Charting Software is an analytical, computer-based tool used to help equity (stock) traders with trading analysis by charting the price stock price for various time periods along with various indicators. Equity charting software packages are used by many traders to determine the direction on any given stock price.

Learn about all the most popular Investing Software available. Our directory includes charting software, trading software from all the major brokerage houses, chart pattern identification software and many more.

Top hedge fund managers have been buying and selling throughout this bumpy market with the aid of the Hedge Fund Wisdom newsletter. It brings to light which stocks top investors invest in today.

You can now purchase the 80+ page issue of the Hedge Fund newsletter. The issue details investment thesis smart money buys, like American International Group (AIG), Sensata Technologies (ST) and First Solar (FSLR). These stocks saw compelling purchases during the quarter.

The Hedge Fund Wisdom Newsletter is composed by hedge fund analysts and is distributed four times a year and has the following topics.

- You will get a thorough portfolio on the top 25 hedge fund managers which will include what they’ve bought, sold, and their reasons why they purchased them.

- Knowledgeable analysis and commentary on each of the fund’s moves.

- A consensus of stock buy and sell list.

- Comprehensive equity analysis section analyzing the investment thesis of the stocks they have bought.

Here are the most recent portfolios of the top hedge fund managers as well as well known investors that are are in the newsletter.

Seth Klarman (Baupost Group)

Warren Buffett (Berkshire Hathaway)

John Paulson (Paulson & Co.)

George Soros (Soros Fund Management)

Carl Icahn (Icahn Capital)

David Einhorn (Greenlight Capital)

Bill Ackman (Pershing Square)

Bruce Berkowitz (Fairholme Capital)

Stephen Mandel (Lone Pine Capital)

David Tepper (Appaloosa Management)

Chase Coleman (Tiger Global Management)

John Burbank (Passport Capital)

Leon Cooperman (Omega Advisors)

Dan Loeb (Third Point)

John Griffin (Blue Ridge Capital)

Lee Ainslie (Maverick Capital)

Julian Robertson (Tiger Management)

Roberto Mignone (Bridger Management)

Philippe Laffont (Coatue Management)

Richard Perry (Perry Capital)

Larry Robbins (Glenview Capital)

Andreas Halvorsen (Viking Global)

Thomas Steyer (Farallon Capital)

Barry Rosenstein (JANA Partners)

Alan Fournier (Pennant Capital)

ETFs can be used like financial instrument (such as options and futures) to take long or short positions in investment portfolios. With ETFs, you can scaled down the size of the transaction for small investors. The investment can be tailored with ETFs that invest in currency. Investors can hedge their portfolios against inflation by using commodity prices using targeted ETFs. Investors with limited experience in trading commodity futures can combind precious metals ETFs, oil ETFs and natural gas ETFs – or any commodity covered by an ETF. The advantage of combinding these type of ETFs is the low transaction and holding costs compared to the costs of futures, forwards, options, and other traditional hedging tools. Small investors have huge benefits using ETFs for hedging as they are able to invest in small number of ETFs shares compared to the prior requirement of larger minimum requirements required with traditional hedging strategies.

Click Here to see all Beginner Stock Trading Articles

Definition: Bear ETFs short stocks to achieve their goals. Bear ETFs show gains when the underlying stocks loose value. Bull ETFs use long positions and show gains when the underlying stocks show gains.

More Detail: Most bull and bear ETFs are leveraged. 2x and 3x leveraged ETFs do not guarantee a 200% or 300% return on their underlying index or asset, even though that is the goal. Also, the return is expected on the daily return, not the annual.

3x ETFs use a variety of complex, exotic financial instruments to generate multiplicative returns, both positive and negative. In order to obtain these returns, these ETFs creates long or short equity positions. They invest around 80% of their assets in equity securities which will not generate daily returns of 3x of the target index. To accomplish this, the balance of the fund assets are invested into futures contracts, options on securities, indices and futures contracts, equity caps, collars, and floors, swap agreements, forward contracts, and reverse repurchase agreements.

