An investing strategy is a plan for how to save money to help it grow. Sometimes this can be just a plan for trading stocks, but it really means a lot more.

Liquidity, Risk, and Potential Returns

All investments balance liquidity (how easily it can be converted into cash for other use), risk (the chance of the investment to lose value), and potential returns (how fast your investment can grow).

The balance between these three items is up to your own individual taste, but it is this balance that will determine what kinds of investments you choose.

Security Types

The security type is what you are holding as an investment. These can be a very wide range, but every full portfolio should have a mix of a couple.

Cash And Bank Deposits

Liquidity: Very High

Risk: Low

Potential Growth: Zero or Negative

Cash, believe it or not, is an investment in and of itself. Cash, and bank deposits you can withdraw right away, are the most liquid assets, since liquidity is basically how quickly you can convert any investment into cash.

Being able to always use cash for whatever you want is valuable. This is why Emergency Funds exist as cash and bank deposits, not as bars of gold. On the other hand, cash does not grow, and loses value over time due to inflation.

Certificates of Deposit

Liquidity: Low

Risk: Low

Potential Growth: Low

A Certificate of Deposit is like a savings account with a locked-in interest rate, but you cannot withdraw the cash for a certain period of time. These are very safe investments, but on the other hand they have a very low potential for growth.

Stocks

Liquidity: High

Risk: Medium

Potential Growth: High

Stocks are usually what come to mind when thinking about investments. As far as an investment strategy is concerned, mutual funds and ETFs which hold stocks are all the same thing – buying a piece of one or many companies in exchange for a share of their profits.

For more information on why to invest in stocks, Click Here.

Bonds

Liquidity: Medium

Risk: Low

Potential Growth: Medium

Bonds come in three flavors, Corporate Bonds, Treasury Bonds, and other Government Bonds. Unlike stocks, a bond is a loan that you make to a company or government, and they need to pay it back plus interest. Corporate bonds from large companies and treasury bonds are usually very safe investments (and so there is a lower return), but there are also Junk Bonds, or bonds which have a higher risk of not being paid back in full. In exchange for the higher risk, organizations who sell Junk Bonds offer higher interest rates to people who buy them.

Real Estate

Liquidity: Low

Risk: Medium

Potential Growth: Medium

Real Estate includes land and buildings. Until fairly recently, the bulk of retirement savings was in the form of the house you lived in. People would buy a house and hope that the value grew enough over the next 30-40 years to sell it and use the profits for retirement. Others buy damaged or discounted houses and do repairs, then sell them for profit (this is known as house flipping).

Since the housing marked crash in 2007, people are more wary of real estate investing, but owning a home is still a very popular investment.

Precious Metals

Liquidity: High

Risk: Medium

Potential Growth: Medium

This includes buying gold and silver. Many investors try to buy gold and other precious metals as an investment (and to protect against inflation), but this has also backfired in recent years as a “Gold Bubble” popped, making the prices of the metals more volatile than before. Holding precious metals as a safeguard against market uncertainty in other security types is still very popular, however.

Derivatives

Liquidity: Medium

Risk: High

Potential Growth: High

Derivatives that normal investors can purchase include stock options and futures. Being a derivative means that it derives its value from something else. A stock option has value because the stock that it lets you buy has value (but the contract itself is useless unless you use it). Futures are good for commodities like oil delivered at a future date.

Derivatives are most useful for hedging (such as buying a stock option for a stock you think will go up in value, but you don’t want to necessarily buy right now).

Tips and Tricks

Many years ago, a common piece of investment advice was that if you are building an investment strategy for retirement, a large chunk of your nest egg would be held in your house, which will mature with the market rates.

For the rest of the assets, financial planners would recommend to balance your assets between stocks and bonds according to your age. Basically take 100, subtract your age, and that should be the percentage of your portfolio in stocks (with the rest in bonds). This means an 18 year old would have 82% of their savings with 18% in bonds.

This advice is a bit out-dated, but it does have a couple important kernels of wisdom that all investors should be aware of.

Don’t Keep All Your Eggs In One Basket

Always keep a diversified portfolio, both in security types and which stocks and bonds you choose! Diversify at a few different levels. Split your assets between a few different security types. In the classic example, the saver would have about 50% of their savings stored in real estate, with the remaining 50% divided between stocks and bonds. This means that if there is a fall in housing prices, they are protected by having lots of savings in stocks and bonds. If the stock market starts to fall, they’re still OK because they have their house and bonds. The value of bonds is determined by the prevailing interest rates, so they are insulated from this as well with their other security types.

On the other hand, they also benefit if there is a surge in housing prices, stock prices, and interest rates.

