Pop Quiz

[mlw_quizmaster quiz=62]Pop Quiz

[mlw_quizmaster quiz=61]Pop Quiz

[mlw_quizmaster quiz=60]First things first: Here’s what you need to know before getting Bitcoin

All cryptocurrency fans should ask themselves: How to buy Bitcoin?

Like some other virtual money forms, Bitcoin has a few properties that you have to think about before actually making up your mind whether to get it or not.

If you are new in the Bitcoin world, you should realize that the trading of cash is not quite the same as how it is typically done in banks. So you might see why it’s important now to keep in mind the pros and cons before making a transaction. Since you are trading cash for Bitcoins, you have to deal with this investment as any other.

You need to secure your Bitcoin wallet

Like any other wallet with cash, you should make sure that your Bitcoin wallet is secure and safe. Wallet alternatives are many, yet you should find one with an important feature, the one with security. So make sure that you get a password, which helps you in getting your wallet private and safe. Be that as it may, if you forget your password, nobody can help you. If Bitcoin is utilized effectively, you shouldn’t encounter any problems. This is an essential thing for your wallet.

What’s the cost of Bitcoin?

The cost of Bitcoin can change over time, because of numerous reasons. Like different monetary forms, the laws of the free market activity decide the cost you pay for Bitcoin. Given the fact that clients appear from nowhere day by day, it’s understandable that the cost will keep on increasing.

This is an irreversible payment

When you have completed a transaction with Bitcoins, you should already know that there is no individual, government or bank ready to give the money back to you if you change your mind. Once is done, is done. You have to ensure that each transaction you do with Bitcoin is with someone you trust, in light of the fact that this person is the only one who can give the money back to you. So be careful with whom you’re making business.

Transactions with Bitcoin aren’t kept a secret

All Bitcoin transactions are recorded, since the system will have the data there, with the respect to every transaction ever made with Bitcoin. Anybody can find the transaction’s data and connect it to a person after some time, i.e people will know that is was you who bought that something. You should know how to take control with the respect to Bitcoins in your general area.

No one there to ruin your transactions

For every transaction, you’ll get an affirmation score to tell you if the potential outcomes of the transaction are being switched. The payment procedure with Bitcoin is a faster one and is also worldwide, and since isn’t possessed by any organization or government, there are no outsiders attempting to exploit or ruin it.

Bitcoin Transactions

There are numerous alternatives to trade cash for Bitcoins. Because of the absurdity of banks, the cost of trade can change from time to time. Dealers will dependably aim to purchase at a low cost and offer at a high cost. Try to do trusted deals to maintain a strategic distance from people who want to get your money by tricking you.

There are so many different ways for a person to build wealth over time. Finding the right investments is a key part of achieving your financial goals. In order to find the right investments, you will have to spend a lot of time researching your options. If you are looking for an investment that can provide you with a steady stream of income, then trading in the Forex market is a great option. This type of trading deals in currencies from all around the world. While you will not get rich overnight with this type of trading, there is an opportunity to make a lot of money over time. An essential part of having success as a trader in this market is by working with the top forex brokers. Read below to find out some helpful tips on how to find the right Forex broker.

- The Spread Amount Being Offered

The first thing you need to find out from a potential Forex broker is what their spread amount is. This amount relates to the amount of times you can buy or sell a particular currency in a designated amount of time. Since Forex is not traded through a central exchange, the spread amount varies from broker to broker. The only way to figure out what type of spread works the best for your Forex trading strategy is by doing a great deal of research. Most experienced traders prefer to deal with a broker that has a fixed spread. By doing this, you can avoid surprises along the way in your Forex trading journey.

- The Amount of Security Offered

Before using a particular broker, you will also need to find out about the level of security they have in place. Often times, the Forex trades you make will be done online. This means that there is always a risk of hacks occurring. Taking the time to contact the various regulatory agencies that are over the Forex trading market, you can find out more about a particular broker. If the broker in question has been reported a number of times for lax security, you need to avoid using them at all costs. Failing to do a great deal of research may lead to you losing a lot of money in the long run.

- What Are Their Transaction Costs?

Finding out what a broker will charge per trade transaction is also important. Some brokers will charge you a flat rate per month for a pre-designated amount of trades. Calling around to the various brokers in your area is the only way to figure out which one of them can offer the best deal on transaction fees. Most of the brokers you contact will be able to give you this type of information over the phone. Once you have this information, you should have no problem narrowing down the selection of brokers at your disposal.

- The Type of Trading Platform Being Used

You will also need to find out more about the trading platform a particular broker uses. There are tons of different Forex trading platforms out there and some are far better than others. Since most of your trades will be taking place online, you need to make sure the platform a particular broker is using is secure and easy to use. Setting up a demo on a few trading platforms will give you a firsthand feel for what each of them can offer. With this information, you can make an informed decision regarding which broker is the right fit.

- The Level of Customer Service Offered

Finding out about the reputation a broker has is also important. You need to make sure that the broker in question is known for providing a high level of customer service.

While choosing the right Forex broker will not be easy, it is well worth the effort you invest.

Five years ago, most people didn’t have a clue what cryptocurrencies were. Ask the average man on the street about bitcoin and he would have raised his eyebrows and said “huh?”. Fast forward a few years and cryptocurrencies have hit the mainstream. Today, your Uber driver can tell you the latest bitcoin price and your neighbour invested in Ripple before breakfast. So far, so good, but apart from making headlines, how will cryptocurrencies affect the markets and businesses in 2018?

A Rollercoaster of a Year

2017 was an epic year for bitcoin and other leading cryptocurrencies. Bitcoin began 2017 trading at less than $1,000. By December 29th, it was worth more than $14,500. It hasn’t all been plain sailing for bitcoin and there have been some huge ups and downs. Early in 2017, China cracked down on bitcoin trading, causing a price slump, but in April, Japan declared bitcoin a legal currency, boosting the price once again.

Other cryptocurrencies have experienced similar upward trajectories, although not quite as spectacular as the bitcoin rollercoaster. Much of the rise in cryptocurrency has been fuelled by media interest, which has pushed cryptocurrencies into the public domain. We are increasingly living our lives in the digital realm and cryptocurrencies are an important part of this. The danger is that public interest in cryptocurrencies, followed by a widespread buy-in, could cause an unsustainable price bubble. And like all bubbles, sooner or later it will pop.

Changing Market Perceptions

Until recently, cryptocurrencies have had very little effect on the markets, but that is beginning to change.

Big companies are starting to jump on the cryptocurrency bandwagon, creating hype and boosting their stock. LongFin Corp., a NASDAQ listed fintech company recently announced it had acquired Ziddu.com, a blockchain solutions provider. LongFin stock shot up by 2,000% in the wake of the announcement. As more companies buy into the crypto-boom, the markets will become increasingly exposed. We are likely to see an economic boost on the back of the demand for cryptocurrencies, but how long this will last is debatable.

The big rise of cryptocurrencies happened right under the noses of big banks and financial institutions, but now they want in. People are interested in cryptocurrencies and banks are realising that there is money to be made by facilitating transactions via online trading. Big finance companies are also keen to get involved in cryptocurrencies and blockchain, as evidenced by JP Morgan Chase, Microsoft, Santander, Intel and others uniting to form the Enterprise Ethereum Alliance.

How Will Cryptocurrencies Affect Businesses?

Businesses can’t ignore cryptocurrencies, particularly those that trade in the online ecosystem. It’s becoming increasingly common for businesses to offer cryptocurrencies as a payment option and online payment providers like Stripe now include cryptocurrencies in their systems. Cryptocurrencies are a less expensive way to accept payments, which is a positive thing. Transactions are also faster and final.

However, the biggest danger for businesses – and the markets – is that cryptocurrencies are extremely volatile and price flash crashes can cause ripples that have a far-reaching effect. All in all, 2018 looks like it could be a very interesting year.

Financial stability is a highly desired commodity for both individuals and businesses, and in both cases, money management is often a key to that stability. Multi-million dollar businesses don’t get to that level of success through improper spending and a blissful lack of awareness regarding their cash flow. It takes careful management, budgeting, and sacrifices to reach that level of financial stability.

If you want to become more financially secure, managing your finances like a business can help you to gain control of your financial situation. Here are a few tips on how to do just that.

Your Spending Accounts

All successful businesses start with a business plan. Typically, this includes things like the product or service their offering, their method for creating and delivering the product, and a company mission statement. For your personal finances, the main part of your “business plan” will be a budget.

Budgets are something most people are familiar with but few people employ properly. To manage your personal finances like a successful business, you should establish “spending accounts” relating to each category that is relevant to your monthly spending. This may include a spending account for rent, utilities, groceries, medical expenses, and personal spending. Everything you buy should be tracked and attributed to the proper spending account. If you fail to track your spending, you’re not managing your cash flow properly, and your financial plan will fail.

