Do you want to be a great investor and have your portfolio consistently beat the market?

Most people think it is as simple as picking more stocks that go up than go down.

Well, it’s not quite that simple.

The real answer to becoming a great investor is to build a portfolio of stocks that outperforms the market every year.

We all have seen the data that says, over most time periods of 10 years or more, the stock market averages 8%-10% return. At that rate, your portfolio should double every 8 years.

But wait! Isn’t the goal to BEAT the market?

Do you realize that if you can get a 20% return every year do you realize that your portfolio will DOUBLE every 4 years and QUADRUPLE every 8 years?

Isn’t that what you really want as an investor?

Fortunately, you have come to the right place. The fact you landed on this page means you already know who David Gardner is and what his reputation is regarding beating the market.

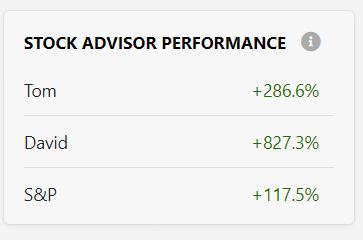

Take a look at that chart again, which I pulled off their site on March 7, 2021.

Since 2002, when David and his brother Tom launched their first newsletter, called Stock Advisor, the S&P is up an average of 117%. While Tom’s picks are fantastic being up 286%, David’s are up 827%. Talk about beating the market!

David’s picks started outperforming Tom’s and so David launched his own newsletter called Rule Breakers that targets companies with high growth potential in high growth markets.

So if you want to get just David’s stock picks, you should take a look at that service.

Before I jump in and reveal some of David’s stock picks, let me give you a quick history.

What is the Motley Fool?

David and Tom Gardner started the Motley Fool in the early days of the internet in 1993.

Their goal is to help investors become smarter, happier and richer.

Specifically, their goal is to help investors beat the market buy finding undervalued stocks in high growth industries. They do say over and over again that you should plan on holding at least 15 of their stocks for 5 years or more.

Today, the Motley Fool runs a full suite of podcasts, webpages, and stock predictions.

It’s a full-service stock advising machine that helps people beat the market.

Their newsletter, “Stock Advisor,” has over 700,000 subscribers.

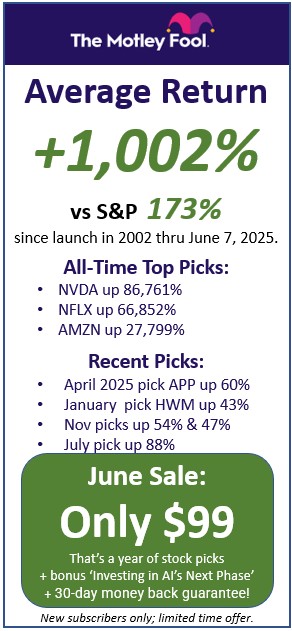

These guys claim that if you’d been picking stocks just based on the Stock Advisor, you’d beat the market by 507% to 117% over the lifespan of the newsletter.

Want more information on Stock Advisor?

Is it worth it?

You can check out our surprising review of the service.

David Versus Tom

Both David and Tom started the Motley Fool, and they both submit their separate picks to the Stock Advisor newsletter each month.

And while they get equal credit for being brilliant investors who have started a wildly successful stock-picking machine…

…David is the slightly better stock picker (so far).

David Gardner’s stock picks for the Stock Advisor have outperformed his brother’s picks by a wide margin.

Tom’s Stock Advisor picks have also beat the S&P 500.

Tom’s picks have gained 286%, while the S&P 500 has only gained 117%.

And as good as this sounds, David has done even better.

David’s Stock Advisor picks have gathered momentum amounting to 827% over the same amount of time.

If you were only picking David instead of Tom, you could beat the market by a lot more.

We bought a subscription to Motley Fool’s incredibly popular Stock Advisor service over five years ago to figure out just how good the stocks picks were.

