If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between more than one sector. This sounds easy, but it can be very challenging finding stocks from a wide range of sources that fit what you’re looking for. Thankfully, our Quotes Tool has all the information you need to Read More…

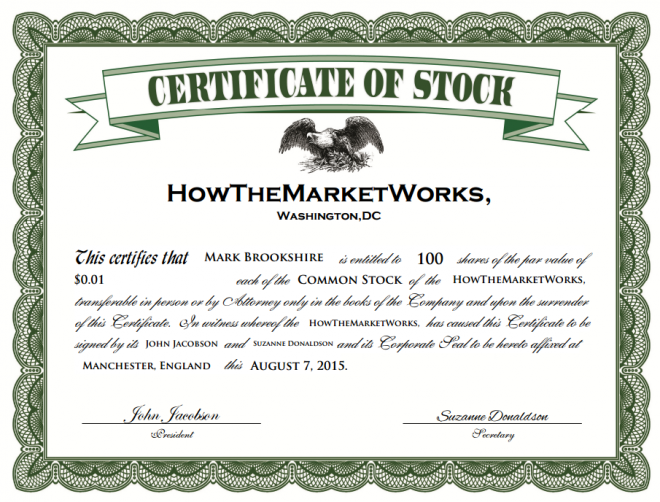

The basics about stocks. What are they? What do they represent? How does Risk figure into stock ownership.

ETFs have been one of the most popular investment vehicles in the world over the last decade or so, with investors of all types attracted to the low fees, but diverse holdings, falling somewhere between mutual funds and stocks in terms of how easy they are to manage in a portfolio. However, one of the Read More…

Live Forex trading includes negotiating of national bills which is performed on a live basis at 24 hour, around-the-clock period. Forex is derived from the words Foreign Exchange which is known as the global market that does business in money trading.

Promissory notes issued by a corporation or government to its lenders, usually with a specified amount of interest for a specified length of time. This is seen as a loan from the bond holder to the corporation. The value of Bonds traded are greater than the value of stocks traded.

ETFs are collections of assets into bundles you can invest in all at once, the most popular ones follow indices (such as SPY following the S&P 500), which is one way for an investor to build a diverse portfolio without holding dozens of individual positions. However, using financial derivatives and debt, there are also Leveraged ETFs, Read More…

ETFs with best rate of return for one and three years

Most Popular Canadian Stocks Looking to trade Canadian stocks in your HowTheMarketWorks portfolio, but not sure where to look? You can find a list of the most popular Canadian companies, their symbol, and quotes here! SYMBOL COMPANY NAME Quote And Chart Trade It On HTMW RY Royal Bank of Canada Get Quote! Buy It On Read More…

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades, and get your portfolio off to a running start. Establish Goals Before choosing Read More…

Over-The-Counter (OTC) Stocks Most investors are familiar with NASDAQ, the NYSE (New York Stock Exchange), TSX (Toronto Stock Exchange), and most other large national stock exchanges. However, there are also thousands of companies that want to sell shares to the general public, but are not able to sell on these exchanges. Stock traded on these Read More…

An annual list of the Fortune 500 companies. They are the top 500 companies to trade and also the 500 largest companies.

An annual list of the Fortune 500 companies. They are the top 500 companies to trade and also the 500 largest companies.

An annual list of the Fortune 500 companies. They are the top 500 companies to trade and also the 500 largest companies.

An annual list of the Fortune 500 companies. They are the top 500 companies to trade and also the 500 largest companies.

Direxion Small Cap Bear3X – Triple-Leveraged ETF is an index fund ETF (Exchange Traded Fund) designed to seek a daily result of 300% of the INVERSE of the performance of the Russell 2000 Small Cap Index.

The two ways to make money with stocks are Dividends and Capital Gains. Investors should have a clear understanding of their strategy before purchasing stock so they know the best way to evaluate any potential stock purchase.

Since the bottom fell out of the stock market in 2008, investors have been shifting money from stocks into bond funds. Since 2007, there have been $1.39 trillion invested in Bond Funds versus $193 billion in stock funds. The most logical explanation is an attempt to find income and safety, but are bonds truly safe?

Stock prices are a direct result of supply and demand. All the other influences like debt, balance sheets, earnings and so on affect the desirability of owning (or selling) a stock.

Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more.