Your Mission Statement

The other part of your business plan should be a personal mission statement. Much like a business’s mission statement, this should outline what your end goal is. Why are you trying so hard to manage your finances? What result do you hope to see? Do you want to get out of debt? Do you want to put a down payment on a house? Maybe you just want to see a certain minimum amount in your savings.

Whatever it is, write it down, and put it somewhere that you can see it every day. Having a personal mission statement gives your financial efforts purpose and keeps you on track, just as it would for a business.

Your Operating Expenses

Businesses keep a close eye on their operating expenses, and are always looking for ways to minimize their overhead costs. You need to view your personal expenses in a similar manner. How much does it cost to “operate” your life on a day-to-day basis? Where can you reduce the spending to minimize those expenses?

Mastering your finances goes hand in hand with mastering yourself. It takes a great amount of self-control to say no to that invitation to go to the movies with your friends, or to pack a lunch for work instead of going out to eat every day. But these small sacrifices add up quickly. Just as a new business must do without the most high-end equipment and furnishings, you will sometimes have to pass on purchases that are extremely tempting.

Over time, these sacrifices will contribute to long-term financial stability as you form a habit of frugality that will guide you through your life. Similarly, businesses that are extremely careful about their spending habits are far more likely to become multi-million dollar success stories.

Your Revenue Streams

A good business owner knows that you must maintain multiple sources of cash flow in order to be successful. You can’t rely on a single client if you want your business to grow. This is a factor that many people don’t work into their personal finances. After all, if you have a job, what other source of income do you need?

It is always a good idea to have a secondary source of income, even if it is a small source. This may be something as simple as teaching piano lessons in the evenings or cleaning someone’s house on the weekends. A secondary income stream is essential to keeping you afloat if your primary income source is cut off.

Consider, as an example, multi-millionaire Sam Ovens. He began his business journey in his parents’ garage, building an app. Though the program was extremely successful, he didn’t stop there. Sam built on his own success and continued creating new revenue streams. He became a business consultant, then began teaching others how to become consultants. Though not everyone can have multiple, large revenue streams, having additional sources of income aside from your primary income is a vital part of managing your finances like a business would.

By constantly searching out new revenue streams, you can find ways to support yourself that you might not have imagined before. And if you follow the tips above, you can manage your personal finances like a successful, multi-million dollar business.

It’s essential to establish a well-thought-out plan regarding your finances, no matter how young one is.

The first thing you need to do is to identify your short-term goals. Though your long-term goals are just as important, the fundamental approach to achieving those hinges on your ability to hit short-term goals. Failure to define your short-term goals clearly will result in your inability to secure a great future in terms of your finances.

The following are short-term financial goals you should set to have control over your finances:

- Eliminate Debt

Take a good, hard look at your financial situation as this is a vital step in achieving financial stability. Before setting out any financial plans and objectives, you ought to consider getting rid of any forms of debt. The sad truth is that you can’t invest your money effectively when you have a lot of debt piled up. Write up a plan to tackle any debt you have.

- Start an Emergency Fund

In an uncertain world, it’s important to be proactive. Instead of waiting until something really terrible happens, why not have a contingency plan in place? Starting an emergency fund doesn’t require a lot of effort and you can start small at first. Commit to putting away an amount that makes sense for your budget every month. Create a separate checking account for your emergency fund and use automatic withdrawals to fund it. Set it and forget it.

- Create a Budget

Controlling what you spend your money on can a bit of a herculean task especially if you don’t have your priorities right. At 20 years of age, now is a good time to practice setting and following a budget. If you are not sure how much money you spend monthly, use an expense tracker to assess your spending for at least 2-3 months and then you can decide what to include and exclude in your budget.

- Generate Multiple Streams of Income<

As you are advance in life, your responsibilities grow with you. More responsibilities translate into more bills, and it’s important to not be dependent on just one stream of income. A steady job is great, but if you aren’t diversified, you will be rocked if you lose your job for whatever reason. Build skills that you can grow a stream of income around.

- Invest, even a little

With the existence of apps such as Stash, Robin Hood and others, it has become easier than ever to invest in the stock market. The earlier you start, the more time your money has to compound and generate stellar returns.You don’t need several thousand dollars to start investing, just $5 and a little bit of curiosity. Stash, for example, enables users to begin their investment career with as little as $5.

- Keep an eye on your credit score

Your early twenties are a great time to start building a credit history. If you decide to open a credit card, make sure to use it sparingly and pay off the balance in full, every time. Building a solid history and great credit score can come in handy down the line, giving you access to great deals in the future when you need it. Future you will thank you profusely.If you haven’t established credit yet and are having issues opening one, try setting up a joint credit card with a relative.

At 20 years of age, short-term financial goals can be as simple as exposing yourself to the concepts and ideas that you will need in the future. Practice good habits like paying off credit cards in full, and keeping a budget and it will pay off in the future. At the same, it’s important to educate yourself about investing as early as possible to take advantage of the magic of compounding.

When looking for investment ideas and tips, stock screeners are a really great idea.

The best screeners available provide a large array of different information based on unique criteria, such as P/E ratios or 12-month trailing EPS (earnings per share), and allow you to identify potential winners.

But since there are so many of them out there which one should you use?

In this article, we’re going to do a finViz review. We’ll look at the pros and cons of using FinViz – a widely known technical analysis platform for investors and traders alike.

In this article, we review the pros and cons of using FinViz – a widely known technical analysis platform for investors and traders alike.

Pros

- It’s free (ish)

Well, great software becomes even better when it’s available to anyone at no cost. Despite having a premium version known as FinViz Elite, available for about $25/month, you probably won’t need it because the free version kicks ass. Especially if you are just starting out, it doesn’t make sense to pay for tools and subscriptions on a monthly basis.

- Simple UI

The amazing thing about Finviz is its very user-friendly, yet powerful user interface (UI). The overall functionality is quite impressive. For instance, you can hover over any stock ticker that shows up in your screener and immediately have its stock chart pop up on screen. Cool right?

Everything is set up precisely, filters make it easy to segment the market the way you desire, and the whole screener is designed beautifully. Other screeners can be guilty of horrible design but Finviz definitely stands out. Finally, and most importantly, it is easy and intuitive to use.

3. Depth of offering

Finviz offers a great depth of technical, descriptive and fundamental information on stocks. It also offers great heat maps and insider trading feeds and displays search results very quickly and in a stable manner. News items, on the other hand, are sourced from very reputable media outlets such as MarketWatch, Bloomberg, NBC and much more. FinViz also has a blog that collates information from sources including Zero Hedge, Ritholtz, Seeking Alpha and Vantage Point.

One really interesting feature Finviz offers is backtesting. Backtesting is when one tests a trading strategy on historical data to figure out whether or not the strategy would be successful. It is an important instrument in any budding investor’s toolkit and the fact that Finviz offers it is very exciting.

4. Insider Sales Tracking

When insiders of a company start dumping stock or buying up stock it is a good idea to not be on the opposite side of that trade. Finviz provides info on insider trading so that you are not left behind. This is a fantastic feature.

Sign Up For Finviz And Find The Best Trending Stocks!

Cons

- Ads

Freebies come with some very common problems and such include video ads. The free version of Finviz displays video ads which can be a little annoying if you are not comfortable viewing random ads from advertisers.

- Freemium model

Some of the coolest features are not available for free. Finviz uses a freemium model, so they offer the basic screener for free and ask you to pay for all the juicier stuff. If you were excited about backtesting then you will be saddened to hear that this feature is saved for paying customers. Other paid features include real-time stock quotes, advanced charting and email alerts.

The Bottom Line

Well thats it folks! Thats it for our FinViz review, you can think of it as an easy-to-use tool that is beneficial to any trader interested in technical analysis and vetting their stock picks in a scientific manner. Sign Up For Finviz And Find The Best Trending Stocks!

Article first seen on Wall Street Survivor

You may have heard a lot about hedge funds on television and perhaps, in newspapers.

What exactly is a hedge fund, and what do they do?

Hedge funds have been in existence for several decades since the launch of the very first ever fund in 1949 by A.W Jones & Co. Since then, their popularity has soared, and today there are more than 10,000 hedge funds.

Break it down: what is a hedge fund?

A hedge fund is essentially a group of people who come together to invest in the market. They raise money or provide the initial funds themselves and hope to make a killing in the market. Eventually, they open the hedge fund to others who wish to invest and participate in the profits.

Similar to mutual funds, hedge funds invest in many types of securities such as bonds, stocks, and commodities. However, investment techniques associated with hedge funds are more sophisticated and risky. Hedge funds allow investors to gain exposure to more exotic financial instruments, like derivatives and options.

And boy, are they popular! Hedge funds being managed globally, are estimated to have a combined value of around $3 trillion. Despite being around for a long time, hedge funds operate with little or no regulation from the SEC – the Securities and Exchange Commission – which is mandated to supervise the activities of such investments.

How do hedge funds work?

