Christmas is undoubtedly, one of the most expensive times of the year. Presents, decorations, food, it all adds up. So, it’s no surprise that people choose to put the cost on a credit card. In essence, buy now, worry and pay later.

But, it’s not as clear cut as it seems. Using a credit card could mean that Christmas is being paid for when the next December comes around, and, it could become a negative cycle. Yet, there are some benefits.

Spread the Cost

The average British household will spend an enormous £821.25 on Christmas, according to VoucherCode and the Centre for Retail Research. But, who has that kind of money in their back pocket?

Ensure that you can get a 0% introductory offer so you can spread the cost free of charge (at least until the interest-free period ends) to soften the blow of the holiday season.

Protecting the Purchases

Credit cards get a plethora of complaints, but at least they come with a “Section 75” agreement. This, effectively, ensures you are financially covered if anything goes wrong, for example, if you receive faulty goods, with any purchases or services you buy between £100 and £30,000.

So, if something does go wrong with a gift, you will not be left out of pocket given the fact that both your credit card and vendor are responsible for a refund.

Saving Whilst Spending

Some credit cards come with the option of cashback on them. So, you could effectively earn money whilst spending it which of course is a nice extra that could help you at the most challenging financial time.

Avoid Festive Fines

It might be worth setting up a direct debit to make sure that payment is on time and if there is no 0% introductory offer on your plan, ensure the balance is paid off in time. In order to avert paying interest. Also you could try and find a low interest credit card. For example, Canadian credit cards offer much higher interest rates than those in the US.

The last thing you want – or need – at Christmas is a fine. Well, there are a few ways in which you can ensure you avoid paying more than you need to.

Not only is paying it on time very important, but so is making the minimum payment. If not, you could be charged which could harm your credit rating and thus any chance of further loans in the future. Your credit rating can be harmed by going over your credit limit too.

It’s also imperative to spend what you know you will be able to repay. Having a financial debt hanging over you for most of the new year is not exactly worth it, however attractive those extra gifts may seem. Plus, Canadian credit cards incur annual fees and offer much less generous rewards system than those in the US, making a Canadian one even less attractive.

Credit History

It’s fair to say that if you’ve already got a bad credit score then a credit card may not even be given to you in the first place. But, even if it’s given, your interest rate will be extortionate. As such, it’s essential to do as much research as possible to find the best interest rate for your circumstances.

The best advice that can be given around the Christmas season is to take it steady. Do not keep applying for a credit card if you have been rejected as numerous applications may appear on your credit score and not only affect your present application, but also other credit forms in the future.

Don’t go Overboard

Getting a credit card seems like a good idea and it can be to alleviate immediate spending concerns. But, ensure you avoid fines, get as good an interest rate as possible and only spend what you know you can pay back. If not, credit cards can become a heavy burden.

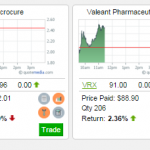

ETF Trading Strategies

ETF Trading Strategies Huge update for your Open Positions!

Huge update for your Open Positions!