Click Here to see all Beginner Stock Trading Articles

Definition: The DIA -DIAMONDS Trust, Series 1 ETF invest in a basket of Dow Jones Industrial Average stocks that will track the price and performance of the Dow Jones Industrial Average (DJIA) Index. When you purchase DIA ETF, you are buying a way to diversify your portfolio with large cap stocks. You don’t have to purchase the individual stocks of the DOW to get a diversified portfolio of large cap stocks. Purchasing this ETF gives you the exposure you’re seeking.

More Detail: As for the allocation of stocks, industrial metals represents the largest sector the ETF, followed by the hardware and energy sectors. Media and software are the two smallest industries in the fund as they are primarily found in the NASDAQ.

Many of the companies in this fund are household names. Johnson and Johnson (JNJ), McDonalds (MCD), Coca Cola (KO), Exxon Mobil (XOM), and many other popular companies as well.

Click Here to see all Beginner Stock Trading Articles

Welcome!

HowTheMarketWorks is a completely free resource for your classroom, you can create a custom investment challenge for your class in about 5 minutes! Since you can set all the rules to what best suits your class’s needs, it can be an occasional “homework” project, or the centerpiece of your Savings and Investments unit, whatever your class has time for! There will never be any cost to you, and you can use it as long as you wish. If you ever have suggestions or problems please let us know at 1-800-786-8725 or 514-871-2222.

This is our handy guide on getting your class started in about 5 minutes, along with covering any extra questions you might have about managing your contest once it is running.

Getting Started

Step One: Register For Free!

Everyone (including teachers, professors, and students) can always register for free on HowTheMarketWorks.

Registration takes about 30 seconds, and you will be automatically logged in. If you need a guide, watch this video on how to register:

Step 2: Create Your Custom Contest

After registering, Click Here to create a Private Classroom Contest with a contest password. Here you will be asked to set the start and stop date of your trading, the initial cash balance you want your students to start with, and other trading variables like commission rates. You can have your trading last anywhere from one day to one year—it’s totally up to you!

If you aren’t sure what to set for your class, don’t worry! We have default settings that we find are most popular with teachers, and you can always come back and edit your rules later.

Watch this video on how to create your a custom stock trading game for your class:

Step 3: Get Your Students Into Your Class!

After creating your private contest, You will get a confirmation page, and a confirmation email, with the unique link that will take your students directly to your class page. Email it to your students, put it on your class website or facebook page, or write it on the board while your students are at a computer, and they will be registered directly into your class!

If you want to set up HowTheMarketWorks as an after school project, and your students do not have an email address, they can also go to our Contests homepage and search for the contest using the Contest Name.

- Students click the Join Contest button, which directs them to register on our site.

- After registering, the students can join the contest using the contest password.

- The contest leaderboard can then be seen on the Contest Status page.

If you lose your link, or can’t find the email, just ask our support team at the “Live Chat” button to the lower right to look it up for you.

The way this link works is that if someone who isn’t logged in clicks it, they will be taken to the registration page where they pick their username and password, then they are joined into your contest. If you click it while you’re logged in as the teacher, it won’t do anything. If you want to show your students how to register, click “Log Out’ at the top of the screen first!

Step 4: Create an Assignment!

Once your stock game is set up, you can forward the invite link to your students and have them start trading right away, but you can also add an “Assignment” to your class to add some more structure.

An Assignment is a list of tasks you give your students, including things like watching tutorial videos, reading educational articles, or placing certain types of trades.

Click Here To Learn More About Assignments

Help! I’m teaching personal finance, or about the stock market, for the first time, and don’t know where to begin!

You’re not alone! We have new teachers every semester that are not quite sure where to begin, but we have tons of resources available that will make you an expert in no time!

Lesson Plans

If you are looking for lesson plans, we have over 45 to browse through on a variety of personal finance, investments, and math subjects, divided by topic and grade level. We also included ways to use HowTheMarketWorks with almost every lesson, so your students will have a great way to tie everything together. Click here to browse our collection of lesson plans!