The goal of a hedge fund is to minimize risk in an unpredictable financial environment. While that seems to be a significant factor driving the establishment of hedge funds, the goal of maximizing profit is probably important too.

Remember a hedge fund works by pooling funds together for investment purposes. This pooling of funds allows a hedge fund manager to make tons of money by leveraging other people’s money.

Let’s assume that a company called Tiny Pony Investments runs a hedge fund, allowing it to invest anywhere in the world. In Tiny Pony’s operating agreement, the company indicates that it will receive a 20% cut on profits over 5%.

Now, five investors who are keen on investing in Tiny Pony Investments decide to sign up, each of them investing 20 million each. Tiny Pony starts out with $100 million in its basket of funds. After a year of activity let’s say Tiny Pony makes $50 million, giving it $150 million in total assets under management.

Per the fund agreement, the five original investors are to benefit from 5% of the 150 million – also known as the hurdle rate. And the remaining amount is split 80-20 between the investors and the firm. With this agreement in place, the firm takes $28 million of the remaining $142 million (after the 5% haircut). Many hedge funds work this way, while others implement slightly different structures.

Hedge funds typically employ the use of long-short strategies to meet their objective of profiting in risky environments. A long strategy simply means you are betting for the price to go up and a short strategy means you expect the price to fall and you position yourself appropriately. So if you ran a hedge fund, you might buy 100 shares of Google (long) and short 20 shares of Apple such that the dollar amounts of each of your bets are equal. Ideally, you want Google to appreciate and Apple to take a dive.

Other things you should know

- Hedge funds are not for everybody. Investors who prefer to hedge are required to have a net worth of not less than $1 million. Make sure you count your bank notes before investing in a hedge fund!

- Hedge funds are not restricted in any form of investments. You can simply invest in anything, from real estate to currencies, unlike mutual funds which have limited investment opportunities. Mutual funds can only invest in stocks or bonds.

- Hedge funds can take advantage of leverage. What this means is that you can use borrowed funds to increase your Keep in mind that this comes at a huge risk.

- Many hedge funds charge an expense ratio, and performance fee typically referred to “Two and Twenty” which translates as a 2% asset management fee and then 20% cut on all gains. This is a controversial operating scheme because the manager makes money even if the fund loses money in a given year. The manager is guaranteed that 2% fee in all cases.

Buyer beware

Most hedge funds fail to beat the market.

There are just a few that consistently outperform. The ones that do attract more assets and become even more insulated from the regular investor than the average hedge fund – already very isolated.

Most famously, Warren Buffet bet the asset manager of Protégé Partners that he could outperform a basket of hedge funds by merely investing in a simple ETF. Over a nine-year period, the bundle of hedge funds returned just 2.2% annually, compared with 7.1% for Buffett’s index fund.

The reason hedge funds fight an uphill battle is similar to why mutual funds fail to the beat the market. Fees just eat away at the gains. In the context of Buffett’s bet, the billionaire estimated that as much as 60% of the returns produced by the basket of hedge funds were destroyed through fees.

The Bottom Line

Hedge funds serve a need, just not for your average investor. Hedge funds like Soros Management or Bridgewater Capital are famous for returning 20% year after year but how many people get to participate in that?

Article first seen on Wall Street Survivor

Marketing is a word often thrown around as an umbrella term for a wide variety of functions within organizations, ranging from the running of social media accounts to inside sales, and anything in between.

Marketing and Value Proposition

The truth of the matter is that a successful marketing strategy is deeply rooted in a firm’s ability to build positive relationships with consumers by consistently providing a high-quality product, exemplary service, and an outstanding customer experience. This ability is often referred to in the business world as the firms’ value proposition. In other words, what unique offerings does the company propose to the consumer to entice them to want to buy their products or services over the competition’s?

If consumers are satisfied by a firms’ value proposition, they will organically create a certain level of brand awareness among their peers, and ultimately inspire a certain extent of brand loyalty. It’s easy to think of this as the reason why certain consumers instinctively refer to tissue paper as Kleenex©. That’s brand awareness. And if those consumers explicitly only purchase Kleenex© tissue papers, they are said to possess a high amount of brand loyalty.

Marketing Mix

Before diving into the complexities of the wide and varying scope of marketing as a function within organizations, it is important to fully grasp the ever-critical Marketing Mix.

The Marketing Mix is essentially a firm’s attempt to optimize on its offerings of Products through effective Prices, Places, and Promotions. The Marketing Mix is utilized by firms in a wide variety of business channels, as companies have begun to realize that the best revenue and profit results are reached when there is a cohesive and effective marketing strategy in place.

Products

First, the firm must identify, produce, and market (sell) the right products and services to fulfill their target markets’ wants and needs. This decision-making process takes place during the Product function of the Marketing Mix. Then, the firm needs to optimize the price of said products and services to coincide not only with what the target consumer is willing to pay, but also with what is profitable and sustainable for the business in the long run.

Price

Finding the proper balance between the elasticity of demand (how much the public is willing to pay) and profitability is a critical part of the Price function of the Mix. Next is typically when the firm begins severely scrutinizing and pinpointing possible strategies for the optimal physical placement of products, as well as the optimal geographical locations where the product needs to be sold (i.e. which retailers should carry the product).

Place

In the Place phase of the Marketing Mix, firms begin to pay much more attention to the demographics of their buyers versus their target demographics and how well both match. This is usually to strategize and try to come up with solutions on how to fill whatever gap might exist between actual customers and potential ones. It is important to note that Price and Place are extremely co-dependent factions of the Marketing Mix. In other words, a product can have the best shelf space available, at the best and biggest retailers in the world, and still have abysmal sales if it is being sold at the incorrect price point. This is because certain consumers are willing to pay more (or less) for different features and conveniences built into a product or service.

Promotions

Customers still want to know they are being treated fairly and wish to feel as if they are getting decent deals, especially when they first take the risk of trying or testing a new product or service. A big aspect of attracting customers initially is delivering them a large amount of value through “can’t miss” Promotions. It is critical to know which types of promotions will attract which types of customers, and if that customer matches your target demographic. For example, mailed paper coupons will reach and entice stay-at-home parents and senior citizens. However, digital coupons, online referral codes, and free shipping deals will attract younger consumers, such as millennials, who are more familiarized with the e-commerce (aka online shopping) experience.

Marketing to Different Channels

The function of marketing at is core is to make a business’ product or service more relevant and desirable, as well as ultimately transform that product or service from a desire to a necessity for the targeted market. The end customer can vary widely in identity, goals, and desires.

Business to Consumer

For example, business-to-consumer marketing focuses mostly on conveying the value proposition of the brand’s product or service directly to the end consumer. Business to consumer marketing is by far the most popular of the different types of marketing channels, simply because of the sheer amount of businesses that provide a product or service directly to the consumer. Think of this as the neighborhood pizza shop. They sell pizzas directly to customers, not through a wholesaler or another retailer.

Business to Business

Business to business marketing is different, however, in that it is businesses selling their products or services directly to other businesses. An easy example of business to business marketing is a payroll company providing a small business with payroll services and human resources tools. Furthermore, industrial marketing tactics usually involve either wholesalers or distributors, and typically entails the selling of raw parts and materials to be used as inputs for other final products.

Non-profit to Consumer

Nonprofit marketing is extremely dependent on brand and issue awareness, which are all deeply rooted in the education of the public. An extremely effective example of nonprofit marketing campaign in recent years has been the “Truth about Smoking” campaign, which has resulted in a sharp decrease of the smoking rate among teens from 23% in 2000 to 6% today. Most nonprofit marketing is mildly aligned with or supported by the government, as this type of marketing tends to tackle public safety concerns and alleviate the financial burden of epidemics on the already strained federal budget. This is the reason why it is said that government marketing can be quite effective in raising awareness regarding many issues, as well as civil epidemics.

Marketing and the Internet

Most companies today are savvy enough to realize that some of the best outcomes come from utilizing and heavily endorsing electronic marketing efforts, as more and more of the world gains stable access to the world-wide web. Over the last ten years, the importance of marketing has grown within organizational structures due to the immense amount of globalization occurring. Plus, the more countries that join the industrialized world, the more opportunities that will be available for their domestic businesses to grow their sales internationally. Therefore, a great brand presence online can be extremely beneficial in courting customers from all over the world. Businesses are no longer limited to their physical locations, or even posting advertisements on the local newspaper in the hopes of receiving the necessary foot traffic to keep their doors open. They now have the opportunity and ability to tap and capitalize on a much wider market of consumers, all thanks to the many ways in which firms can market their products and services online. Additionally, it has become much more effective for businesses to utilize the internet to market their products and services since many of the tools they sell their products with are free, such as Facebook, Twitter, Instagram, and Snapchat.

Pop Quiz

[mlw_quizmaster quiz=59]Win prizes in our stock market contests!

Find all of the information for any stock contests with prizes we are currently running here!

You can also find information on past contests and their winners.

Register Here To HTMW Fall Challenge

Who can join?

