words such as “shares”, “equity” and “stock” all mean Read More…

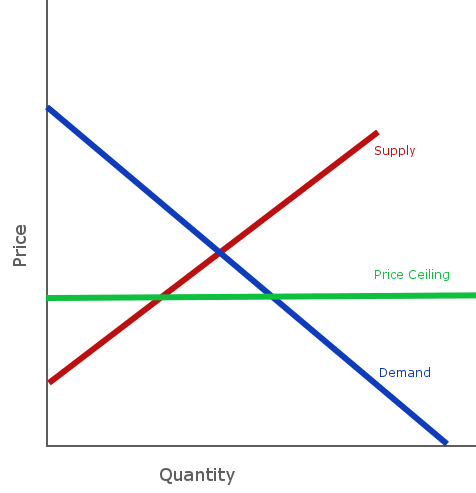

Definition “Price Controls” are artificial limits that are put on prices. If the limit is put in place to prevent prices from getting too high, they are called Ceilings. If they are in place to prevent the price from getting too low, they are called “Floors”. Price Ceilings Price Ceilings are controls put in place Read More…

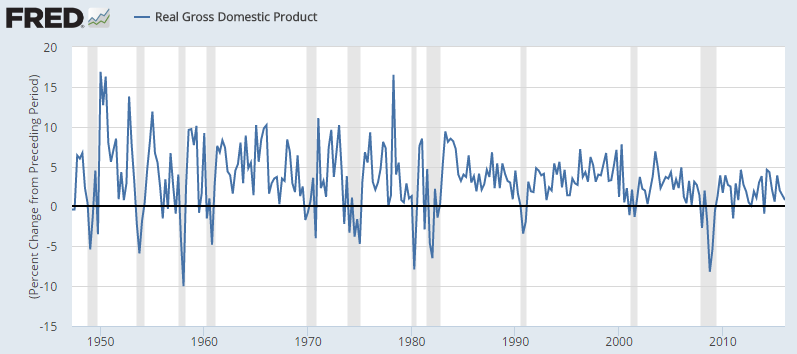

What Is The Business Cycle? The Business Cycle is the broad, over-stretching cycle of expansion and recession in an economy. The Business Cycle is concerned with many things – unemployment, industrial expansion, inflation rates, but the most important indicator is GDP (Gross Domestic Product) growth. Below you can see a graph of the GDP growth Read More…

What are Credit Cards? Credit cards is a form of unsecured credit (meaning a loan without collateral) that you can use to make everyday purchases. All credit card purchases are made using a loan – you borrow money from your credit card issuer, and later pay it back with interest. Credit Cards Vs Debit Cards Read More…

What Is Credit? “Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of Read More…

Credit Reports are basically a report that contains your credit history – both the good and bad. If you watch late-night TV, you have probably seen a few commercials offering free credit reports, so you might know that these are important. Most people, however, don’t know just how big a role a credit report can Read More…

Definition “Economics” is often called the Dismal Science – it studies the trade-offs between making choices. The purpose of economics is to look at the different incentives, assets, and choices facing people, businesses, schools, and governments, and see if there is any way to improve outcomes. This is done by looking at how supply and Read More…

Definition A “Contract” is a legally binding agreement between two parties (people, companies, or both). Having a contract means that if one party does not keep their word, the other can sue them in court to either force them to fulfill their side of the agreement, or pay back compensation. What Makes A Contract Binding? Read More…

When talking about Banking, people generally group Banks, Credit Unions, and Savings & Loan companies all in one group. They do provide similar services, but they each have specific differences that might make them a better or worse fit for your financial needs. What They Have In Common All three of these institutions can do Read More…

Definition of Wealth “Wealth” means having an abundance of something desirable. This can be tangible, like money and property, or intangible. Intangible Wealth Just because something does not have a monetary value does not mean it is worthless. Having strong connections with friends and family is often considered a major component of wealth – since Read More…

Definition When we think of money, stored value means anything that isn’t cash, but you can still use to transfer value – checks, debit cards, gift cards, and forms like that. These are used to transport some dollar amount which we can later exchange for goods and services. Each of these forms of stored value have their Read More…

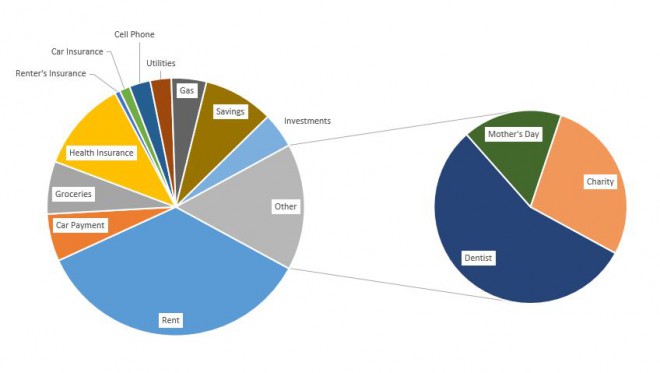

A “Spending Plan” is exactly as it says – a plan of what you will be spending each month. There are usually two parts – your “fixed” spending and your “variable” spending. The fixed part is usually the same every month, with things like rent/mortgage payments, grocery bills, insurance, and car payments. The variable part Read More…

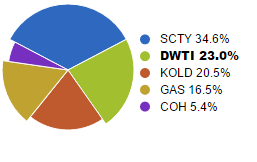

Contest: December Trading Contest Final Portfolio Value: $117,803.89 (+17.80%) Trading Strategy For This Contest I’ll be general with my strategy so what I have done is I kept a max 5 stocks so it is easy to manage and chose which stock to buy wisely. (BUY WHAT YOU KNOW) that’s pretty much it 🙂 Final Read More…

Definition In Economics, “Demand” is the relationship between prices and how much people want to buy a good or service. Details As the market price of a good goes up, the amount of that good that people are willing to pay generally goes down. This is because each person puts some value on the good – Read More…