One of the benefits of using HowTheMarketWorks is that we do a lot of your homework for you so we can help you make more money! You can also learn how to invest in the stock market by following the same strategy we use with HTMW’s paper trading.

We subscribe to a few dozen stock market newsletters, and then we make their recommended trades in virtual trading accounts. While we do buy all of the stocks that the services recommend, we don’t always make the trade exactly when we get the recommendations. Like you, we are busy doing other things. We eventually get around to making all of the trades. They are usually within a few days of getting the recommendations.

The Best Stock Newsletter:

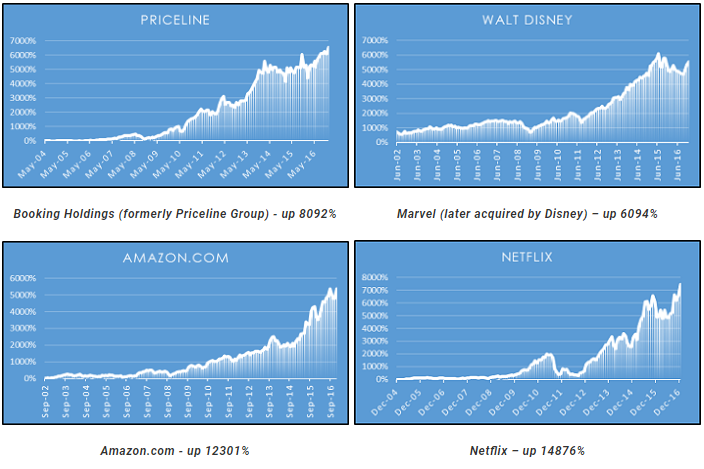

Based on our dozens of paper trading portfolios, the best stock newsletter and best stock sites over the last 24 months was the Motley Fool’s Stock Advisor. This service recommended stocks like SHOP (up 158% since we bought it), NVDA (up 120%) and MAR (up 97%). To have a stock portfolio that performs well, you MUST have a few stocks like these that double or triple in value. This Motley Fool service has a habit of picking these 2x and 3x stocks!

As recently as August 2018, the Stock Advisor recommended stocks such as PAYC (up 43.39%), FICO (up 25.77%), and OKTA (up 57.05%). Percentages are thru August 14, 2018. In our paper trading portfolios, we used 8% trailing stops to minimize risk of any poor picks. This trailing stop also helped us take profits on any high fliers that might have had a significant pullback.