Over that time, David picked high-performance stocks like AMZN, NFLX, DIS, BKNG, and SHOP.

All of those picks that were just listed have shot up over 1,000% in the timespan after he picked them.

David usually finds one stock each year that has an incredible performance.

Plus, if you get in on the ground floor when he recommends, you stand to make a lot of money.

The Motley Fool now also runs The Motley Fool Rule Breakers which is just for David’s picks.

Since Rule Breakers has launched, the those picks have beat the market by 6 times, or 6x!

David Gardner Stock Performance (Since 2016)

Not convinced yet?

Here are some highlights from David Gardner’s stock picks over the last few years, since 2016.

While it doesn’t give you an idea of just what the averages are, we’ll take a look at those below.

For now, just think what it would’ve meant to have any of these individual stocks in your portfolio. Returns as of February 5, 2021

- January 2016 pick of PLNT is up 552%

- February 2016 pick of SHOP is up 6,026%

- March 2016 pick of SHOP again is up 4,815%

- Sept 2016 pick of TEAM is up 712%

- October 2016 pick of RMD is up 254%

- Nov 2016 pick of ETSY is up 1,661%

- Nov 16 pick of UI is up 508%

- January 2017 pick of TWLO is up 1,277%

- Feb 2017 pick of TREX is up 507%

- Feb 2017 pick of TTD is up 2,393%

- March 2017 pick of VEEV is up 508%

- May 2017 pick of TTD again is up another 1,560%

- January 2018 pick of AYX is up 379%

- Nov 2018 pick of GH is up 337%

- January 2019 pick of SKX is up 49%

- Feb 2019 pic of GH is up 232%

- March 2019 pick of ROKU is up 611%

- June 2019 pick of NVCR is up 189%

- Sept 2019 pick of TDOC is up 312%

- Oct pick of DDOG is up 253%

- Nov 2019 picks of ETSY and PTON are up 452 and 361%

- For 2020, Jan PINS is up 262%, Feb SE is up 469%, Mar QDEL is up 166%, June HUBS is up 106% and Sept RDFN is up 64%

David Gardner vs. The S&P 500

Now, those are some hand picked stocks from the last few years that have way outperformed the market expectations.

While that isn’t perhaps the best statistical sample for you to see how well David Gardner’s stocks are performing, let’s compare David’s picks to a better sample.

The S&P 500 is a collection of 500 of the largest companies that are listed on the stock exchange.

A stock that plays the S&P 500 bets on all of these companies as a collective, which gives you a nice, stable stock that should give returns.

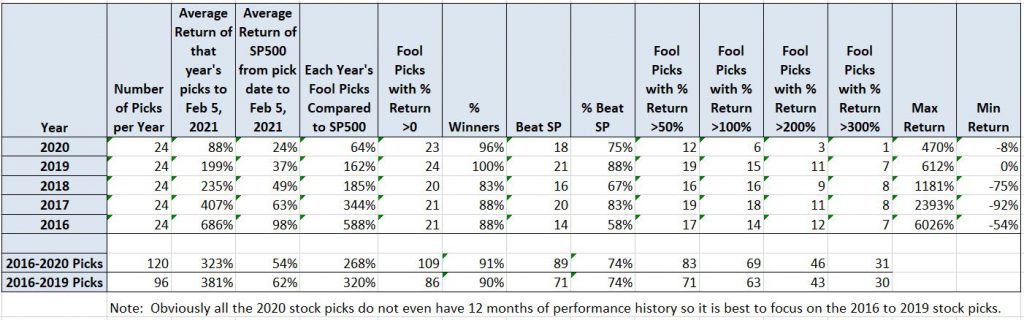

Here’s how David’s picks compared to the S&P 500 over the last few years (as of Feb 5, 2021):

- 2016 picks are up 686% as an average vs. the S&P 500 being up 98% since 2016

- 2017 picks are up 407% as an average vs. the S&P 500 being up 63% since 2017

- 2018 picks are up 235% as an average vs. the S&P 500 being up 49% since 2018

- 2019 picks are up 199% as an average vs. the S&P 500 being up 37% since 2017

- and the 2020 picks that most don’t even have a year of history are up 88%

Look at those stats!

