If you have ever wanted to protect your portfolio on HowTheMarketWorks from losses, you have definitely used Stop Orders. The biggest downside of stop orders is, of course, the fact that you have to constantly update them as your investments grow to “lock in” your gains…

What are Trailing Stop Orders?

Trailing Stop orders work a lot like regular stop orders evolve with the market. This means you can set a Trailing Stop sell order to sell if your stock’s price falls by $2.00, or even 2%. As your stock’s price grows, the trailing stop price goes up with it. It will only execute when the stock’s price falls by your Trailing Stop threshold from its peak – meaning you lock in your gains without constantly updating your stop orders.

How Does It Work?

Good question! Check out our tutorial video below to see how to use Trailing Stops with your portfolio.

Money Creation

Money Creation Indications of a Market Pull Back

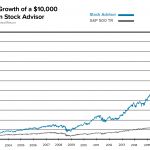

Indications of a Market Pull Back Motley Fool Stock Advisor Review

Motley Fool Stock Advisor Review