Introduction

Chile is one of Latin American countries that have a vibrant market-oriented economy and an OECD member. It depends heavily on foreign trade due to its natural resources, and is a dominant and major exporter of copper.

Chile’s Main Industries

Chile is economically known for its strength in:

- Mining and Minerals Sector

- Copper

- Lithium

- Agriculture Sector

- Fishing

- Salmon

- Fruits and Vegetables

- Forestry Sector

- Radiata Pine

- Eucalyptus

- Pulp

- Wood

- Lumber

- Services Sector

- Tourism

Chile’s Main Stock Exchanges

The two main stock exchanges in Chile by size are:

- Santiago Stock Exchange

- Chile’s dominant and principal secondary market

- Trading occurs in equities, bonds, derivatives, and commodities

- Main Index

- IGPA Index

- IPSA index, published by the exchange, contains Chile’s 40 most liquid stocks

- Private pension funds constitute an important investor group

- Santiago Electronic Stock Exchange

- Allows online trading

- Based on its real-time, electronic-trading platform SITREL

- Trading in equities, bonds, derivatives, and foreign exchange

NOTE: The Santiago Stock Exchange has formally merged its stock exchange trading activities with those of Colombia and Peru, to form the Mercado Integrado Latino Americano (MILA), which will allow increased cross-listings of the three countries’ companies.

Glimpse into Chile’s Equity Market

Chilean equities weathered the 2008 economic crisis quite well, mainly due to a lack of exposure to the banking crisis and its commodity-rich resources and exports. The IGPA and IPSA Indices climbed above 35% in 2010, and have outperformed many other Latin American equities.

In $US dollar terms, market capitalization of listed equities surged by over 60% during 2010, from $US 209.5 billion in 2009.

After experiencing lacklustre IPO activity since 2005, Chile is witnessing a busy IPO season in 2011 with Chilean companies expected to raise up to $10 billion through 2012. The recent integration of its securities exchange trading with Colombia and Peru may further bolster IPO levels.