Anyone can join! Joining our stock market contests is completely free, so Sign Up Today! If you are under 18, by joining this contest you imply that you have obtained your parent’s permission to participate.

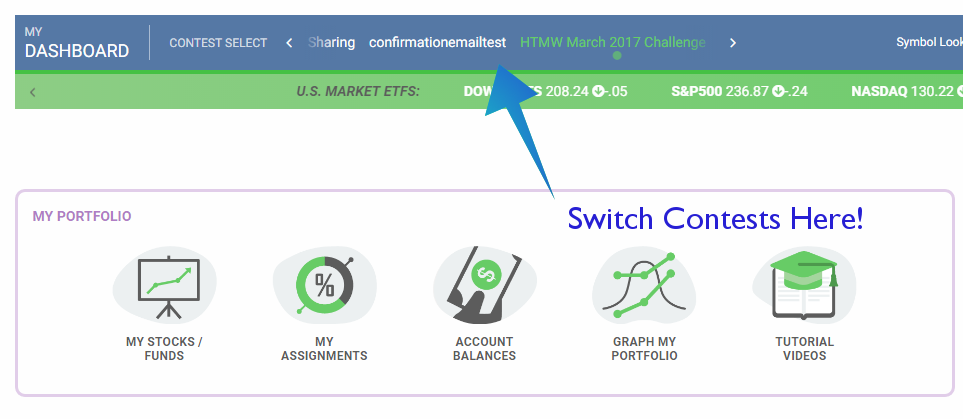

How Can I Participate?

The only thing you need is a completely free HowTheMarketWorks account, Click Here to register! If you are already logged in to an account, clicking any of the stock market contest “join” buttons will automatically enter you into the contest – just switch to your contest portfolio and start trading.

What can I win?

There are two great ways to win prizes:

- The top 5 finishers with the highest portfolio returns will each win a $100 Amazon Gift Card

- To celebrate Economics Education Month on HTMW, everyone who completes the Economics Assignment will win free access to the Investing101 Beginners Investing Course ($99 value!)

Once I’ve Joined, How Do I Make Trades In My Contest Portfolio?

If you are joined into more than one stock contest, you can switch between your portfolios using the drop-down menu you’ll find near the top of most pages:

Just select the contest you want to start trading in, and you’re set!

Is there a cost?

Nope! No costs, everything we have is completely free! The prizes are sponsored by the brokerage industry to help promote financial literacy and early investment. However, if you do want to support our team, Buy a T-Shirt from our store!

Is there any educational value to the contests?

Of course! Everything we do is centered on education. The HowTheMarketWorks Team participates in all contests, and all of our team gives live updates on our portfolio holdings, what kinds of trades we made, and why we made them. No one on our team can win prizes, but we want to give new investors an idea of what kinds of things to look for.

Every month we also celebrate a different aspect of personal finance and economics with a different theme to the contest. We also add educational articles, videos and more to help all of our participants learn!

The top finishers from each contest are also invited to share their portfolio holdings and give some explanation for their trades to help new beginners learn how to make great trades!

Click Here To See Winning Strategies Posted By Previous Participants

Teachers can also create their own custom contests for their class, and use all HowTheMarketWorks features, research tools, and classroom perks as part of their mathematics, social studies, economics, and personal finance classes, and its all completely free!

Special Rules

- Each individual is allowed only one portfolio in any contest

- Winners will be contacted by email to receive their prize. This must be the email address associated with your account. If you need to change your email address, contact support@howthemarketworks.com

- Every contest has a starting portfolio value of $100,000 USD, allows only US equities and ETFs.

- Day trading and short selling are permitted in all contests

- 9999 max trades per account

- 25% position limit

- All winners will be audited, and disqualifications will take place at our team’s sole discretion

- Winners must claim their prize within 30 days of the results being announced

- We may ask winners to provide a photo ID upon claiming their prize as part of our auditing process.

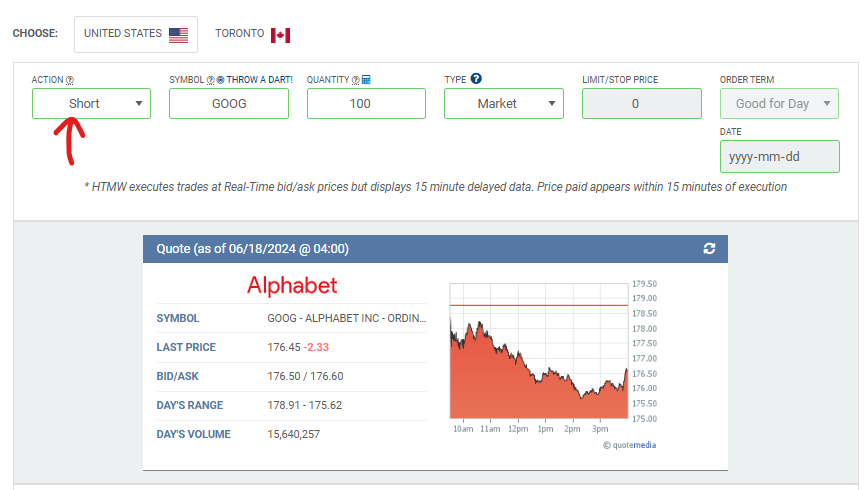

A short stock is an expression used when you sold shares of a company that you did not own beforehand. Let’s say you expect a stock’s price to drop. Shorting a stock would involve a strategy where you borrow shares from another party (usually a broker) and sell it on the market. Borrowing from a third party implies that you will have margin requirements, which is cash set aside for the borrower’s protection on the asset. You would close this position by buying back the quantity of shares at a lower price, return the shares to the broker and pocket the difference as a gain (or a loss, if you purchased the stock at a higher price). Words such as “shares”, “equity” and “stock” all mean the same thing.

In the world of trading, being short on a stock means that you currently sold shares of a company and have a negative number of shares in your open positions. You would eventually bring back this number to zero by covering (buying back) these shares in the future.

What are its components? Can you show me how to short a stock on HTMW?

The components of a short stock are quite simple. You simply need to perform a short sell order to open a short position on a stock:

When and why should I have a short stock?

You should short sell a stock when you expect the stock price to go down. In other words, you have a bearish position on the security.

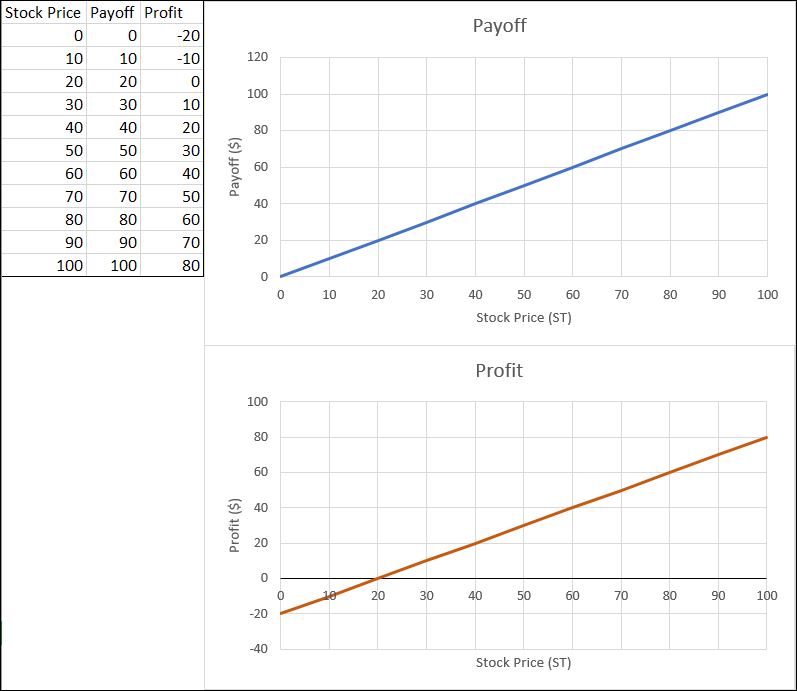

What does it look like graphically? What is the payoff and profit graph?

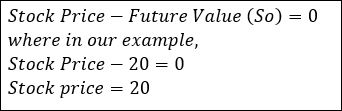

What is the break-even point?

Long Stock

What is a long stock?

