What is a Stock?

When starting a business, the business structure usually falls into one of three categories: a sole proprietorship, a partnership, or a corporation. In this intro to stocks, you’ll learn the basics of the different kinds of business structures, and how stocks are issued to help raise capital for business expansion.

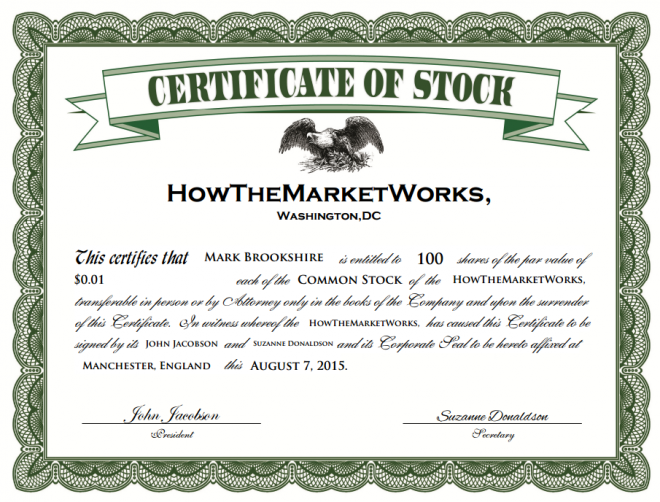

A proprietorship is the simplest and has just one owner, a partnership generally has 2 or more partners that reach an agreement as to their responsibilities and ownership percentage. Businesses that incorporate create a separate legal entity (a corporation) and then issue share certificates (stocks) to show who owns how many shares of the corporation.

Corporations usually start off small with just a few shareholders. For example, a corporation when it is formed could issue 100,000 shares of stock. The person with the business idea may put in $50,000 of his own money, and then ask his first 5 employees to each put in $10,000. This business would then have 6 shareholders: the founder would have 50,000 shares, and each of the 5 employees would own 10,000 shares.

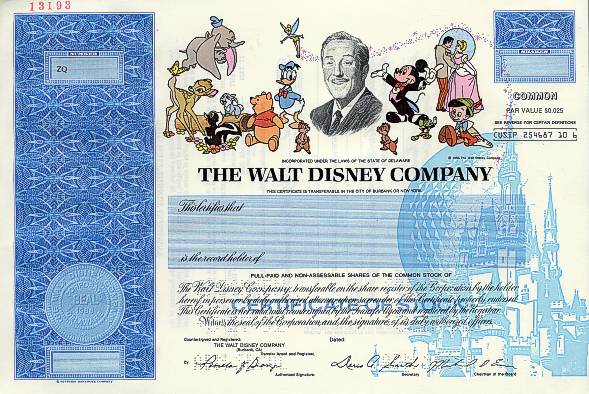

As corporations grow, they often find they need to raise more money and get a lot more investors. They often turn to Wall Street to help them raise more money by selling more shares of the company. If you bought 100 shares of a company you might get a stock certificate like the one above indicating your ownership.

If you decided you no longer wanted to own those shares you could try to sell them to another investor that might want to own part of that company. This is the essence of the stock market–it is where investors invest in new companies, or they buy and sell (or exchange) shares if they can agree on a fair price.

Pro tip: There are many stock picking services which will help you find the BEST stocks to invest in. Check out this review of the Motley Fool’s Service.

Definition

A stock is defined as a share of ownership of a company; if you own a company’s stock, you actually own a percentage of the company itself (including its assets, like chairs, vehicles, and buildings) and a percentage of its profits.

People invest in companies that they think will be profitable with the hope that the company will start paying out its profits to its shareholders. Likewise, if the company was not profitable and decided to close, then the company might just sell all of its furniture for $1,000 and you would only get $100 back.

For example, if a company issued 1,000 shares and you owned 100 shares, that does not mean that you can go to the company headquarters and take 1/10 of the furniture. It means that if the company was profitable and they made $100,000 and decided to pay it out to the shareholders, you would get 1/10 of $100,000 which is $10,000.