Use An Evolving Portfolio

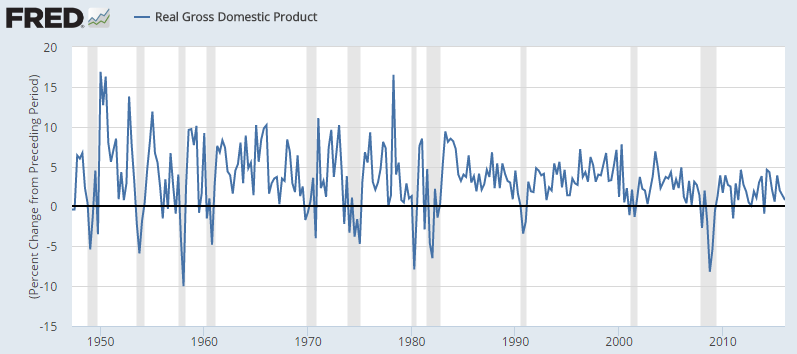

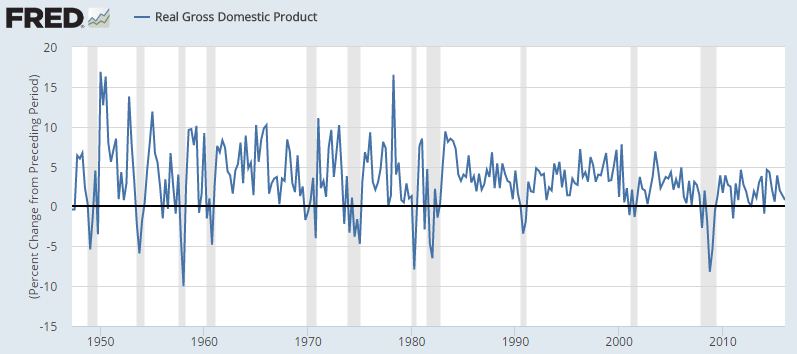

The old adage of “more bonds as you get older” is based on the idea that as you get closer to retirement, your portfolio should get more conservative. If you have lots of stock that lose value when you’re 25, you still have 40 years of income to make up for it. If you have lots of stocks that lose value when you’re 62, it becomes a lot more difficult to make up that income.

Common Investing Strategies

If you’re ready to start investing, there are a couple major strategies to keep in mind. Most long-term investing strategies are based on one, or a combination, of these.

Buy And Hold

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.” – Warren Buffet

The Buy and Hold strategy is based on the idea that you do extensive research on what you’re buying, choosing your investments for solid long-term reasoning, then buy it and hold on to it, regardless of what its market price does. The only time to sell is either:

- When the underlying reasons why you bought the stock change (such as the company’s management changing to a team with a different business strategy you don’t like), or

- When you plan on exiting the market entirely

Warren Buffet is generally considered the most famous Buy and Hold investor.

Downside

“The market can stay irrational longer than you can stay solvent.” – John Maynard Keynes

Even if all your research is great, and even if what you invested in does regain all its value in the long run, you still have a deadline of when you need that money to live on in retirement. You also have a very real chance of just being wrong in your choice, and with a Buy and Hold strategy you might take a huge loss before admitting defeat.

Value Investing

“Know what you own, and know why you own it.” – Peter Lynch

Value Investing is looking for stocks that are under-valued compared to the rest of the market. This means looking for companies that seem to be growing strongly but have not yet attracted much market attention, or new players with solid foundations and the potential for growth. You will buy and sell stocks more often with value investing – as soon as your picks start looking “priced in” or “over-valued”, you’ll start thinking about selling and moving on.

Peter Lynch was made famous by his use of Value Investing while acting as the primary manager of the Magellan Fund Fidelity Investments.

Downside

“The four most expensive words in the English language are, ‘This time it’s different.’” – Sir John Templeton

Value investing requires you to pay close attention to companies and re-evaluate how much you think they’re worth regularly. If you’re wrong a few times in a row, you could have trouble bouncing back.

Active Trading

“Understanding the value of a security and whether it’s trading above or below that value is the difference between investing and speculating.” – Coreen T. Sol

Active Trading is when you are buying and selling stock regularly. Day Trading is when you buy or sell in the same day, trying to take advantage of market swings to earn a profit. Active trading requires more advanced knowledge of chart patterns, fundamental and technical analysis, and an appetite for risk. In exchange, you can make huge returns with active trading by riding market trends.

Downside

“The individual investor should act consistently as an investor and not as a speculator.” – Ben Graham

Active trading can get big returns quickly, but it can get big losses even faster. Most professional investors and financial advisers suggest using only a very small portion of your portfolio for active trading, since the damage can be hard to undo.

Ready to Get Started?