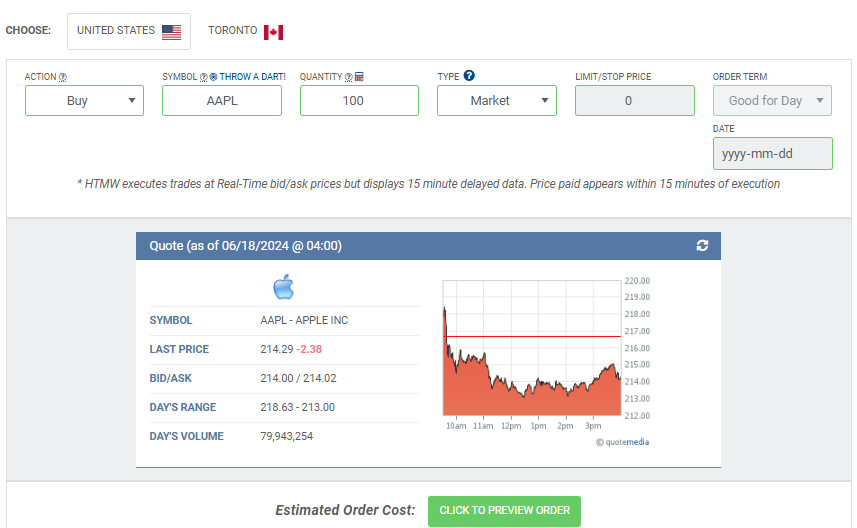

A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Words such as “shares”, “equity” and “stock” all mean the same thing. In the world of trading, being long on a stock means that you currently purchased shares of a company and have it part of your open positions.

What are its components? Can you show me how to long a stock on a trading platform?

The components of a long stock are quite simple. You simply need to perform a buy order to open a long position on a stock:

When and why should I have a long stock?

You should have a long stock when you expect the stock price to go up. In other words, you have a bullish position on the security.

What does it look like graphically? What is the payoff and profit graph?

What is the break-even point?

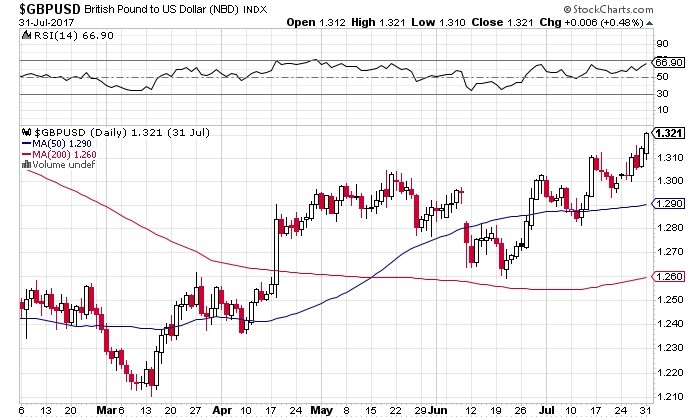

The GBP/USD pair is currently trading at 1.3205, close to its 52-week high of 1.34427. The sterling has enjoyed an imperious run of form in 2017, starting at around 1.23, and gaining approximately 7.3%. The US dollar index indicates an overall poor run of form by the greenback, with a year to date decline of 9.09%. Over the past 5 days (ending August 1, 2017) the DXY has shed 0.96%.

During July, this broad measure of the USD’s performance against 6 currencies (JPY, CHF, GBP, CAD, SEK, and EUR) shed 3.25%. The performance of the USD mirrors the uncertainty currently felt in the US political arena. President Donald J. Trump has been battling to get anything passed in the Senate, with Republicans and Democrats digging in their heels and refusing to budge on repealing and replacing the Affordable Care Act.

Prospects Ahead of Super Thursday Powwow

Weiss Finance expert, Montgomery Smyth is short-term bullish on the cable, and had this to say about its recent performance,

‘…While we have seen a notable uptick in the strength of the GBP, caution remains the order of the day. In the six weeks between 21 June 2017 and 1 August 2017, the cable has appreciated by 5.1%. The last time that occurred was 11 months ago in September 2016. Sterling strength is being helped by USD weakness, but neither points to a fundamental strengthening of the UK economy. Brexit -related concerns remain, and the UK’s negotiating hand has certainly been weakened after the general elections. The main concerns faced by Britons relate to rising CPI figures and weak wage growth. It remains to be seen how the Bank of England will address these concerns when it meets on Super Thursday.’

Meanwhile, currency traders are wasting no time pinning their hopes on an impressive sterling recovery. The GBP/EUR pair rallied on Tuesday, 1 August 2017, in the hopes of increased hawkish sentiment at the BOE. The August interest-rate decision is a big one, and pundits are anxiously awaiting Mark Carney’s statement. The MPC meeting on Thursday will wrap up August’s interest rate decision. Previously, a split vote of 5:3 in favour of retaining interest rates at the historically low 0.25% was adopted. A rate hike may not come to fruition, but sentiment of MPC members will be an important barometer of which direction the GBP will move.

Trading Above the Averages

Experts like Montgomery Smyth believe that even if 2 of the 8 Monetary Policy Committee members vote in favour of a rate hike, the GBP/USD pair could extend its rally. For Pound bears, there is equal optimism. Inflation has retreated from the red line zone of 3%, and that is typically associated with decreased urgency to raise the Bank Rate. The dissenting voices in the MPC include Ian McCafferty and Michael Saunders, but it remains to be seen whether Andrew Haldane will vote to pull the trigger. It has been 10 years since the Bank of England raised interest rates, and most projections indicate this being an unlikely scenario. Currently, the GBP/USD pair is trading well above its 50-day moving average of 1.290, and its 200-day moving average of 1.260. Short-term bulls dominate the scene.

Have you ever thought about a career in the finance industry? Have you wondered what is required to be considered a professional in the stock trading world? Well I have good news: you’ve come to the right place! We’ll cover educational requirements and the basics of Series 6, Series 7, and several professional designations in the industry. So buckle in and let’s get started!

Buying and Selling Securities – The FINRA Series Exams

The Series 6 and Series 7 exams are administered by Financial Industry Regulatory Authority (FINRA).

Series 6 Exam

The Series 6 exam (Investment Company and Variable Contracts Products Representative Exam) consists of 100 multiple choice questions, takes 2 hours and 15 minutes to complete, and costs $100. The passing score is 70%. A candidate who passes this exam is able to solicit, buy, and/or sell mutual funds and variable annuities.

Series 7 Exam

The Series 7 exam (General Securities Representative Exam) consists of 250 multiple choice questions, takes six hours to complete, and costs $305. Passing score is 72%. A candidate who passes this exam is able to solicit, buy, and/or sell all securities products, which include products such as common/preferred stock, options, and bonds. There are no prerequisites for either the Series 6 or Series 7 exams, but you do need to be sponsored by your employer to take them.

The main difference between the exams is increased difficulty and study time for the Series 7, but it allows you to sell a larger choice of investment products. Recommended study time for the Series 7 is about 2 months, and a little less for Series 6. If you want to show your potential employer that you are serious about getting the Series 7 as soon as you start, you can take a Series 7 Training Course to get pre-certified.

Other Series Exams

Series 7 is a prerequisite for most other examinations that FINRA offers, such as Series 4 (Registered Options Principal Exam) and Series 24 (General Securities Principal Exam). The Series 4 is a great registration for anyone that enjoys trading options, and the Series 24 is beneficial for anyone wanting to get into a supervisory or management role in a financial organization.

The CFA Institute Charters

As in all professions such as doctor or lawyer, certain professional designations help grow your career. The most prestigious designations you can hold in the world of finance today are issued by the CFA Institute.

Certified Financial Analyst

The CFA designation is currently the gold-standard of professional designations in the finance world – having this on your resume will open a lot of doors. This program is offered through CFA Institute. It consists of three levels, and once a candidate completes the program and meets all professional requirements they are awarded the “CFA charter” and become a “CFA charter-holder”. Currently, there are about 132,000 charter-holders around the world. The requirements of a charter-holder include four years of qualified work experience and holding a university degree. Candidates take one exam per year for three years (if passing each level). Costs vary depending on registration time, but range from $710-$955 for each level. Passing rates vary as well, averaging 40% for Level 1, 44% for Level 2, and 58% for Level 3. The recommended study time can be pretty intensive, with most candidates reporting 4-6 months of study time per level. The low passing rates add to the prestige of acquiring this designation. This is the designation to have for anyone interested in equity research or portfolio management. The topics covered in the three levels of the program include Ethics, Quantitative Methods, Economics, Corporate Finance, Financial Reporting and Analysis, Security Analysis, and Portfolio Management.

You can find more about the CFA Program by Clicking Here.

Certificate in Investment Performance Measurement

The CFA Institute also offers enrollment in the Certificate in Investment Performance Measurement (CIPM) Program. This focuses on advanced, globally relevant, and practice based investment performance and risk evaluation skills. The exam is offered twice a year, consists of 100 multiple choice questions, and takes 3 hours to complete. First time early registration will set you back $575. This exam has no prerequisites, usually takes one year to complete, and is perfect for portfolio managers, financial advisors, and investment professionals in general.

You can find out more about the CIPM Program by Clicking Here.

The Institute of Business & Finance Certifications

Besides the CFA Institute, the next most important set of professional designations is offered by the Institute of Business & Finance, or IBF. These certifications focus more on mutual funds, annuities, and bonds.