Role of Stock Exchanges

Stock exchanges provide a platform for buyers and sellers to trade shares of publicly listed companies. These exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, act as an intermediary between investors and companies. Whether stock trading is happening on a physical trading floor, or through electronic trading systems, the exchanges allow for an efficient settlement process. This means investors can buy and sell shares of companies from around the world. Providing investors access to a wide range of investment opportunities, and allowing companies to raise capital to manage their business operations or for further growth.

In the US, stock exchanges are primarily regulated by government agencies like the Securities and Exchange Commission, (SEC) to ensure they operate fairly and to protect investors from fraud, as well as preventing a stock market crash. To maintain a fair and efficient platform, stock exchanges may suspend all trading or impose a trading restriction on a certain company or ticker symbol if they no longer meet the listing requirements of a publicly traded company. The SEC provides a list of suspended stocks on their website, sec.gov.

Below are some key regulations that help to maintain fair trading on all stock exchanges in the United States.

- The Securities Exchange Act of 1934: provides a framework for securities exchanges by authorizing the SEC to regulate and oversee brokerage firms and exchanges.

- The Investment Company Act of 1940: this act aims to protect investors through requiring investment companies to provide accurate and timely information about their holdings.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010: this act enhanced consumer protection through increased regulation of financial institutions, including the creation of a new agency called the Consumer Financial Protection Bureau (CFPB) that regulates financial products like credit cards and student loans.

What Does Owning Stock Get Me?

Since you own part of the company, you are now involved in some of its management decisions, and you are entitled to some of the company’s profits. Shareholders often get to vote to choose the Board of Directors, to pick independent accountants, to approve any major change in the company like merging with another company. What exactly you are entitled to depends on the amount of stock that you own. Take the company Apple, for example.

Apple has approximately 5.575 billion shares outstanding, so if you owned 100 shares of Apple, you would own 0.00000179% of the company. That seems like a tiny amount, but keep in mind that Apple makes $50 billion a year so if they paid out all of their earnings one year, you would get $896!

If you decide that you no longer want to own your Apple shares, you can always sell your shares on one of the stock exchanges.

Types Of Stock

There is more than one kind of stock or ownership that companies sell. While almost all stock traded on the stock exchanges is common stock, some companies have issued preferred stock.

Common Stock

Common stock is the kind most investors buy. Common stock generally gives one vote at shareholder meetings for every share owned. Common stock holders may also be entitled to receive distributions of the companies profits, called dividend payments.

For blue chip stocks, or larger and more stable companies, a portion of corporate profits is usually paid back to shareholders 4 times a year as a dividend. Companies that are still growing usually pay no or very little dividends; but well established companies like utilities generally pay higher dividends.

Preferred Stock

Generally, preferred stocks do not have voting rights, and you won’t find them trading on an exchange. However, preferred stock shares have the benefit of preference for dividend payments; if a company decides it is going to pay dividends, preferred stock holders may get a bigger share, and be paid before common stock holders. Preferred stock holders are also entitled to be paid first if a company goes bankrupt and all the assets are sold off.

The Difference Between Stocks and Bonds

When you buy a stock, you are buying a piece of ownership of a company. A bond, however, is more like a loan or debt; a bond is a promise that a company makes to pay back the amount you lent them plus interest. Hence, if you own a bond, you are only lending a company money, but if you own a stock, you own part of the company itself.

Where Do Stocks Come From?

