Can Seeking Alpha Help You Invest Smarter?

If you’ve ever opened a trading app and wondered how to tell a good stock from a risky one, you’re not alone. Beginners often face an overwhelming mix of opinions, numbers, and charts—but there’s one platform designed to make sense of it all: Seeking Alpha.

Home to the world’s largest investing community, Seeking Alpha brings together millions of investors who share insights, stock ideas, and research. It’s where everyday investors and Wall Street analysts meet, offering a bridge between casual curiosity and professional-level stock analysis.

Seeking Alpha Premium promises high-quality investment research, Quant Ratings, and model portfolios that can help you make informed investment decisions—even if you’re just starting out.

What Is Seeking Alpha?

Seeking Alpha was founded in 2004 by former Wall Street analyst David Jackson. His goal was simple but ambitious: give investors access to the kind of in-depth analysis and data typically reserved for professionals.

The term “alpha” comes from finance—it means outperforming the market. Seeking Alpha helps investors find that edge by providing data-driven investment research, commentary, and diverse perspectives from thousands of contributors.

Today, it has more than 20 million active users and 7,000+ verified authors who write daily about stocks, mutual funds, ETFs, and investment strategies. For beginners, it’s a powerful educational resource to learn how analysts think—and how markets really move.

Academic Study of Seeking Alpha’s Quant Rating: A 2024 independent study by professors at a major university found that Seeking Alpha’s proprietary rating system Seeking Alpha Quant Ratings “strongly predict” future returns and offer “pronounced benefits” to investors.

Dr. Jame and Ph.D. Candidate Yuling Guo, Gatton College of Business & Economics, University of Kentucky

Seeking Alpha isn’t a licensed broker or financial advisory service—it’s a platform for investment research and market analysis. While it offers quantitative data and stock insights, it doesn’t handle trades or manage client funds, meaning it isn’t directly regulated by the SEC or FINRA.

February, 2026 SALE happening now:

Seeking Alpha is a very successful stock research and rating service. With that, they rarely offer discounts, so when you see a sale it's crucial to take advantage of it. They're currently offering one of their best discounts of the year!

You can get a free trial, save 20% off their premium services AND get their Lowest Price this Year.

- Seeking Alpha Premium: 7 Day Free Trial & Save $30; usually

$299now only $269/year — Claim Your Discount.- Alpha Picks: Save $50; usually

$499now only $449/year — Claim Your Discount.- Seeking Alpha Bundle (get both): Save $159; usually

$798now only $639/year — Claim Your Discount.

How Seeking Alpha Works

Getting started on Seeking Alpha is easy. You can sign up for free to read a limited number of articles each month, follow authors, and build a watchlist. But most investors eventually upgrade to Seeking Alpha Premium or Pro for full access to data and tools.

Free Plan

- Access to daily market news and limited articles

- Basic portfolio tracking

- Stock quotes and community discussions

Premium Plan

- Unlimited access to all analysis and news

- Full Quant Ratings and Dividend Grades

- Earnings call transcripts and financial metrics

- Portfolio health check and monitoring tools

Alpha Picks

- 2 top Quant Rating stock picks each month with complete explanation

- Sell recommendations of previous picks

- Takes the stress out of investing

Pro Plan

Key Features of Seeking Alpha Premium

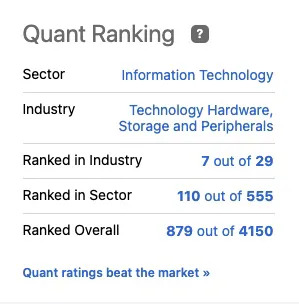

Quant Ratings – The Heart of Seeking Alpha’s Research Tools

The platform’s most talked-about feature is its Quant Rating System, an algorithm that scores over 10,000 stocks as Strong Buy, Buy, Hold, Sell, or Strong Sell.

These Alpha Quant Ratings are based on five key metrics: value, growth, profitability, momentum, and EPS revisions. The system constantly updates using real-time market data.

Since 2010, stocks rated Strong Buy by Seeking Alpha’s quant model have consistently outperformed the market, while Strong Sell stocks have underperformed. That track record makes it a favorite among both active investors and students learning fundamental analysis.

For beginners, Quant Ratings provide a shortcut to understanding what professional analysts look for—without needing a finance degree.

Stock Analysis and Research Reports

Seeking Alpha’s core value lies in its independent stock research. Each day, contributors publish thousands of research reports, earnings call transcripts, and in-depth analysis covering nearly every listed company.

