A short stock is an expression used when you sold shares of a company that you did not own beforehand. Let’s say you expect a stock’s price to drop. Shorting a stock would involve a strategy where you borrow shares from another party (usually a broker) and sell it on the market. Borrowing from a third party implies that you will have margin requirements, which is cash set aside for the borrower’s protection on the asset. You would close this position by buying back the quantity of shares at a lower price, return the shares to the broker and pocket the difference as a gain (or a loss, if you purchased the stock at a higher price). Words such as “shares”, “equity” and “stock” all mean the same thing.

In the world of trading, being short on a stock means that you currently sold shares of a company and have a negative number of shares in your open positions. You would eventually bring back this number to zero by covering (buying back) these shares in the future.

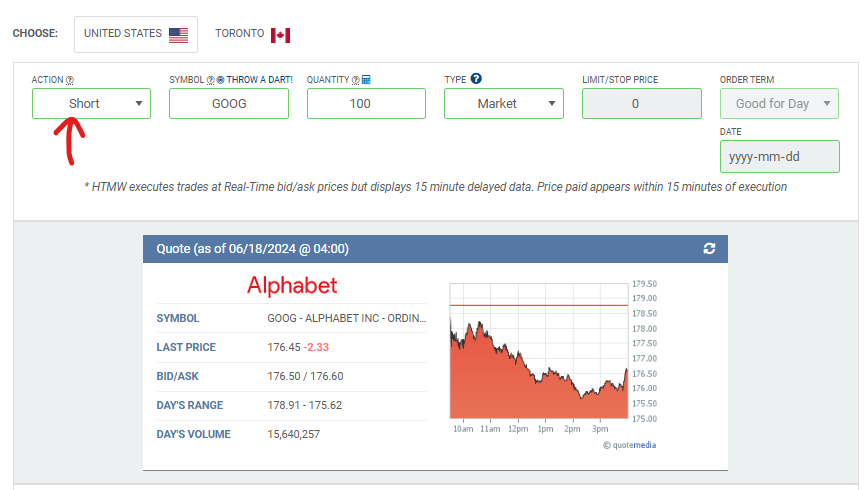

What are its components? Can you show me how to short a stock on HTMW?

The components of a short stock are quite simple. You simply need to perform a short sell order to open a short position on a stock:

When and why should I have a short stock?

You should short sell a stock when you expect the stock price to go down. In other words, you have a bearish position on the security.

What does it look like graphically? What is the payoff and profit graph?

What is the break-even point?