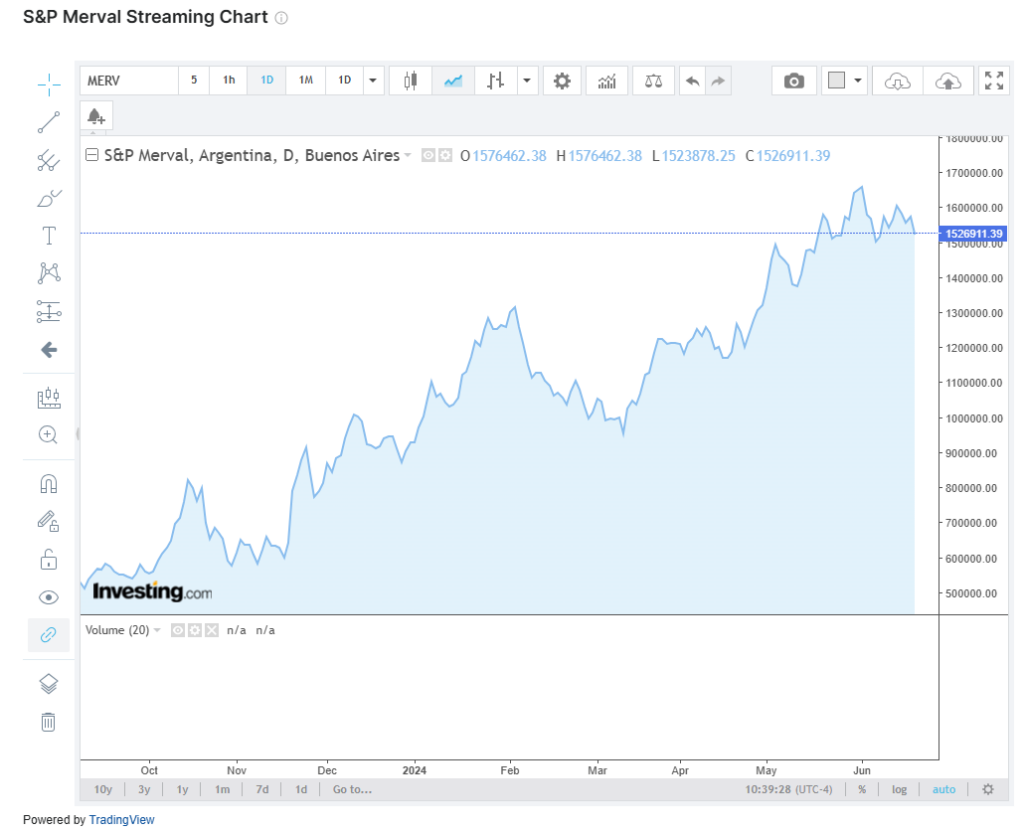

Stock Index Performance 2011: IGPA

| 2011 Values: | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last |

|

-1 Mo. |

-3 Mo. |

-6 Mo. |

-9 Mo. |

|

-1 Yr. |

-3 Yr. |

-5 Yr. |

-10 Yr. |

|

|

6/10/2011 |

|

5/10/2011 |

3/10/2011 |

12/10/2010 |

9/10/2010 |

|

6/10/2010 |

6/10/2008 |

6/12/2006 |

6/11/2001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price |

22,466.37 |

|

22,983.36 |

20,924.79 |

23,012.71 |

22,106.52 |

|

18,359.26 |

14,366.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 Performance: |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YTD |

|

-1 Mo. |

-3 Mo. |

-6 Mo. |

-9 Mo. |

|

-1 Yr. |

-3 Yr. |

-5 Yr. |

-10 Yr. |

|

Value Change |

-68116.00 |

|

-516.99 |

1,541.58 |

-546.34 |

359.85 |

|

4,107.11 |

8,100.03 |

|

|

|

% Change |

|

|

-2.25% |

7.37% |

-2.37% |

1.63% |

|

22.37% |

56.38% |

132.25% |

311.97% |

Source: Datastream

Chile’s 10 Most Profitable Companies in 2010

|

Rank |

Company |

Industry Group |

Sector |

Symbol/Ticker |

Profit ($ mil) |

Revenue ($ mil) |

|

1 |

Axxion SA |

Real Estate |

Financials |

AXXION-SN |

1,127.70 |

719.42 |

|

2 |

Empresas Copec SA |

Petroleum Refining |

Energy |

COPEC-SN |

1,105.33 |

13,246.86 |

|

3 |

Banco De Chile |

Banks |

Financials |

XBCH-MC |

892.43 |

3,288.51 |

|

4 |

Saci Falabella |

Retailing |

Consumer Discretionary |

FALABELLA-SN |

883.31 |

9,454.65 |

|

5 |

Banco Santander-Chile SA |

Banks |

Financials |

BSANTANDER-SN |

850.18 |

3,383.84 |

|

6 |

Empresas Cmpc SA |

Paper Products |

Materials |

CMPC-SN |

695.11 |

4,600.15 |

|

7 |

Antarchile SA |

Petroleum Refining |

Energy |

ANTARCHILE-SN |

657.42 |

13,257.42 |

|

8 |

Cap SA |

Steel Mills |

Materials |

CAP-SN |

643.67 |

2,173.60 |

|

9 |

Cencosud SA |

Retailing |

Consumer Discretionary |

CENCOSUD-SN |

633.10 |

13,237.98 |

|

10 |

Quinenco SA |

Diversified Financials |

Financials |

QUINENCO-SN |

623.16 |

2,789.64 |

Ways to Invest in Chile

There are a couple of different ways to invest in Chilean companies:

- Through a Chilean Bank

- Regional banks in Chile allow investors to purchase equities

- Banco de Santiago

- Banco Credito Inversiones

- Banco de Chile

- Through a foreign bank located in Chile

- HSBC

- Citibank

- Banco Santander

- Canadian ETFs

- ECH:NYSEArca – tracks the iShares MSCI Chile Index Fund

- Through some international online brokers:

- MB Trading

- Interactive Brokers

- TD Ameritrade

- E-Trade

- Questrade

- optionsXpress

- optionshouse

- tradeMONSTER

- Charles Schwab

Austria is an EU member and currently the 12th richest country in the world. It has experienced sustained economic growth and attracts many foreign investors. Austria is home to internationally reputable law firms and banks, and has a vibrant tourism sector.

Austria is an EU member and currently the 12th richest country in the world. It has experienced sustained economic growth and attracts many foreign investors. Austria is home to internationally reputable law firms and banks, and has a vibrant tourism sector.