You can read multiple viewpoints on the same stock—bullish, bearish, and neutral—helping you develop your own research process.

Premium members get unlimited access to these insights, plus tools for portfolio tracking, real-time alerts, and analyst upgrades. If you’re learning how to analyze companies, this section is like a free classroom in investment research.

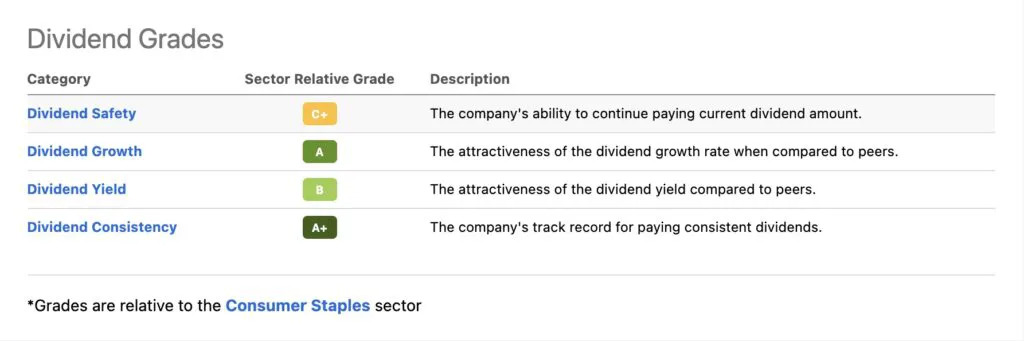

Dividend Grades and Income Investing Tools

For income-focused investors, Seeking Alpha offers Dividend Grades that rate each company’s dividend safety, growth, yield, and consistency.

These grades help dividend investors quickly identify reliable income stocks without combing through balance sheets. It’s especially useful for dividend investing strategies or building a stable, long-term portfolio.

You can also filter by dividend yield, payout ratio, and growth history, giving students a hands-on way to practice evaluating stock ideas for passive income.

Portfolio Monitoring and Health Check

Seeking Alpha Premium goes beyond research—it helps you manage what you own. The Portfolio Health Check tool analyzes your holdings using Quant Ratings and provides insights into diversification, valuation, and performance trends.

You’ll also get real-time alerts when a stock in your portfolio gets downgraded or upgraded, so you can act quickly.

February, 2026 SALE happening now:

Seeking Alpha is a very successful stock research and rating service. With that, they rarely offer discounts, so when you see a sale it's crucial to take advantage of it. They're currently offering one of their best discounts of the year!

You can get a free trial, save 20% off their premium services AND get their Lowest Price this Year.

- Seeking Alpha Premium: 7 Day Free Trial & Save $30; usually

$299now only $269/year — Claim Your Discount.- Alpha Picks: Save $50; usually

$499now only $449/year — Claim Your Discount.- Seeking Alpha Bundle (get both): Save $159; usually

$798now only $639/year — Claim Your Discount.

What Is Alpha Picks?

While Seeking Alpha Premium gives you the tools, Alpha Picks gives you the trades.

Launched in 2022, Alpha Picks is Seeking Alpha’s stock-picking service that provides two new stock ideas every month. Each pick is chosen from top-rated stocks in the Quant Ratings system and vetted by Seeking Alpha’s in-house analysts.

Subscribers also gain access to model portfolios and performance tracking to see how the picks stack up over time.

Historically, Alpha Picks has outperformed the S&P 500 by a wide margin—making it a top contender among premium subscription services like Motley Fool Stock Advisor.