Certified Fund Specialist

If mutual funds peak your interest, the Certified Fund Specialist might be the certification for you. It is the oldest designation in the mutual fund industry, and is provided by the Institute of Business & Finance. It consists of a 60 hour self-study program. To learn more about this certification, Click Here.

Other IBF Certifications

The IBF offers several other designations that include Certified Annuity Specialist (CAS), Certified Income Specialist (CIS), Certified Tax Specialist (CTS), Board Certified in Estate Planning (CES), and a Master’s of Science in Financial Services (MSFS). There are over 13,000 IBF designation holders across the globe.

Certifications for Retirement Planning

If you enjoy working with senior citizens, a Certified Senior Advisor certification will allow you to build effective relationships with seniors and help them plan their retirement. This designation is offered through the Society of Certified Senior Advisors. The Institute of Business & Finance also offers a Certified Senior Consultant (CSC) program consisting of a 30 hour self-study program. This program concentrates on issues facing the aging population including Social Security, Medicare, housing and retirement.

Certified Financial Planner

A Certified Financial Planner is administered by the Certified Financial Planner Board of Standards Inc. and covers over 100 topics. The CFP designation is kind of like an umbrella – a Certified Financial Planner is someone who can help an individual plan all aspects of their financial life, from how to allocate their income between saving, spending, investing, and retirement, all the way through managing fixed-income portfolios for retirees, and even helping with income tax planning.

The exam takes place over two days (10 hours total) and consists of 180 questions, although recently it has been reduced to 170 questions and 6 hour testing period thanks to converting from paper based to computer based test taking. The cost is $595 and passing rate averages in the low 60%. A bachelor’s degree is required to hold the certification along with 3 years of full time work experience or a 2 year apprenticeship. The major topics covered include general principles of finance and financial planning, insurance planning, employee benefits planning, investment and securities planning, state and federal income tax planning, asset protection planning, retirement planning, estate planning, and financial consulting. This certification is perfect for anyone looking to become an expert in the financial planning field. You do need a bachelor’s degree to obtain the CFP Certification.

Other Professional Designations

This is not an all-inclusive list, as the list of available designation for financial services professionals is numbered over 208 (and growing). Some of the other designations include Chartered Alternative Investment Analyst, Chartered Market Technician, and Certified Public Accountant, the latter being the most prestigious in the accounting world, but going a long way in the financial world as well. It can be overwhelming choosing one or two designations to pursue, and it can be expensive and time consuming as well.

If you are trying to plan your career in Finance, the two most popular currently are Series 7 and Chartered Financial Analyst, which will open a lot of doors if you can feature on your resume. If you have a specific interest such as mutual funds, options, or supervisor, there are designations that are perfect for those career paths as well. I hope this basic introduction to available certifications in the finance industry was useful and best of luck in your career!

Pop Quiz

[mlw_quizmaster quiz=58]HowTheMarketWorks is all about education – we want students to learn about investing and personal finance by managing their virtual portfolio with carefully-selected trades.

How It Works

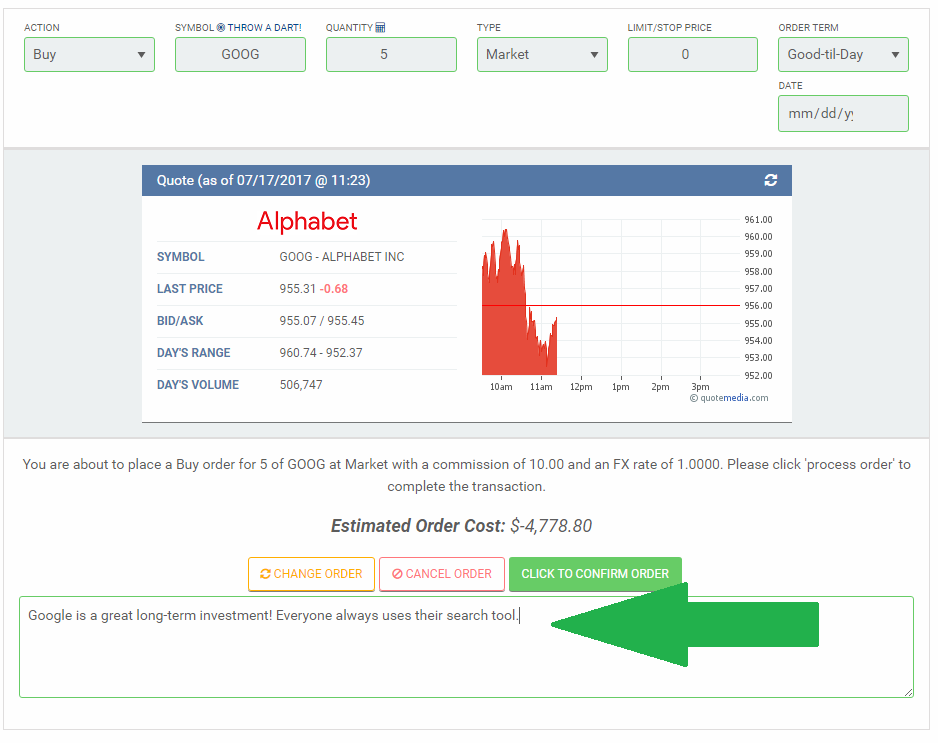

Every time your students place a trade, they will be prompted to enter their “Trade Notes” – a short sentence mentioning why they are placing this trade (almost like a tweet, but we allow up to 300 characters).

Students can review their Trade Notes later from their Transaction History and Order History page. They can also add a note to any trade at a later time to explain if it was a good investment, or if they took a big loss.

Help The Learning Process

Most teachers already include a writing project for students to show how their portfolio moves over time – the only drawback is that students can always look back at their portfolio with 20/20 hindsight.

To make sure students can always review their critical thinking skills, teachers have two powerful new tools with trade notes.

- First, you can make the notes optional or required for your class. If you require trade notes, students will need to enter a note every time they trade. If it is optional, students can enter trade notes as often as they want.

- To protect students from themselves, trade notes cannot be deleted. This means they cannot realize a mistake and change their reasoning later! Students can always add extra notes to the same trade, but as the teacher you will have a time stamp showing when the trade was placed, and when each note is added.

Enabling Trade Notes For Your Class

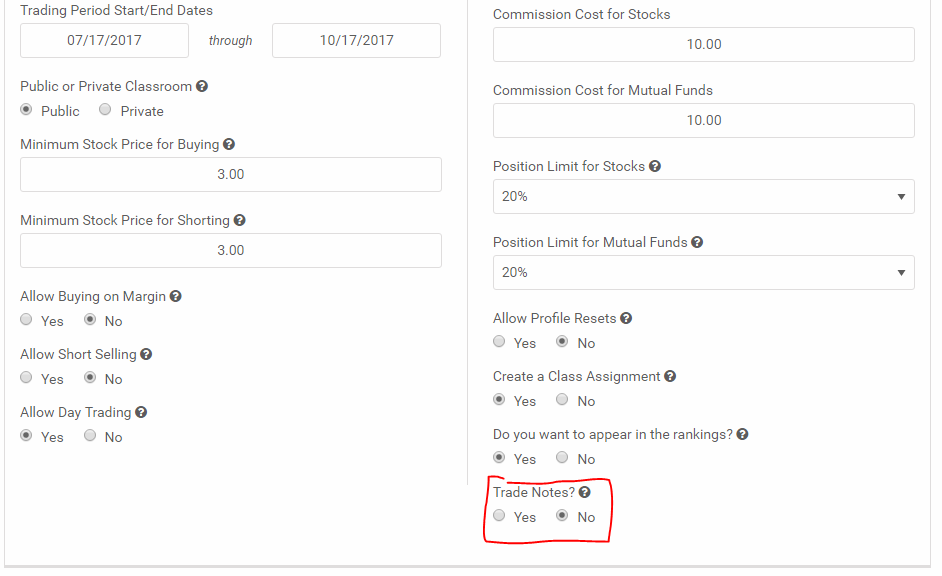

Trade Notes are optional on all classes, so your students can start taking notes right away! If you want to make Trade Notes required, create your new contest, or edit your existing contest, and set the “Trade Notes” rule to “Yes”.

Viewing Trade Notes

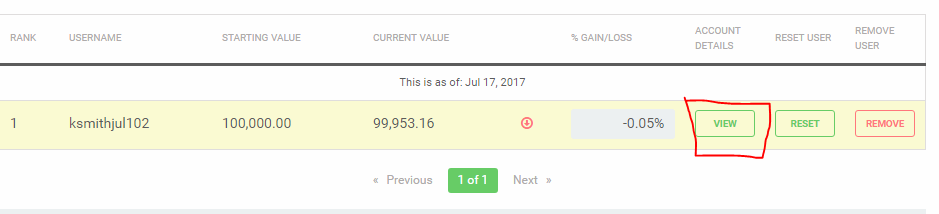

You can also see the trade notes for every student in your class. Just visit your class Rankings page and click “View” next to the student you want to review. This will show you everything about that students’ portfolio – including their trade notes!