If you had just been buying equal amounts of the full set of David Gardner’s stocks since 2016 you have 6x the return of the S&P500. That is 323% compared to the market’s 54%! That stat alone is the single most compelling reason to follow David Gardner.

Click Here to Get David’s next 24 picks for only $99.

Now, extrapolate this data out a few years into the future.

If you buy some of David’s stocks now, there’s a pretty good chance that you could make a ton of money off of them!

If you had his 2016 picks in your portfolio now, in 2020, you’d be well on your way to a huge payday.

Investing in his current stocks for just a few years could pay huge returns.

How to Get David’s Picks Each Week

The best way to stay up to date with David Gardner’s stock picks and market analysis, you should do what we tell you to do…

…and subscribe to the Motley Fool Rule Breakers services.

Usually the service is around $300 a year, but usually there are also deals and promotions that allow you to jump in for 50% off or at a lower monthly rate.

Follow this link to the Motley Fool Rule Breakers and you’ll get to see the latest promotion that they are running!

You should be able to try the service for quite a bit cheaper than the full price.

Usually they are also running a deal that allows you to take advantage of a 30-day cancellation period.

You’ll get a full refund and they give it to you without you having to explain yourself!

If you aren’t ready for the full service, you can check out David’s podcast, the Rule Breaker Investing podcast.

We’ve found that Gardner has beaten the S&P 500’s performance for every single 5-stock set that he recommends over the period of a year.

The podcast is a great way to get into the game without paying for the entry fee.

If you like the podcast and appreciate David’s approach, then you can get the full service to take full advantage.

5 of David’s 2019 Picks and How They’re Doing in 2020

Let’s take a look at 5 of David Gardner’s stock picks from early in 2019.

We’ll see why David chose the stock in the first place, how the stock performed over time, and where the stock currently is in 2020.

David’s podcast gives you a look into the services that they offer.

These 2019 picks are from the January 23rd podcast, “5 Stocks Shrouded in Mystery.”

We’ve selected this podcast at random so that you can see how you would’ve done if you’d listened to a random podcast and bought those stocks on David’s advice!

Pick #1: Carter’s (CRI)

Carter’s, with the NYSE index of CRI, is a children’s clothing company that has a bunch of stores.

They have multiple brands of clothing and have been around for a while.

It’s pretty likely that your parents bought clothing from Carter’s, and you may have done so for your own kids, and you kids might do so for their kids, and so on.

The company has been around, and David thought that it would stay around for a while.

The company has hundreds of stores and does a lot of international business, and also was a forward player in the e-commerce space.

They also have been pretty realistic about the future of retail and the ecommerce world.

They’ve been focusing on closing under-performing stores and driving more traffic online.

When David ran the podcast, the day of the show Carter’s was trading for $78 a share.

How is Carter’s Doing in 2020?

As of today (1/21/2020), Carter’s is worth $110.38 a share.

That means that the stock went up by a good bit, by more than the market average for stocks.

The company has been successful in it’s closing of stores and the outlook for Carters looks solid.

Pick #2: Ellie Mae (ELLI)

At the time of the 2019 show, Ellie Mae (ELLI) was trading for $69.

The company runs the Encompass Mortgage platform, which a lot of industry leading mortgage lenders use to originate loans and lower costs.

The Encompass platform is a big deal.

The stock went down quite a bit over the course of the months prior to David picking it, but he thought that it was under-performing at the time and that it would bounce back.

A few weeks before David’s show, Ellie Mae said that it was going to move to the Amazon Web Services platform.

David thought that this would be a good move and that the stock had a lot of potential.

How is Ellie Mae Doing in 2020?

Well, this is a bit of a tricky question.