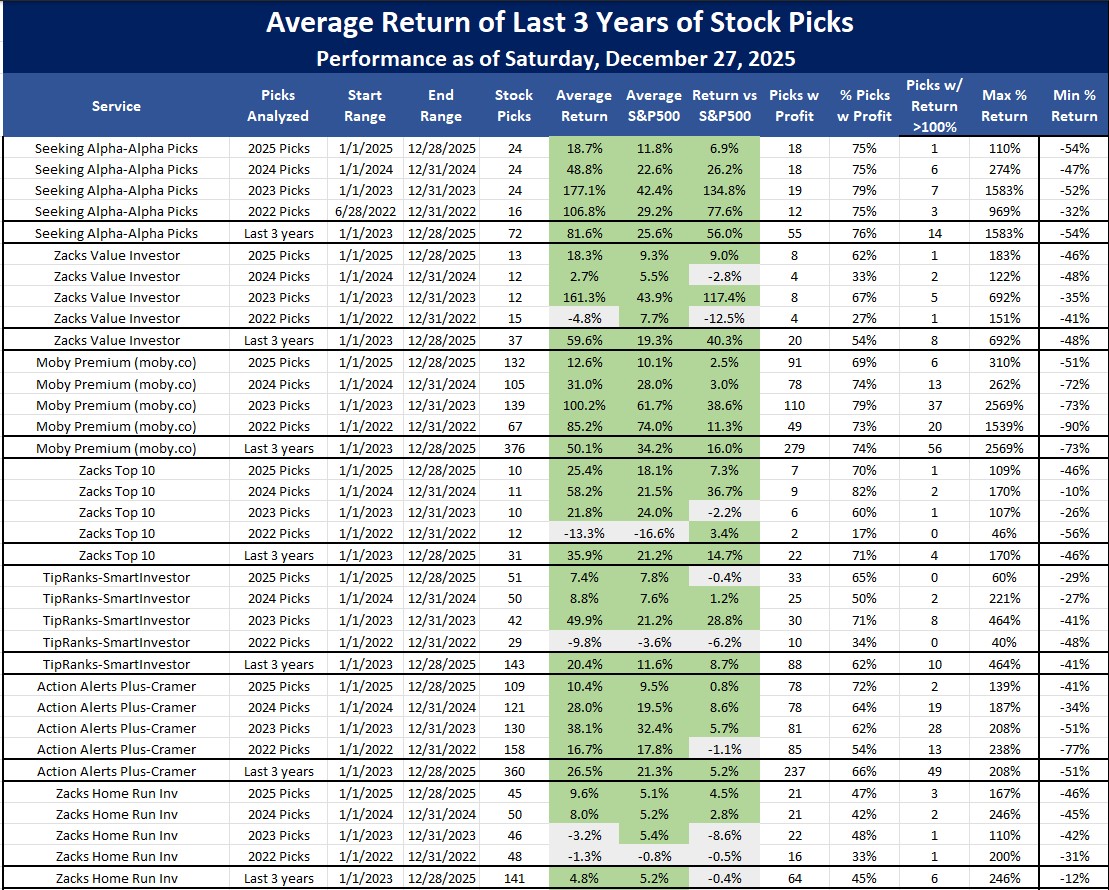

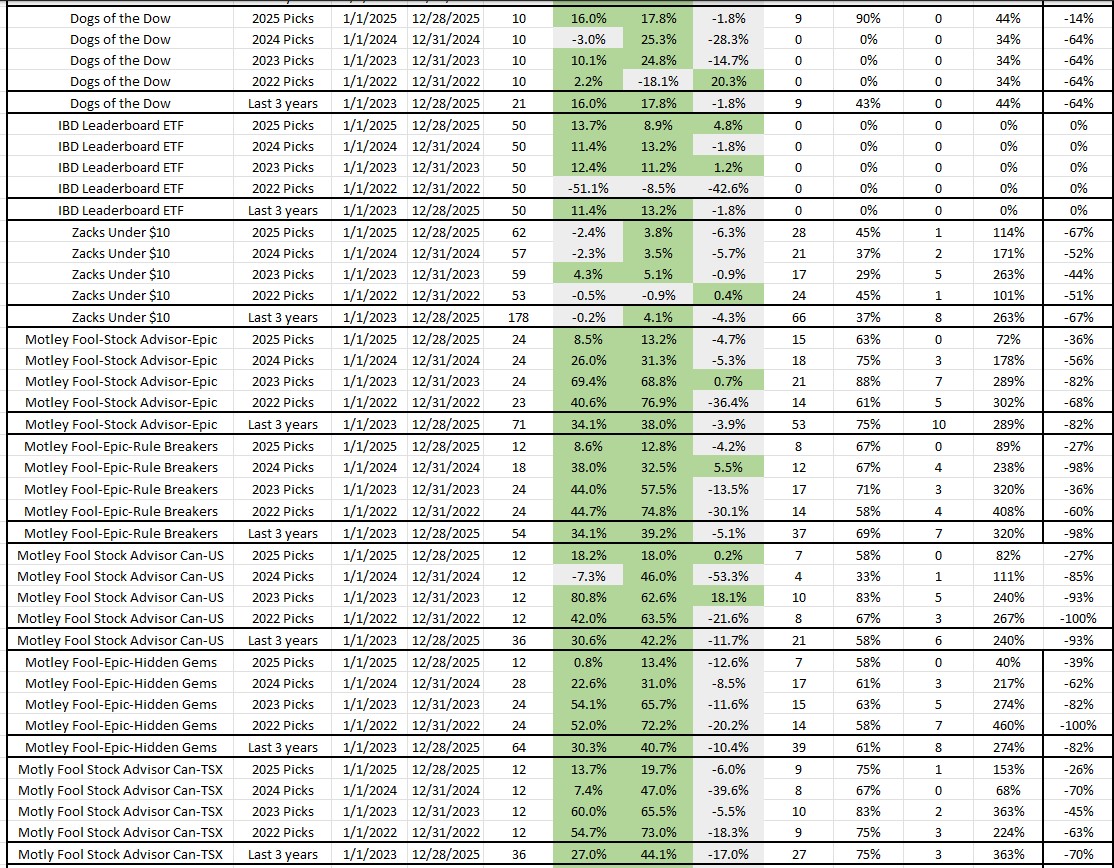

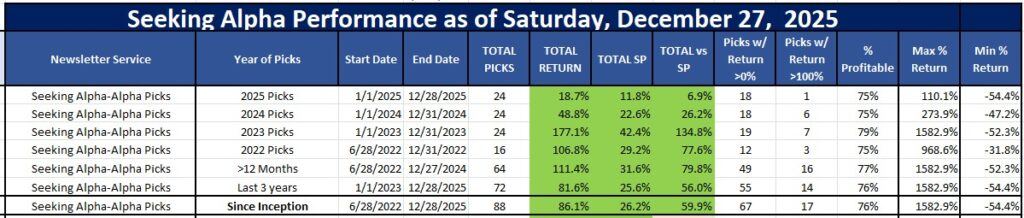

Here's a summary of the performance of all of their picks as of December 27, 2025 so you can see how their picks performed at calendar year-end.

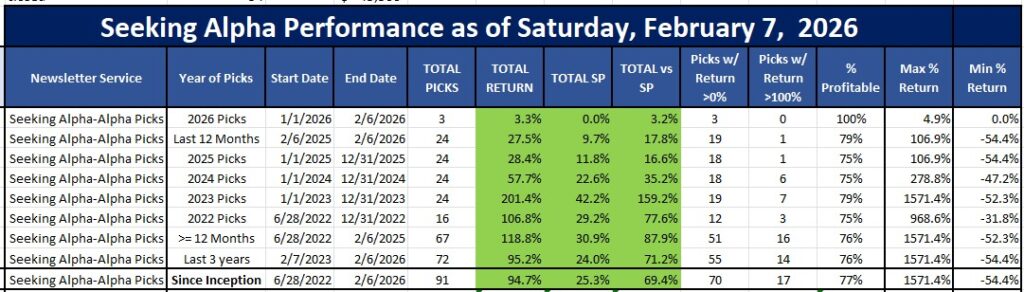

And here's a little teaser of their performance so far as of February 7, 2026 to give you an idea if it is worth it. My analysis is pretty convincing as these returns prove it has definitely been providing huge gains over the S&P since its launch.

Alpha Picks Update as of February 7, 2026: Since its launch in July, 2022, the 91 Alpha picks from 2022 thru 2026 are up an average of 95% and are easily beating the S&P500's return of 25% by 69%. But most impressively, their picks that are at least 12 months old are up 119% vs 31% for 88% ALPHA and 76% of their picks are profitable. Yes, these picks are almost 4x the SPY. Their October, 2025 pick of Micron is already up 107% and their July picks are up 75 and 87% already in just 7 months. Their December pick (TIGO) is already up 25%. WOW! See our full Seeking Alpha Picks Review for further analysis.

And when we compare 3 year performance, you will see Alpha Picks is consistently profitable and outperforming the market. Take a look at this amazing table of performance of various newsletters priced less than $500 per year.

With a historical track record like that, Alpha Picks seems like a very safe investment!