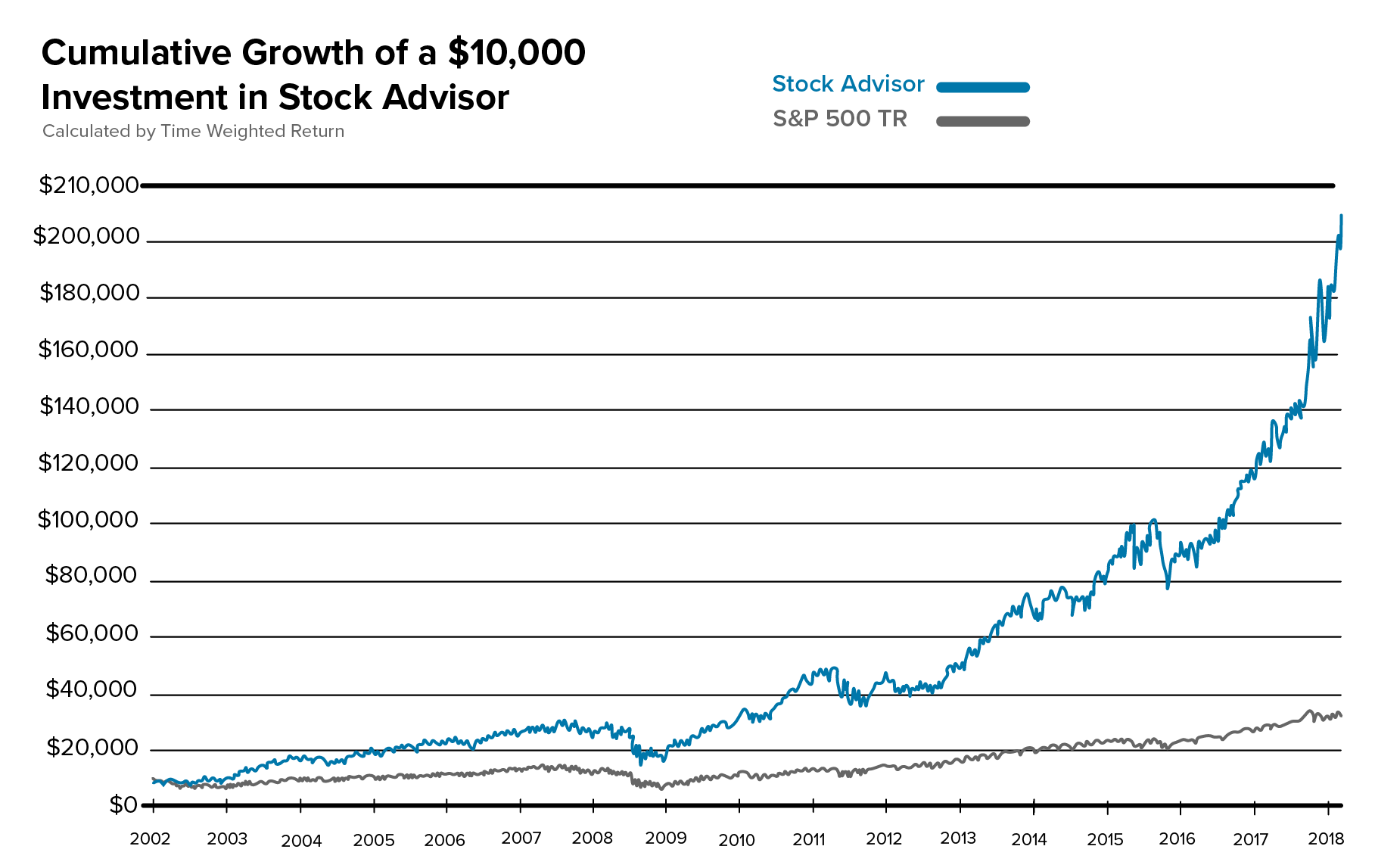

The Fool’s marketing campaign for this service says their portfolio is up an amazing 348% since inception, compared to the SP’s 81%. See the graph below that shows their return versus the S&P500’s return over the same time period. It seems impossible right? But now we see that a lot of their picks do double or triple in a short period of time.

The Best Stock Newsletter Offered by The Best Stock Sites:

Based on our dozens of paper trading portfolios, the best stock newsletter over the last 24 months was the Motley Fool’s Stock Advisor. This service recommended stocks like SHOP (up 158% since we bought it), NVDA (up 120%) and MAR (up 97%). To have a stock portfolio that performs well, you MUST have a few stocks like these that double or triple in value. This Motley Fool service has a habit of picking these 2x and 3x stocks! You should use the same HTMW paper trading platform to learn to invest.

As recently as August 2018, the Stock Advisor recommended stocks such as PAYC (up 43.39%), FICO (up 25.77%), and OKTA (up 57.05%). Percentages are thru August 14, 2018. In our paper trading portfolios, we used 8% trailing stops to minimize risk of any poor picks. This trailing stop also helped us take profits on any high fliers that might have had a significant pullback.

The Fool’s marketing campaign for this service says their portfolio is up an amazing 348% since inception, compared to the SP’s 81%. See the graph below that shows their return versus the S&P500’s return over the same time period. It seems impossible right? But now we see that a lot of their picks do double or triple in a short period of time.

Best of all, the Motley Fool currently has this stock newsletter on sale. It usually costs $299 a year, but they currently are running a too-good-to-be-true promotion of just $19 a month or $99 a year. That is a very reasonable price to pay for such solid stock picks in this stock newsletter. They also have a 30 day, 100% money back guarantee. You should definitely try it for 30 days!

If you are not sure that you are ready to trade on their suggestions, you can learn to invest by following the Motley Fools trade suggestions using a HTMW’s virtual trading account. This is an excellent way to learn.