New shares in a company can come from two places: New Issues and Stock Dividends (or Splits)

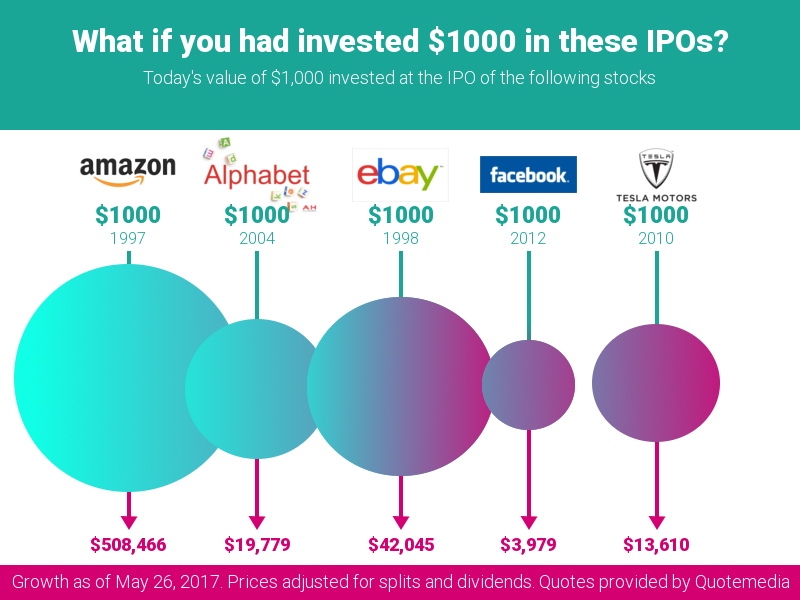

New Issues (Initial Public Offering)

A new issue of stock is when a private company decides to go public, and issues shares of stock for anyone to buy. This is often called an Initial Public Offering, or IPO, and when large private companies go public, it can be a very exciting event with huge fluctuations in the stock’s price in the first weeks while the market decides on a fair price for the shares.

Private companies go public and issue stock primarily to raise money. As they sell the shares in the company, the original owners allow the public to vote on some management decisions in exchange for the cash raised in the stock sale to re-invest and help the company grow.

Stock Dividends (Splits)

Companies may also issue new shares of stock after the IPO. This can be done by giving all current shareholders additional shares in proportion to how many shares they currently have; for example they can say that for every 10 shares you own now, they are issuing you one extra share.

This would be a 10% stock dividend, and the market price for the stocks would drop by 10% (although all shareholders still have the same ‘value’).

If the stock dividend is large enough (usually about 20%), it is instead called a stock split. There are many reasons why companies would want to have a stock dividend or split, but they usually happen for one of two reasons:

Attract Attention and Increase Trading

Companies may split their stock to attract attention to the company through the hype that can come from a stock dividend. However, the simple act of there being more shares in circulation may encourage people to buy and sell more, since each individual share takes up a smaller percentage of a portfolio.

Lower The Price

Some large companies like to have their stock price stay in a certain range. One reason for this is that the more expensive a stock, the fewer people who can afford to buy it (or buy an additional share). So splitting stocks can help it become more affordable, and increase the total value of all stocks in the long run.

History Of Stocks

Stocks trace their origins back to the Roman Empire, where large, private companies that carried out some public duties would sell shares of stock to Roman citizens for the same reasons companies do today; raise cash and grow their business.

Over the centuries, Joint Stock Corporations were often chartered by monarchs for large projects that the government simply did not want to invest all the cash (and therefore risk) to fund.

For example many canal projects, railroads, and roads in Western Europe were built by Joint Stock Corporations; private investors who were willing to take the risk that a project would fail in exchange for some of the profits if it succeeded.

During the Age of Exploration, joint stock corporations were what funded explorers to voyage across oceans, and later ship goods across continents. The British East India Company is perhaps the most famous of these, which was involved in everything from the exploration of Canada and the Americas to the British conquest of India, and even the slave trade.

How are Stock Prices Determined?