Happy Learning!

How To Pick Stocks – The Basics

The most challenging aspect of starting to invest in the stock market is deciding what stocks to buy. Every experienced investor has his/her own techniques and strategies that they believe in. But when you are just getting started, learning how to pick stocks can be very challenging.

Here at HowTheMarketWorks, we want to give you the tools and confidence you need and show you how to buy stocks and make your first trades. This will help you get your portfolio off to a good start.

Getting Started

Remember, your HowTheMarketWorks account is virtual money! The point of using virtual money is to learn and practice, so just jump right in! You need to make a couple of trades on your virtual account just to see how easy it is to place trades. This will get your confidence up.

The first thing you need to know is all stocks have a unique code, or ticker symbol. Here are some popular stocks and their ticker symbols: Starbucks (SBUX), Walmart (WMT), Coca-Cola (KO), Netflix (NFLX), Amazon (AMZN), Apple (AAPL), Home Depot (HD), and Tesla (TSLA). When you go to make your first trade and enter a ticker symbol, you will see the price. So if your stock is at $50 and your buy 100 shares, it will cost $5,000.

Those are some of the most popular stocks. Now, if you want to get some other ideas from proven sources of the best stock picks in recent years, you can review these articles about the most popular stock newsletters. Each of these has a fee of about $100 for the first year, but since their recommendations have historically been very good and have beaten the market’s overall return, if you are considering investing your real money in the market these might be a good place to go.

For example, here are some of our reviews of the most popular stock market tools:

- This Seeking Alpha Review shows you their STRONG BUY rated stocks have beat the market year over year. Get Seeking Alpha premium for just $119 a year.

- This Motley Fool Review shows you the performance of their top Stock Advisor newsletter. Get their next 12 months of picks for just $79.

- Our Motley Fool Vs Zacks Comparison shows you which of these 2 top stock newsletters is best for you.

- Our Alpha Picks Review shows you this newest service is already beating the market by 20% in their first six months. Get the next year of Alpha picks for just $99.

- See which is the Best Stock Newsletter.

Before picking your first stock, the first step is deciding what your goals are for your portfolio.

Risk and Reward

The biggest choice you will make will be balancing risk and reward. Should you invest all your cash in very risky stocks with high growth (and loss) potential, or focus on companies that you believe can be strong in the long term?

Think of this risk and reward choice this way: Would you rather have an 10% chance of doubling your money (risky) or a 100% chance of making 10% on your money? The expected return of each of those choices is 10%, but in the first scenario 9 out of ten times you will make nothing.

Establish Goals

In order to reduce some risk in picking stocks, many first time investors will often ask their friends for stock tips. This is not a good idea. Investing in the stock market is not easy and you need to learn to do it correctly.

We recommend learning stock picking by reading how the professionals do it. One of the most popular stock advisory services is called The Motley Fool. This Motley Fool Review will explain how the Motley Fool team analyzes stocks to find what they believe are the best stocks to buy. Their stock picks over the last 4 years have beaten the overall market by at least 20% each of the last 4 years. They frequently run special offers on THIS PAGE available to new subscribers for a trial of just $19. It is well worth the money to get solid recommendations.

Diversification

Once you consider how risky you are feeling, next decide how you want to diversify your portfolio, which will help you decide how much cash to invest in each symbol. Your challenge may do this automatically – most challenges include a position limit, meaning you can only invest a certain percentage of your cash in any single stock. You can check if your contest has a Position Limit rule on the Account Balances page.

Once you establish the minimum number of securities you need, you can now start handpicking stock symbols by using a trading strategy. You can also create a mix of these strategies to get the best of each strategy.

Trading Strategies for Beginners

The goal of your trading strategy is to get a list of stocks or ETFs that you might want to invest in. The purpose is just to get a wish list of stocks – at the end of the day, you will probably add half (or fewer) of your initial picks to your permanent portfolio. Once we get that initial list of possibilities, we will take a look at how to narrow the list down.

“Invest in what you know” Strategy

The best way to start when buying stocks is to buy what you know, not trying to follow stock tips or read a bunch of technical analysis that you cannot follow. Think of it this way: if you already know a company, they have done well enough in the past to already become a household name today. This gives you, as the investor a big advantage; you can see how that company is doing just by looking at their stores and reading normal business news.

Ask yourself the following questions:

- Have they started to open new stores around me lately, or are they closing some shops?

- Does there seem to always be a lot of people you know using their products, or are they still more obscure?

- Do you find yourself using more of their services (giving them more money) month after month?

- Does their current news look positive or negative?

If all of these are positive, then this might be a good place to invest.

Earnings Strategy

An investor can always handpick stocks based on the earnings calendar. To do so, you would have to know your investment time horizons, and flip through the earnings calendar to find gems (i.e. stocks that you can buy and that will soar during its earning season, or stocks that will tank and that can be shorted beforehand).

The Earning Strategy is somewhat of an evolution of the “Invest in what you know” strategy – you will be looking for companies that you believe will have high earnings announcements coming up soon, which can cause their stock price to rise.

Once you have found your stocks, it’s very important to analyze them and back-up your assumption of how the market will react to their earnings report.

An example of a well executed trade based on the earnings’ expectations would be Nvidia (NVDA). Before the presentation, NVDA was trading around 102 and soared continuously ever since to 139.67 on the 20th of June 2024!

You can compare with other stocks with recently-released earnings using our Quotes Tool.

Buy the Best Stock Newsletter to Get Their Stock Picks

As mentioned earlier, we track many stock newsletters and the best one for the last 4 years has been the Motley Fool Stock Advisor. It’s average pick for the last 4 years is up 74.63%. Not all of their picks are winners. They just have a very good record of picking a few stocks that double or triple each year so these winners more than offset a few losers. You can try their service for just $19 if you CLICK HERE so it is an excellent place to start. It is well worth the money to get solid stock picks.

If you want a more thorough review of their best selling newsletter then our Motley Fool Stock Advisor Review will tell you about their most popular advisory service, how it has performed in the last 4 years, and give you a 50% discount if you want to try it. If you still aren’t convinced, then read this review of the top stock newsletters.

The Passive strategy

If you are not sure which specific stock to select, you can always invest in ETFs and market indices. These products are already diversified and will track a specific market for you.

The most popular ETFs are the ones that match the most popular indices: Dow Jones Industrial Average (DIA), S&P500 (SPY), Nasdaq (QQQ). Starting your portfolio with either or all of these is often the best place to start.

ETFs come in specific industries too. As an example, let’s say you want to invest in a gaming company, but don’t know which company in specific. You can always invest in an ETF that will track the gaming market for you. In this situation, you can invest in the Amplify Video Game Tech ETF (GAMR), which tracks this market for you. They have invested in various aspects of video game technology, like game developers, retailers and console or chip manufacturers. This means the stock picking and allocation tasks has been already taken care of by the Fund Managers of this ETF.

You can find a specific ETF from etf.com: The Best ETF Screener | etf.com

Many investors also start with a passive strategy, and slowly break out. This would mean starting your portfolio by picking ETFs in 5 industries you want to invest in, then looking at each of those industries in detail using some of the other strategies here. Once you identify some stocks within those industries, you can sell off some of the ETF holding, and use the cash to invest in the stocks you have researched.

Stock Screeners Strategy

You can also use stock screeners to find good purchases and short sales. A Stock Screener is a program or website that will ask you some questions about what you are looking for in a stock, and return a list of stocks that match your criteria. You can then do extra research on these stocks to determine if they should be added to your portfolio.

Getting Trading Ideas

We also have a Trading Ideas page that will help you review the overall market’s health and help you adjust your stock picks.

The Research pages on HowTheMarketWorks have the following information:

Today’s Market Summary

The Market Summary page is very useful for the start of your research. It presents the day’s market summary. It is useful because it tells you how the overall market is doing today. As an example, on May 17th, 2017, you would notice that indices such as SPY dropped 5 points due to the “Trump-Russia” investigation. This can be used as a signal to certain investors to buy more. If an investor purchased SPY during the dip, he/she would have gained more than $5 per share! It’s important to review how the overall market is doing and the market news each day. This can help you to capture the perfect timing to buy stocks at their lowest price (or to short sale them at their peak).

Earnings Release

The Earnings Release page presents a stock’s quarterly earnings pre-announcements with the current estimate and new range. A stock’s volatility increases when it is near the earnings report.

Analyst Ratings:

The Analyst Ratings page presents the recommendations given by brokerage firms and financial analysts. This page will be useful to analyze a stock’s recommendation trend and the current average recommendation.

Best/Worst Exchange-Traded-Funds (ETFs)

Looking for an Exchange-Traded Fund? The Top Performing ETFs page is a great place to see which ETF is currently doing well and which is not. This can signal current market trends and help you make choices based on that.