Pricing and Subscription Plans

| Seeking Alpha Premium | Alpha Picks | Seeking Alpha Bundle | |

|---|---|---|---|

| Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type & Strengths | Full access to all their research; link your brokerage account to get Quant Ratings on your stocks and alerts of when to sell. | 2 stock picks a month that have highest Quant Rating and most likely to outperform the market. | Includes both services. |

| Strengths | Strong Buy Quant Rating stocks have 5x the market since 2010. Quant Rating value now verified by academic study. 250,000+ Premium members. | Beating the market by an average of 60% in just 3 years; 17 picks have already doubled; 76% of picks are profitable. Quickly sell losers as half of picks have already been sold. | Get both to monitor your portfolio & get the best picks to buy. |

| Best for | Self-directed investors who want to easily optimize their portfolio’s return. | Investors wanting specific stock recommendations each month. | Investors looking to better manage their current stocks & get excellent picks to add to their portfolio. |

| Retail Cost | $299 a year | $499 a year | $798 a year |

| Current Promotion: | February, 2026 Sale: Save $30, get 7-day free trial | February, 2026 Promo: Save $50 & get access to all their recent stock picks. Next pick comes out . | February, 2026 Promo: Get Premium AND Alpha Picks for just $639 |

| Link to Promo Page: | Save $30, get 7-day FREE trial to Alpha Premium on THIS promo page. | Save $50 on Alpha Picks on THIS promo page. | Try Both and save $159 now. |

All plans include a 7-day free trial so you can explore everything before paying.

Seeking Alpha also provides occasional discounts on their services, which you can learn about in our Seeking Alpha discount article.

Is Seeking Alpha Reliable?

When it comes to reliability, few investment platforms have the track record Seeking Alpha does.

A 2024 University of Kentucky study found that Seeking Alpha’s Quant Ratings “strongly predict future returns” and provide “pronounced benefits” to investors who follow them.

Additionally, Seeking Alpha data feeds are sourced directly from SEC filings, earnings reports, and real-time market data.

The platform doesn’t just host opinions—it blends quantitative analysis, crowdsourced insights, and fundamental research, creating one of the most comprehensive tools for both new and experienced investors.

Seeking Alpha Performance

Here’s the proof that their Quant Ratings are valuable. Every year from 2017 to 2025 the Seeking Alpha Quant Ratings “Strong Buy” stocks have outperformed Wall Street Analysts and the S&P500.

Is Seeking Alpha Worth It for Beginners?

Absolutely—if you’re ready to take your learning seriously.

Here’s how different types of users benefit:

For Casual Investors:

Seeking Alpha helps you move beyond social-media hype to genuine stock research. Even if you read one or two analyses per week, you’ll gain a deeper understanding of how the market values companies.

For Active Traders:

You get real-time alerts, analyst upgrades, and financial metrics that can refine your timing and boost confidence in your trades.

For Students and New Investors:

It’s an incredible educational resource. By reading professional reports, following earnings call transcripts, and checking Quant Ratings, students can learn how to perform own due diligence and portfolio management like pros.

The bottom line: Seeking Alpha is worth it if you’re serious about learning to invest, not just speculate.

Final Verdict – Our Seeking Alpha Review Summary

After reviewing Seeking Alpha’s research tools, Quant Ratings, and Alpha Picks performance, we can confidently say: Seeking Alpha Premium is worth it—especially for beginners who want to learn by doing.

It’s rare to find a platform that blends community insights, quantitative models, and expert analysis so seamlessly. The combination of investment research, portfolio monitoring, and educational depth makes it an ideal bridge between paper trading and real-world investing.

Whether you’re managing a student portfolio or making your first brokerage trade, Seeking Alpha offers the clarity and confidence every investor needs.

February, 2026 SALE happening now:

Seeking Alpha is a very successful stock research and rating service. With that, they rarely offer discounts, so when you see a sale it's crucial to take advantage of it. They're currently offering one of their best discounts of the year!

You can get a free trial, save 20% off their premium services AND get their Lowest Price this Year.

- Seeking Alpha Premium: 7 Day Free Trial & Save $30; usually

$299now only $269/year — Claim Your Discount.- Alpha Picks: Save $50; usually

$499now only $449/year — Claim Your Discount.- Seeking Alpha Bundle (get both): Save $159; usually

$798now only $639/year — Claim Your Discount.

FAQs

Yes. It gives investors access to advanced Quant Ratings, stock screeners, and investment ideas proven to outperform the market.

Definitely. The platform includes educational resources, fundamental analysis, and a community of investors who explain their reasoning in plain language.

Extremely. Quant Ratings are algorithmically generated and back-tested, with Strong Buy stocks outperforming the S&P 500 by significant margins.

Yes, but its primary focus is on stocks, ETFs, and dividend investing. Mutual fund coverage is limited compared to individual stock research.

Yes, you can link most major brokerage accounts for automatic portfolio tracking and real-time alerts.

Premium members receive real-time alerts, earnings calendars, and analyst revisions, keeping you ahead of market moves.