Webinars

We always love giving teachers a full tour of the site, and helping you find the best way to integrate HowTheMarketWorks with your classroom. Near the beginning of each school session, we usually schedule several, but if you don’t see one coming up (or can’t make it to one that is), just let our team know and we will be happy to give you a personal tour. Click here for our webinar schedule!

Our Investing Crash Course

The first time you teach investing or personal finance can be very stressful, especially if the topics are outside your comfort zone. To help beginning investors master all the basics, we have created the Investing101 Course. The course is divided into 10 chapters about investing, designed to help someone with little to no previous finance or investing knowledge acquire the skills they need to start investing on their own.

Teachers have frequently registered for the course to brush up before (or while!) teaching about investing for the first time, and you would be free to use any of our materials in your classroom. We even include activities that make use of the HowTheMarketWorks stock market game to practice what you’re learning in the real world. Unlike our other resources, the Investing101 course is not free, but we give teachers a 50% discount, just use the coupon code “TEACH-HTMW“. Click Here to see the beginners investing course!

Get Outside Help

Another great idea to help you get started is to visit your local bank or brokerage office and ask if one of their licensed stock brokers could come into your class and talk to them about the stock market and what they would do if they were given a brand new brokerage account with a large cash balance.

Frequently Asked Questions

What if my students don’t have email addresses?

We do not require an email address to register. However, students who do not use a valid email address may have a hard time recovering their password if they forget it.

Do you have any prizes for students?

Yes! If you want to give the winner of your contest a certificate of their achievement, Click Here for a template you can download.

If you want to give a participation certificate to everyone who took part in your contest, you can Click here for a Participation Certificate.

There is also HTMW branded gear in our Shop that you can give away to your students.

We also have monthly contests open to all users, with $500 in more we give out as prizes. You and your students are encouraged to participate and win money for a great class pizza party! Click Here for more details.

A student forgot his/her email address or password. What do we do?

Every user can use our Forgot Password feature to recover their password by email. If the user did not use a valid email address when registering, they will need to Contact Support

How long is the trading period for the students?

Each teacher/professor sets the length of the trading period so it is totally up to you! We recommend that you describe the stock market project to your students and give them at least a week to think about what stocks they might want to buy, do some research, ask their parents, read the Wall Street Journal, etc. before you ask them to start trading. There are also tons of trading ideas in our Education Center and “Trading Ideas” section on the top menu bar.

Is there a way for me to keep track of student’s activities outside the classroom?

Class time is sometimes scarce, so we have added a number of ways for teachers to keep track of their students while using HowTheMarketWorks as a homework assignment, or just have everything organized in one place. The best ways to take advantage of this is with our Teacher features:

- Assignments: You can create assignments for your students to complete. These range from watching tutorial videos on how to place trades and use the site to making a certain number of trades, and even reading articles about stocks and mutual funds, or using an interactive calculator to see how to effectively save. As the teacher, you will get a report showing each student’s progress on each assignment item. You can create as many assignments as you like, with any items you want to track. Click Here for more information.

- Teacher Reports: On the class Rankings page, you can see the current open positions, trades, and account balances of all students in your class. You can also remove students who do not belong, or reset accounts.

- Downloading Reports: You can also download all your class reports straight to excel for all students at once. On the Contests page, just click “Download Rankings and Registrations” for an excel file with all trades, account balances, and more information for every student.

When does the trading period begin?

Each teacher/professor sets the beginning date and ending date of their class trading period, so you can have your students trade for one day, one week, one month, one year or any time period you want!

What time is the stock market open?

The U.S. stock markets all open at 9:30 am ET and close at 4pm ET. Trades placed when the markets are closed will be executed at the next morning opening prices. Mutual funds are different: trades placed before 4pm will execute that night (usually around 6pm), trades placed after 4pm will execute the next business day.

Can the students see their performance and class rankings?

Yes, after the students have registered and made at least one trade, each student’s portfolio value and ranking will appear in the Contest Rankings page.

How do I extend the contest or change its settings?

Go to the My Contests page and click “edit contest” next to the contest you want to change the rules for.

My students are brand new to the stock market. How do I help the get started?