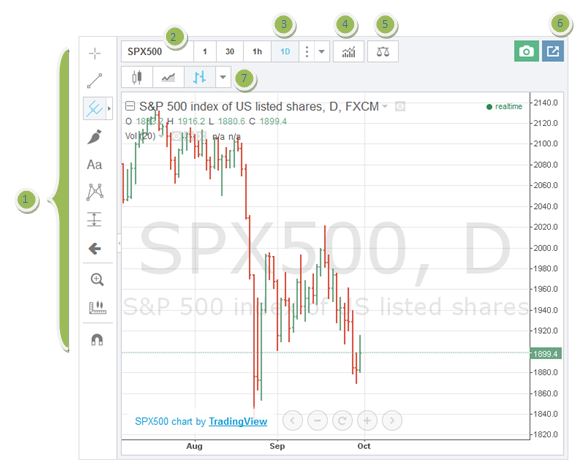

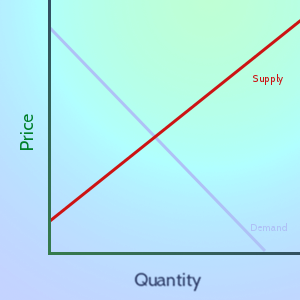

Stock prices are determined by the forces of supply and demand in the financial markets.

When there are more buyers than sellers, demand is greater than supply, and prices tend to rise. On the other hand, when there are more sellers than buyers, supply is greater than demand, and prices tend to fall. This is known as the law of supply and demand, and is the driving force behind the fluctuations in stock prices.

If a company announces in their latest earnings report that there will be major revenue growth, investors may become more optimistic, which often leads to an increase in demand for its shares and a subsequent rise in price. Earnings reports have a significant impact on stock prices. Understanding the impact of earnings report on stock prices will help you time your investments.

Earnings Reports

An earnings report, (a.k.a. quarterly earnings report or quarterly results), is a financial report released by a publicly traded company that summarizes its financial performance for a specific quarter or fiscal year.

The report typically includes information on the company’s financial performance during the reporting period.

- Revenue: total amount of money earned by the company.

- Net income: profit or loss for the period, calculated by subtracting expenses from revenue.

- Earnings per share (EPS): net income divided by the number of outstanding shares, providing a measure of profitability per share.

- Gross margin: the cost of goods sold subtracted from revenue, expressed as a percentage.

- Operating expenses: includes all expenses, like salaries, rent, and marketing costs.

- Operating income: profit from operations, calculated by subtracting operating expenses from revenue.

- Cash flow: inflows and outflows of cash during the period.

The report is typically released after the market closes on the scheduled date. If the report shows strong earnings, the stock price may rise as investors become more confident in the company’s future. However, if the report shows weak earnings, the stock price may fall as investors become more cautious about where the company is going. In the short-term, earnings reports are a key driver of price fluctuations. In the longer term, other factors such as economic indicators, interest rates or major global events, (like 9-11) will impact stock prices.