To get their next stock picks at this discounted price, you must click here. We recommend that you review their picks and analysis carefully. Make sure you buy in slowly with the expectation that over a year you should have 10-20 stocks in your portfolio. Do NOT put all of your money in their first few stock picks!

THE BEST NEWSLETTER CONCLUSION:

Based on the last 24 months of performance, the Motley Fool’s Stock Advisor is the best stock sites available. Best of all, it is currently on sale for just $19 a month or $99 a year. If you are looking for solid stock picks to add to your portfolios, this is where you should start. Click here to get this special price.

If you are still not satisfied, then read this Motley Fool Stock Advisor Review and get even more information. You will find that this site is the best stock site for maximizing your returns.

*August 9, 2018 Update:

A key aspect in selecting a good newsletter would be its consistency in suggesting undervalued stocks. To evaluate this, the HowTheMarketWorks team kept on trading the Fool’s stock picks. Here are some recent highlights from our portfolios for David and Tom’s recommendations since December 2017:

| David’s Portfolio Highlights | ||||

| Company | Suggested | Price Paid | Last Price | Return |

| OKTA | January + April 2018 | 34.93 | 57.23 | 63.84% |

| ILMN | January 2018 | 248.76 | 337.32 | 35.60% |

| FICO | March 2018 | 169.71 | 213.73 | 25.94% |

| AMZN | March + April 2018 | 1585.52 | 1898.89 | 19.76% |

| ADBE | April 2018 | 221.90 | 254.95 | 14.89% |

| Tom’s Portfolio Highlights | ||||

| Company | Suggested | Price Paid | Last Price | Return |

| NFLX | February 2018 (trailing stop order activated) | 264.18 | 361.99 | 37.02% |

| VRNS | March 2018 (trailing stop order activated) | 58.25 | 75.25 | 29.18% |

| SHOP | May 2018 | 138.76 | 163.53 | 17.85% |

| APPN | July 2018 | 32.30 | 34.69 | 7.40% |

| IRBT | Dec 2017 (trailing stop order activated) | 64.30 | 87.08 | 35.43% |

One of the most recent suggestion by the Fool’s Stock Advisor is Appian Corporation (APPN:NASDAQ). In nearly two weeks, it has achieved a return of 7.40% in our portfolio and we believe there is still a lot more room for growth. On the 2nd of August 2018, Appian reported its Q2 results with a 39% revenue growth due to a “combination of new customer acquisition, a 119% subscription revenue retention rate among existing customers, and a one-off perpetual software deal. This figure grew much faster than management had previously predicted” (Source: MotleyFool News & Updates). Thanks to our friends at Motley Fool, we were able to get an early seat and capture APPN’s growth.

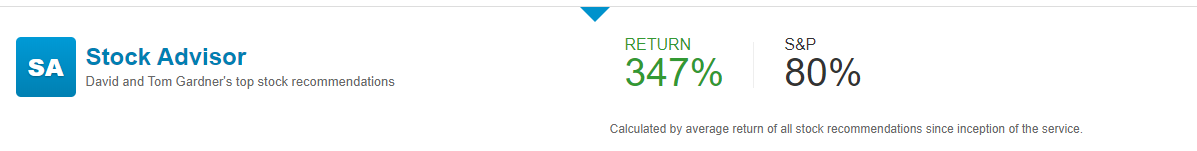

The Fool’s marketing campaign is still supporting its claim that it can beat the market. As of right now, the Fool’s Stock Advisor is averaging a 347% return since their inception, while the S&P has a 80% return.

How to get Their Next Stock Pick

Investing in the S&P can be advantageous due to its simplicity in investing in a diversified portfolio. However, we are confident that the Motley Fool’s Stock Advisor service can generate greater returns with a small effort from the investor. When factoring the discounted price of the service and the return it generates (4 times Standard & Poor’s return), we believe the Stock Advisor is still the best newsletter service available in their price range. You can get the next stock picks from this newsletter by clicking here.

Markets Pilot Review | Uncovering the Pros & Cons Involved

Markets Pilot Review | Uncovering the Pros & Cons Involved April Trading Contest

April Trading Contest Fundamental Research Links

Fundamental Research Links