We have tons of resources for that! First, they can check out our Trading Ideas page to get a quote and news from companies they already know, and see if those companies have been gaining or losing value. They can also visit our Education Center where we include articles for complete beginners, we take current market news and provide background information on beginners on how real-world events interact with savings and investing, and showcase popular Glossary terms and interactive calculators!

If you as the teacher registered for the Investing101 course, you can also share our beginners investing materials with your class.

More Information

You can also get more information from our webinars and support team!

Our Support Team makes sure to respond to all issues within 1 business day, Click Here to ask a question!. You can also call them directly at 1-800-786-8725 or 514-871-2222.

We also frequently have webinars were we have teachers get together with our support team to walk through the site and ask questions! Click Here to see the current schedule.

Other Important Notes:

Please make sure students Log Out every time they leave the classroom! Otherwise, the next person at the computer will be logged into the previous account.

Teachers!

How will your students benefit from HowTheMarketWorks?

Stock Market Simulators have been shown to enhance problem-solving, risk assessment, cooperation and teamwork- capabilities. Help in learning on way to help students understand economic concepts and important life skills such as budgeting, decision making and personal finance.

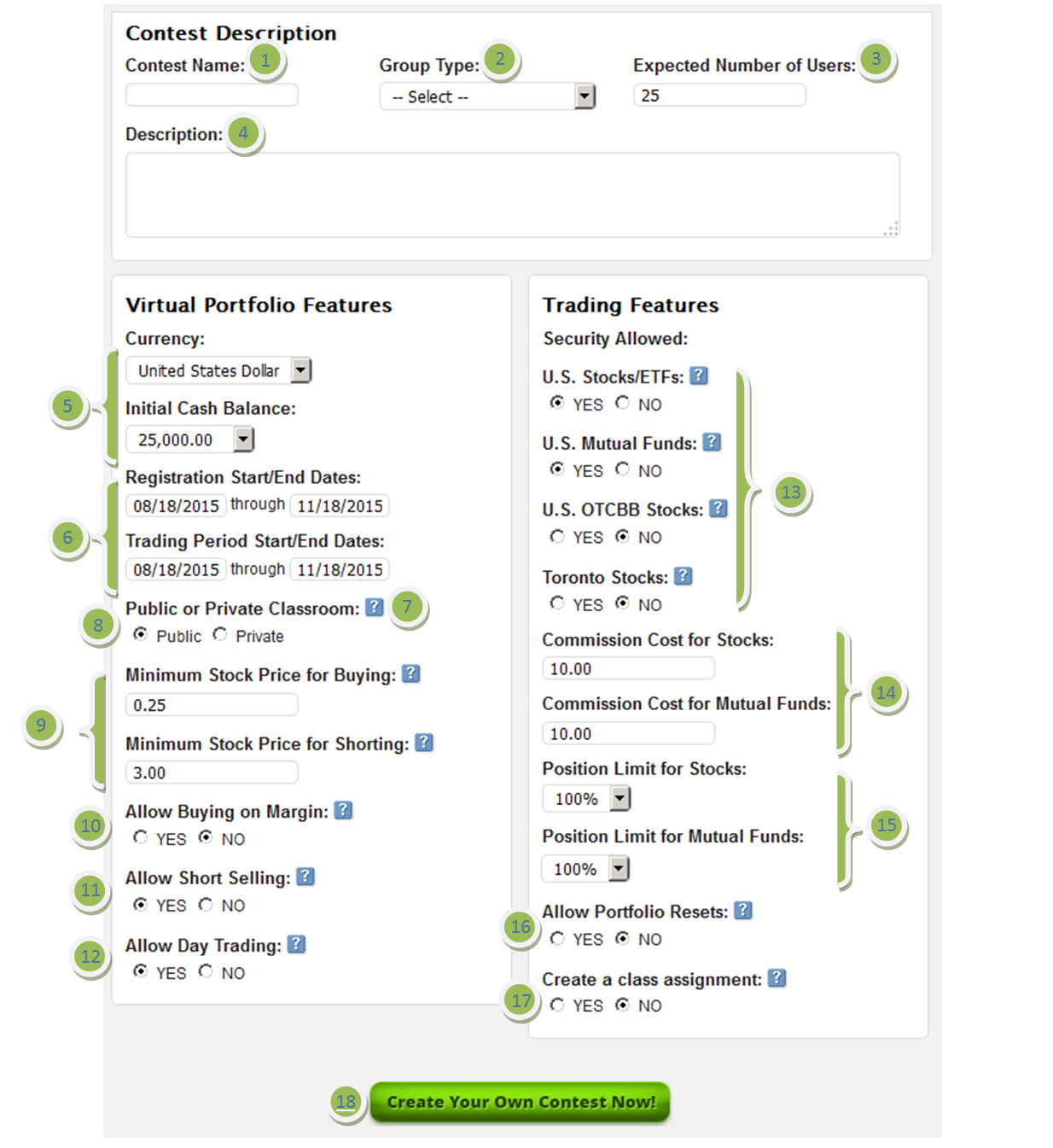