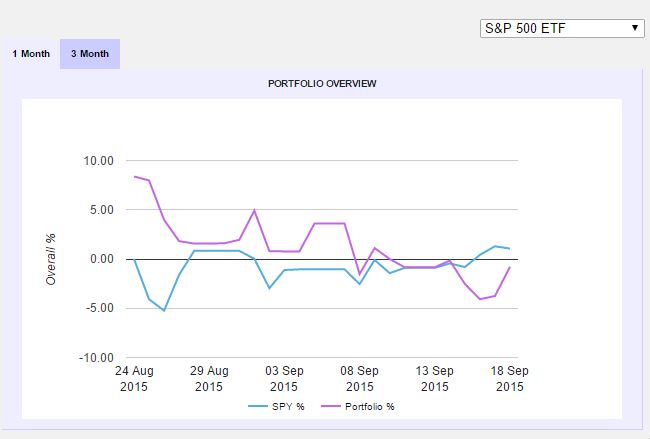

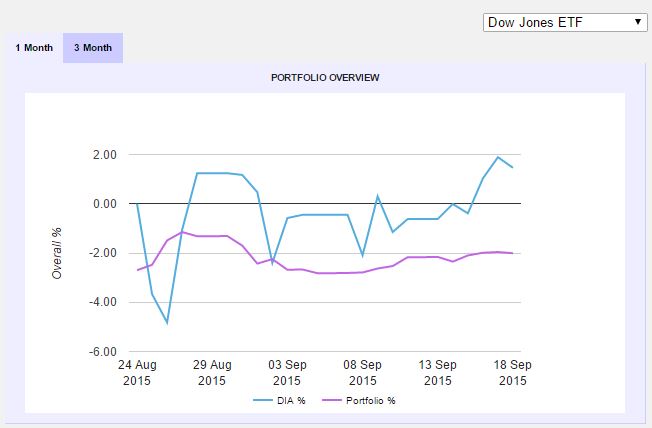

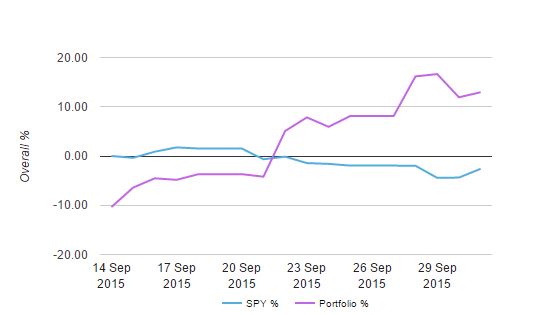

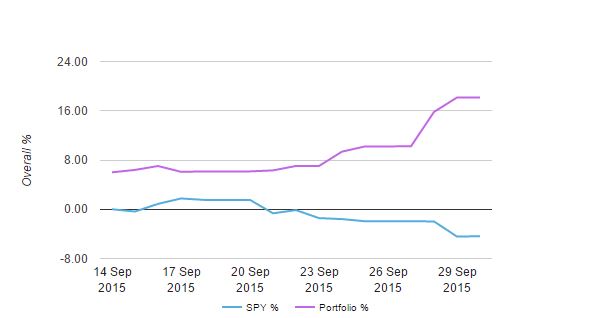

“Beating the Market”

“Beating the Market” is a concept in investing that aims to achieve higher returns than the overall performance of the stock market or a specific benchmark. The most used benchmarks are the S&P 500 and the Dow Jones Industrial Average. For example, if the S&P 500 has a 10% return, and you’re able to reach 12% on your investments over the same time period, then you’ve successfully beaten the market. There are many index funds, or Exchange Traded Funds (ETFs) that track these benchmarks which you can invest in, instead of buying the individual stocks for each company.

Investors want to beat the market because they want to protect their buying power. The stock market is affected by inflation, economic downturns, and changes in interest rates, (among other factors). When inflation is high, the value of money goes down, so investors need to earn higher returns to maintain their purchasing power. Stocks can provide a hedge against inflation by offering a potential for long-term growth that can keep pace with rising prices.