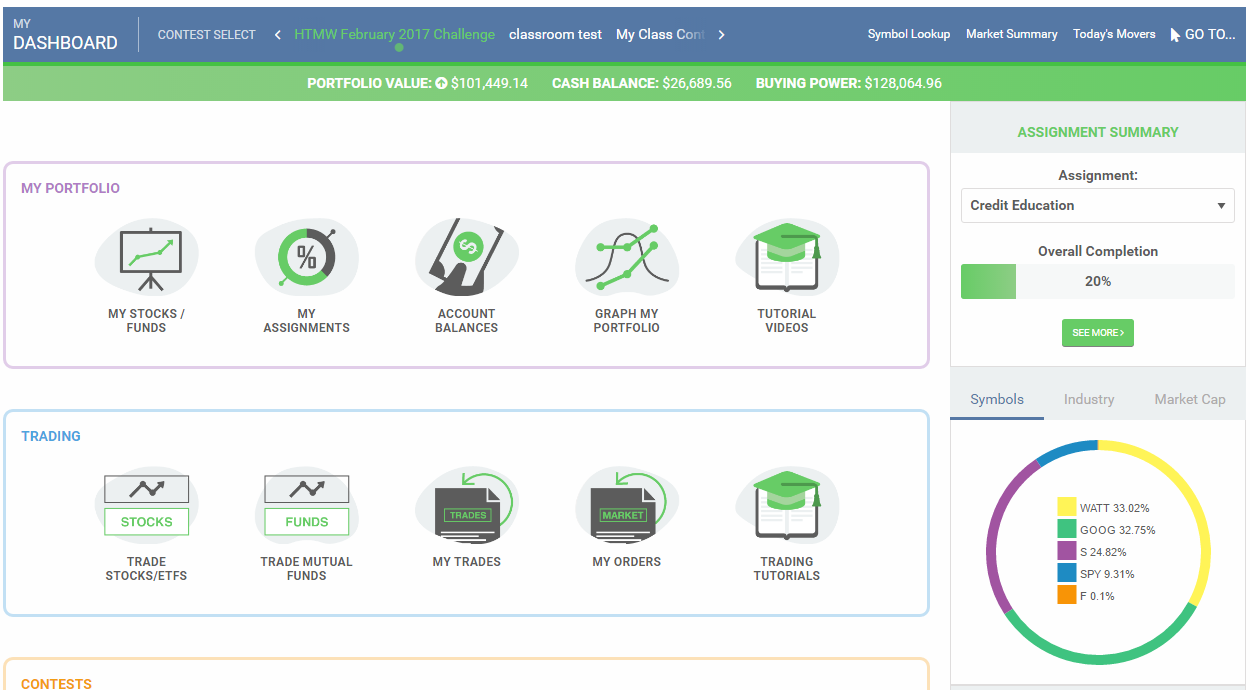

If you need a little more guidance, check out How to Pick Stocks, you’ll learn more about evaluating the performance of different companies so you know which will be the best to add to your portfolio. Then, when you’re ready to test out your trading ideas, create an account on HowTheMarketWorks to buy your first few stocks. Discover the best investing strategies for you before you use real money!

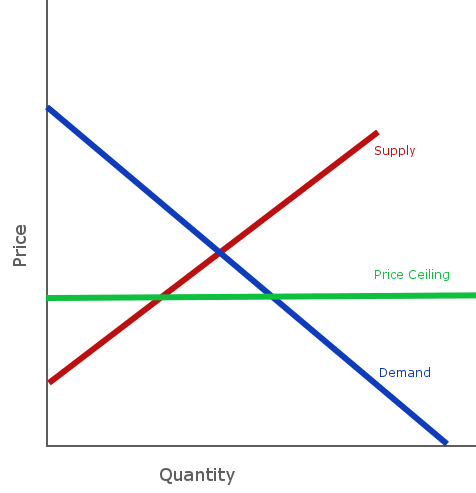

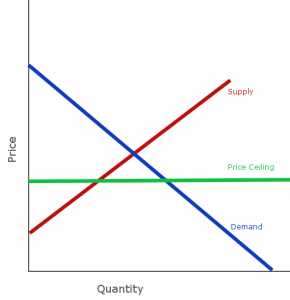

Price Ceilings are controls put in place to prevent the price of some good or service from getting too high. This type of control is most common with food, where there might be a maximum price that businesses can charge for things like flour or electricity.

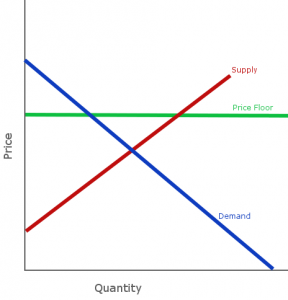

Price Ceilings are controls put in place to prevent the price of some good or service from getting too high. This type of control is most common with food, where there might be a maximum price that businesses can charge for things like flour or electricity. Price Floors are the opposite – a control put in place to ensure that a certain amount of something is produced by making sure producers are guaranteed at least a certain price for what they supply. These types of control are common for milk.

Price Floors are the opposite – a control put in place to ensure that a certain amount of something is produced by making sure producers are guaranteed at least a certain price for what they supply. These types of control are common for milk.

Types:

Types: