Definition

An order type that allows to set a moving stop or limit target price. The target price moves based on the daily high. Trailing stops can be set either in percentage or in dollars and cents terms. When in dollar terms it will activate when the price has moved by the target you have set relative to the day’s high.

Example

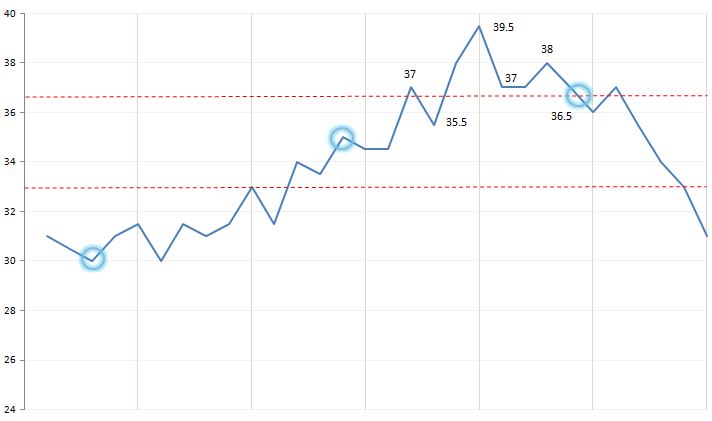

Let’s say we bought a stock for 30$. The stock then climbs to 35$. We don’t think it will go much higher but we do not want to lose our profit either. We could then set a trailing stop order for 3$. This will act just like a normal stop order. Selling at your target price. Here, however, your target (moving) price is 3$ and when the price is 35$ it will trigger at just below 32$. As we will see though, it changes based on the high:

We’ve set our trailing stop at the second bubble. Currently our selling point is 32$. The price then goes up to 37$. The new stop order will occur at 34$ (shown by the lower red dotted line). However, the price continues to go up to 39.50$ making our stop target price 36.50$ The price moves down and then back up to 38$ but this will not affect your trailing stop since it is not higher than the previous high. Thus our stop target is still 36.50$ which will be activated at which point we fall just below it.

Similarly, we could have use a percentage trailing stop. This will act just as it did previously but the target will change based on the high price. Hence if we used a 10% trailing stop in the example above. Our exit would have been at 39.50 – 10% * 39.50 = 35.55$. Percentage trailing stops can be very useful to help protect you if your price has increased considerably. For example, a 1$ trailing stop might be fine at 10$ but wouldn’t be if your stock had increased to 100$. You would be sold out of your position far too early.

Note: There are many variations that can be made with trailing stops with advanced trading software. You can change the high’s and the duration by tick size or have different ways of calculating the target price. This is far more complex however and requires a very experienced trader.