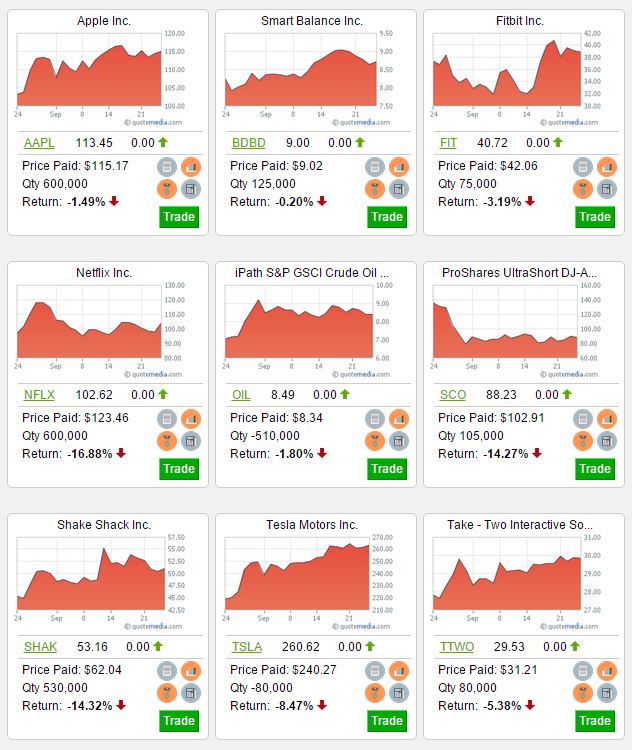

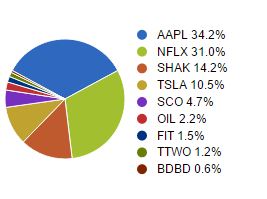

It’s challenging for any investor to consistently beat the market, but if you focus on building a well-diversified portfolio, you should be able to limit the risks of of unpredictable prices on the stock market.

Risks of Investing in Stocks

There are risks associating with investing your money in any type of asset. Although stocks have proven to be one of the best ways of growing your wealth over the long-term, it’s important to understand and manage the risks of investing in the stock market. Below are some of the main risks to look out for as you get started with investing in stocks.

- Market Volatility: in the short-term stock markets will change rapidly due to investor sentiment, or how investors are feeling about the direction of a company or industry; as well as trading volumes, or how many investors are actively trading a particular stock. Bull markets (rising prices) mean there is a lot of investor confidence, whereas bear markets (falling prices) mean there is a lot of uncertainty.

- Economic Changes: announcements about positive or negative changes in GDP growth, unemployment rates, interest rates or inflation rates will impact how the stock market performs as a whole.

- Company Performance: earnings reports (explained above), changes in management, mergers or acquisitions, as well as announcements of dividends or stock splits will impact the price of specific stocks or companies.

- Global Events: wars, natural disasters, pandemics, political unrest or other major news can change the direction of prices in certain industries or the markets as a whole.

- Regulatory Changes: tax law changes, for instance increases in capital gains tax, or new regulation for financial institutions can change investors’ behavior which leads to changes in all financial markets.

- Technological Advancements: technological disruptions happen in every industry, some innovations like artificial intelligence affect all industries, while others like the introduction of digital image processing affected some companies and industries more than others. It’s increasingly important for investors to stay up-to-date on how new innovations will impact the companies in their stock portfolios.

- Currency Fluctuations: changes in the value of currencies will impact the prices of international and domestic stocks. For example, if the strength of the US dollar increases, this could have a negative impact on companies that rely on exports as their goods will be more expensive (and less desirable) than goods from countries will weaker currencies.

Mitigating Risks

As a beginner investor, it’s natural to feel nervous about the risks associated with investing in the stock market. However, there are several methods you can use to mitigate these risks and increase your chances of success. One of the most effective ways to do this is by diversifying your portfolio. Check out this article, How to Diversify Your Portfolio to learn more.

Another method is to use stop-loss orders, which is a set of instructions you provide your broker, (online broker or brokerage account) to automatically sell off your shares if the price decreases below a certain threshold. You can learn more about different Order Types and practice setting them up in your HowTheMarketWords account.

Finally, you can limit your risks by keeping a long-term perspective while building and managing your stock portfolio. Though it is tempting to make quick gains through actively buying and selling stocks, you can end up losing money through getting the timing wrong, as well as losing money through taxes and fees.

By understanding the basics of stocks and how the stock market works, you can start investing in stocks to reach your investment goals.

Budgeting is perhaps the most essential skill a person can have as they begin living on their own. Whether it is the simple act of balancing a check book, managing bank accounts, or deciding whether it is time to buy or rent, building a budget is the basic core of personal finance. Browse this collection of lesson plans, and find great ways to incorporate HowTheMarketWorks!

Budgeting is perhaps the most essential skill a person can have as they begin living on their own. Whether it is the simple act of balancing a check book, managing bank accounts, or deciding whether it is time to buy or rent, building a budget is the basic core of personal finance. Browse this collection of lesson plans, and find great ways to incorporate HowTheMarketWorks!