If you look up ELLI right now you’ll see that the stock isn’t worth any money right now, because the stock no longer exists.

But this isn’t because it crashed or because Ellie Mae went bankrupt, it is because the company was acquired.

If you had sold the stock when the Motley Fool Stock Advisory recommended that you sell before the acquisition, you would’ve made out with $98.99 per share, which is about a 50% increase in the original stock price at the time of the podcast.

So while we’ll call this a definite win for David, it certainly has a bit of an asterisk on it because your growth potential is capped at the time of the acquisition.

Pick #3: IPG Photonics (IPGP)

IPGP is a NASDAQ company. IPG Photonics was started by a Russian immagrant who now lives in the United States, and he’s got a long history of building companies that do really well.

He has built a ton of intellectual property that is moving the industry toward fibre lasers instead of different kinds of lasers.

Basically, he owns a better version of lasers that people are buying.

Now, David loved this stock because it had lost about half of the value that it had in the summer of 2018.

Which, for him, made it a bargain in the early days of 2019. At the time that the podcast was running you could’ve picked up IPGP for about $128 a share.

How is IPG Photonics Doing in 2020?

David once again made a solid pick.

If you had turned off the podcast and immediately made a trade for IPGP, you’d have seen your stock increase from $128 to $144.85 over the course of 2019 to where it sits currently.

It’s not a bad stock, and might even go up from where it is. IPG Photonics looks like a great long term pick that David could’ve gotten you in early on.

Pick #4: Mercadolibre (MELI)

Mercadolibre is something that David called in the podcast “one of my favorite companies.”

The stock was worth a solid $349 when David recommended that you buy it. What is MELI?

Well, it is the e-commerce leader of Latin America.

David thought that the emerging middle class in Latin America was going to continue to watch Mercadolibre grow with it.

He recommended that you go in and go in fast on MELI.

How is Mercadolibre Doing in 2020?

Suppose you listened to David’s podcast and thought to yourself that MELI sounded like a great bargain.

It represents something of the Amazon of Latin America.

Suppose you put all your money into this single stock?

Well, as of today (1/21/2020), MELI is trading for $658.46 a share, which would mean that you’ve almost doubled your money in a single year!

Now that’s a great stock pick.

Pick #5: Planet Fitness (PLNT)

When David told you to buy Planet Fitness, the gym phenomenon that is banking on relatable branding and cheap membership fees, the stock was trading at $58 a share.

The wellness space is continuing to boom, and David thought that one year ago, despite the rise of boutique fitness and hipster wellness, PLNT would be able to rise through the trends and be a solid bet.

How is Planet Fitness Doing in 2020?

PLNT has gone up from $58 a share the day that David recorded this podcast to $78.90 a share today (1/21/2020).

That means that if you bet on Planet Fitness like David recommended, you’d have made decent returns on your stock.

So How Much is a Subscription to the Fool's Stock Advisor service?

The Stock Advisor service is usually $199 a year, but there is a special sales page for new subscribers. They frequently run special promotions like "40% OFF" and "TRY IT FOR JUST $99." So if you are a new subscriber, click THIS LINK and you can save $100.

And, there is a 30 day cancellation period for a full refund.

Results of David’s 2019 Picks in 2020

Every single one of David’s Rule Breakers picks from the January edition of the podcast made money almost a year from the date that he picked it.

While one stock is no longer trading, if you continued to follow Fool advice, you’d have gotten out with some nice earnings.

The other 4 stocks are showing no signs of slowing down.

If you got in on MELI early in 2019, you would have doubled your money by this time this year!

Needless to say, David has a knack for picking great stocks and a crack team of analysts to back up the moves that he is advising.

Who knows?

If you pick David’s 5 stocks from an early edition of rule breakers from this year, you might see some great returns for 2021.

Click Here to Get David’s next 24 picks for only $99.

CLICK HERE to save $200. & get his next 24 picks for only $99