Dollar Cost Averaging Investing in the stock market involves a lot of unpredictable factors. So many first time investors get scared off by not knowing what stock(s) to buy at what time. Timing the market is a daunting task, but thankfully there are strategies that take timing out of the investing equation. Dollar Cost Averaging Read More…

There are so many different ways for a person to build wealth over time. Finding the right investments is a key part of achieving your financial goals. In order to find the right investments, you will have to spend a lot of time researching your options. If you are looking for an investment that can Read More…

Five years ago, most people didn’t have a clue what cryptocurrencies were. Ask the average man on the street about bitcoin and he would have raised his eyebrows and said “huh?”. Fast forward a few years and cryptocurrencies have hit the mainstream. Today, your Uber driver can tell you the latest bitcoin price and your Read More…

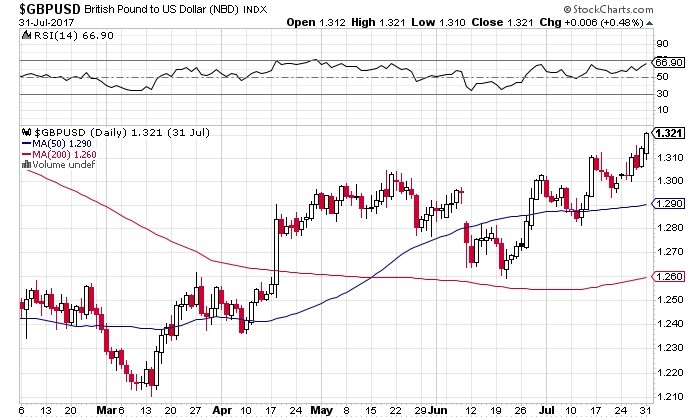

The GBP/USD pair is currently trading at 1.3205, close to its 52-week high of 1.34427. The sterling has enjoyed an imperious run of form in 2017, starting at around 1.23, and gaining approximately 7.3%. The US dollar index indicates an overall poor run of form by the greenback, with a year to date decline of Read More…

When it comes to currency trading, there is a vast range of different strategies you can adopt to generate trading profits. For example, you could pursue an event-focused strategy, where you place trades just after large market-moving macroeconomic or political events. Alternatively, you could put on medium to long-term trades based on your view of Read More…

The most widely traded financial asset in the world is not any particular stock, oil or gold – it is the EURUSD (Euro/ US dollar) currency pair. The pair represents two of the largest economies of the world. Created to facilitate cross-border trading among European and American partners, the euro (EUR) has risen to become Read More…

In the last six months we have witnessed strong volatility in the global currency markets. Emerging markets currencies weakened aggressively against the U.S. dollar, which has strengthened substantially leading up to the Federal Reserve’s U.S. benchmark interest rate hike in December of last year. Volatility in the currency markets is not just an issue for Read More…

Contest: March Trading Strategy Final Portfolio Value: $101,169.24 Trading Strategy For This Contest Trading Strategy: Investing for the first time in the stock market is very overwhelming; even if it is done with virtual money. I’ll start saying that implementing a strategy takes a lot of practice and patience. You must begin understanding some of Read More…

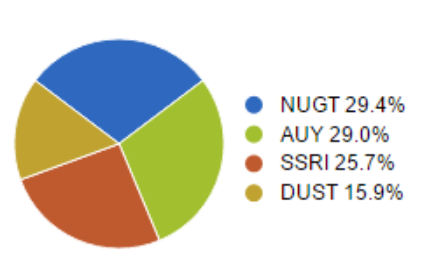

Contest: February Trading Contest Final Portfolio Value: $135,104.98 (+35.1%) Trading Strategy For This Contest I made 4 trades at the start of the month all based on gold being undervalued. I suspected a medium term rally and I therefor bought leveraged gold stocks/etf. The only reason I made 4 trades was because I was forced Read More…

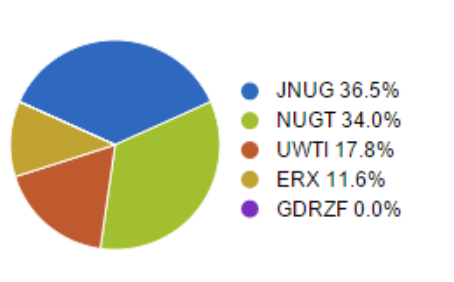

Contest: February Trading Contest Final Portfolio Value: $143,899.64 (+43.9%) Trading Strategy For This Contest Study sectors precious metals and energy- they have greatest potential for change because of most “auction” mentality” in stock and options activity. Research understanding small cap stocks. Read up on them and knowledge of these individuals is key. Final Open Positions Read More…

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between more than one sector. This sounds easy, but it can be very challenging finding stocks from a wide range of sources that fit what you’re looking for. Thankfully, our Quotes Tool has all the information you need to Read More…

Contest: Second November Investing Contest Final Rank: 2 Final Portfolio Value: $113,134.06 (+13.13%) Trading Strategy For This Contest I usually found stocks that had high volume and good community sentiment. As well as good stock short term news. I then bought into those stocks, and when they went up. I shorted them. MACD and Bolinger Read More…

Contest: Second November Investing Contest Final Rank: 3 Final Portfolio Value: $112,739.67 (+12.73%) Trading Strategy For This Contest First off, thanks for the great game everyone! Well played. This being my first HTMW monetized contest, I feel very humbled and excited to win. During last week, I played the VIX and biotech stocks. TVIX and Read More…

Contest: October Third Daily Challenge Final Rank: 7 Final Portfolio Value: $101,621.37 (+1.62%) Trading Strategy For This Contest For the October 3rd Daily Contest I picked a mix between triple-leveraged ETFs and a few companies that I felt were undervalued. The triple-leveraged ETFs are great for a daily competition because the profits are huge if Read More…

Contest: October Third Daily Challenge Final Rank: 1 Final Portfolio Value: $108,724.97 (+8.72%) Trading Strategy For This Contest The strategy I prefer to use is to look for stocks that have been unfairly beaten down. Many stocks are down at any given time and most justifiably so. However, there are those that have become oversold. Read More…

Contest: September Monthly Million Contest Final Rank: 1 Final Portfolio Value: $1,308,146.64 (+30.8%) Trading Strategy For This Contest My strategy is finding pharmaceutical/biotech companies. I find corporations that are testing products. I look for ones who have an upcoming announcement on phase 3 testing or FDA approvals. I keep those stocks on my watchlist. Once Read More…

Contest: October First Daily Challenge Final Rank: 1 Final Portfolio Value: $104,671.33 (+4.67%) Day Trading Strategy For This Contest For this daily contest, I purchased 4 ETF stocks, then sold 2 of them once I had a good lead, not wanting to give up all of my gains. My strategy is to purchase the riskiest Read More…

Contest: Official September Contest Final Rank: 5 Final Portfolio Value: $1,119,202.95 (+11.19%) Trading Strategy For This Contest My strategy is to look for stocks to short that are moving up (30% +)on news with greater than average volume. So much of the time people get overly excited about the news and drive the price higher Read More…

Final Rank: 3 Final Portfolio Value: $1,181,543.46 (+18.15%) Trading Strategy For This Contest I used was mainly “gap plays”; I analyze gaps in the premarket everyday, once I determine if the gap will be filled for short term investing, I will place my trade and swing looking for a 10%-20% profit. 90% of all gaps Read More…

Definition Your “Risk Level” is how much risk you are willing to accept to get a certain level of reward; riskier stocks are both the ones that can lose the most or gain the most over time. Risk Understanding the level of risk you need and want is a very important part of selecting a Read More…