Picking Stocks – Intermediate Analysis

Now that you have a couple of stocks in mind, you should perform a more advanced analysis of your selection. This extra step of your research will be useful for two major reasons:

- You will verify if these stocks are truly good investments. They can be rejected if you discover there has been a lot of hype, but the company is not actually doing well.

- You will back up your assumptions about these stocks. If your classmates or teacher have any questions about the reasoning behind your choices, you will be able to provide a robust and solid argument.

This is where you can choose the stocks that actually go into your portfolio for the long-run. If you started with a passive strategy, your portfolio might already have some industry ETFs, but now we will be looking at specific companies to replace part of those investments.

We will explore a couple of basic research methods that will complement your findings.

Technical Analysis

Technical analysis is the process of determining patterns and trends with the use of historical data for a security and charts of a specific timeframe. Charts are clearly an efficient way to visually notice a pattern and act upon a specific trend. We will visit a couple of basic chart patterns and put them in real-life contexts as well. Most of the technical analysis tools make use of the charts you can find in the Quotes Tool.

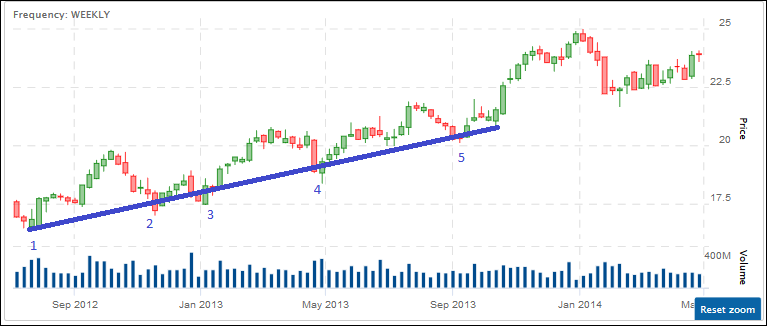

Trends & Trend lines

A trendline is a straight line that connects the stock’s price movement together and creates an upward or downward pattern. It is often recommended to connect more than 2 points to have a stronger trend line.

Trendlines are useful to give you a general idea of how a stock’s price is generally moving. A positive trendline does not mean it will keep going up forever, but can be an indication that there are some strong underlying business foundations.

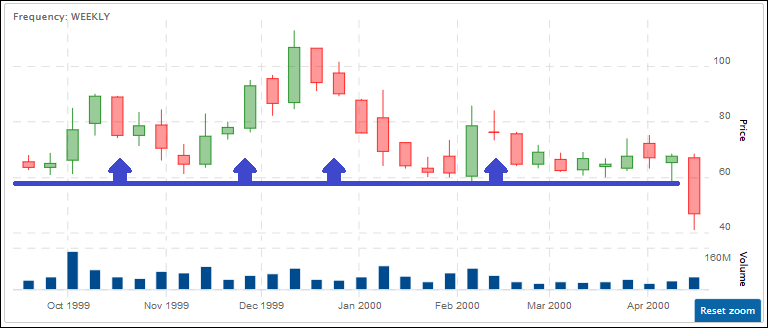

Support & Resistance

A support line represents a price level at which the stock never went below. In other words, it is the point at which the stock struggles to go under. On the other side, a resistance line represents the price level for which the stock cannot breakthrough.

Stocks near their support lines tend to rebound, so they might make a good investment (at least in the short term). Stocks near their resistance line tend to fall back down, so they might signal a shorting opportunity.

When a stock breaks through their support or resistance lines, it is called a breakout.

Symmetrical Triangle

This pattern consists of two trend lines which are symmetrical to the horizontal and are convergent. To prove a symmetrical triangle, one must have oscillation between the two lines.

A triangle pattern indicates that the price is about to move – but a symmetrical triangle does not give a clear indication that the price will go up or down.

Ascending Triangle

The Ascending Triangle pattern refers to two converging trend lines. The first line is an upward slant which is the support and the other is a horizontal resistance line. To validate the ascending triangle, there must be an oscillation between the two lines.

This triangle implies a bullish continuation pattern.

Descending Triangle

The Descending Triangle pattern refers to two converging trend lines. The first line is an downward slant which is the support and the other is a horizontal resistance line. To validate the ascending triangle, there must be an oscillation between the two lines.

This triangle implies a bearish continuation pattern.

Fundamental Analysis

Fundamental analysis is the process of examining the fundamental aspects of a firm. It involves reviewing a company’s financial statements, like their income statement, cashflow statement and balance sheet, to define its health and attractiveness. Since financial statements are standardized between companies, this can help compare two potential investments apples-to-apples.

Warren Buffet famously said, “Never invest in a company you cannot understand.” What he meant was to read the company’s balance sheet, and their other financial statements. Study the role they play in their industry so that you understand how they operate. Keep track of any changes to their dividend yields. All of this is part of fundamental analysis.

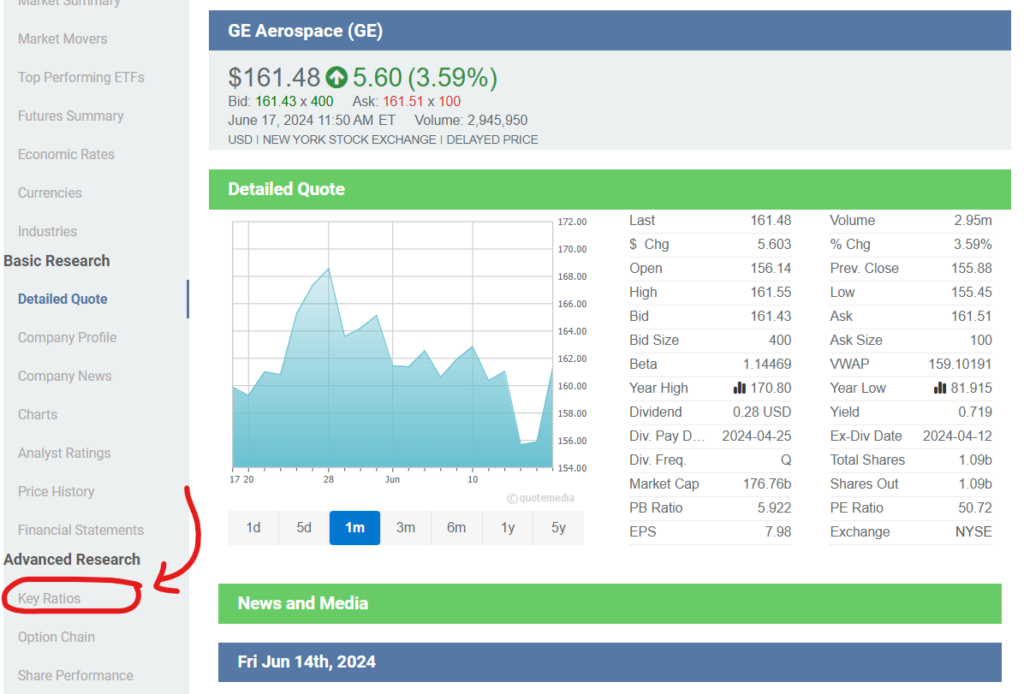

You can directly find most of the ratios by clicking on Key Ratios in the Quotes Tool.

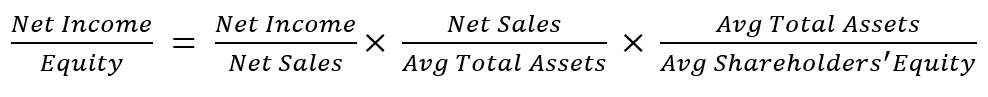

One of the most popular and simple fundamental analysis is the DuPont Model. The DuPont Analysis breaks down the firm’s Return on Equity (ROE) based on its profitability decisions, how efficiently their assets are utilized and their financial leverage. The model focuses on the profitability of a firm using the following equation:

This equation can be re-written as:

To analyze a company using the Dupont Model, you can use the following tables:

Analysis of Company XYZ from 2014 to 2017

| DuPont Model Components | 2020 | 2021 | 2022 | 2023 |

| Net Income | ||||

| Equity | ||||

| Net Sales | ||||

| Average Total Assets | ||||

| Average Shareholders’ Equity | ||||

| Profit Margin | ||||

| Asset Turnover | ||||

| Equity Multiplier | ||||

| ROE |

Analysis of Company XYZ with Industry Competitors

| DuPont Model Components | Company XYZ | Company A | Company B |

| Net Income | |||

| Equity | |||

| Net Sales | |||

| Average Total Assets | |||

| Average Shareholders’ Equity | |||

| Profit Margin | |||

| Asset Turnover | |||

| Equity Multiplier | |||

| ROE |

These tables will allow you to see the evolution of the firm in terms of their profitability. This can be useful for analyzing whether a company will be profitable over the long-term or if this is a growth stock that will soon reach its zenith. You will also have the bird’s eye view of the business and its competitors in the same industry. By doing this, you might find a competitor that would be a better stock pick or reassure yourself that your stock pick is the best in its category.