A contest is the primary way in which your students will interact with each other, you and the stock market. It is a powerful tool to help shape your students experience on HowTheMarketWorks.com. In this quick tutorial we will teach how to create, manage and monitor your contest.

Contest Creation

To start, make sure you are logged in and click on Create Your Own Contest. This will bring you directly to the contest page.

Similarly, if you are already on the contest page you can click in either of these places.

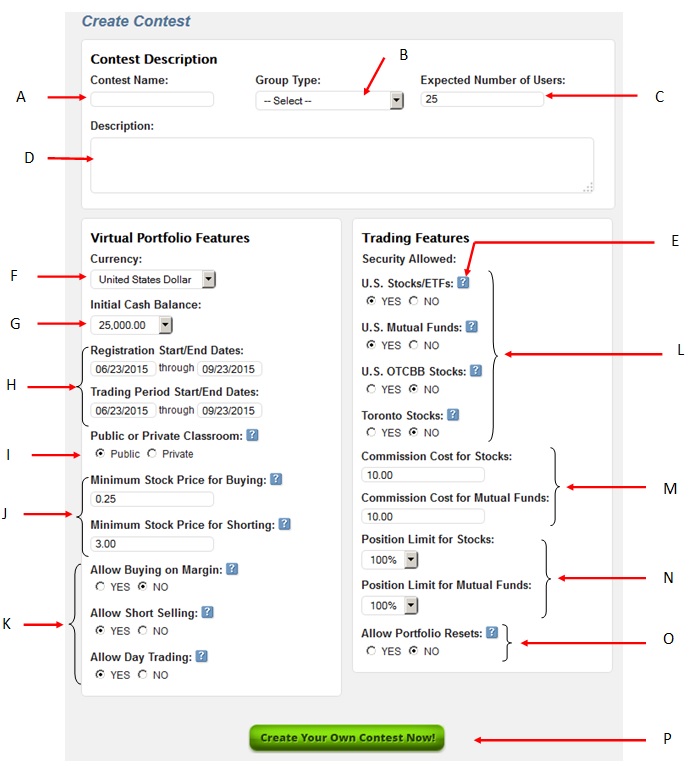

After scrolling down you will be able to see the contest creation form.

A: This is the contest name that Students will use to find their class. This must be a unique name as there are many contests on the site. We generally suggest naming it something easy but precise SchoolNamePeriodSeasonYear, for example: LHSPeriod1Fall15. It is completely up to you how you name it however.

B,C: Group Type and the estimated number of users are for our information. If you do not know the exact number of students you will have that is not a problem. This will no limit the number of accounts you can have in your contest in any way.

D: This field is for a brief description for the people in your contests. Here you can put information about the contest, etc. Anyone can see this description, including people who are searching.

E: By hovering over these questions marks you can get a quick summary of what some of the fields mean

F: Here the currency can be selected. We generally suggest using the currency where you live to make the simulation realistic. Don’t worry about changing money etc., we apply the exchange rate automatically when purchasing foreign stocks.

G: Select the initial cash balance here in the currency you just selected. It can be changed in the future.

H: The registration dates are the time period that students are allowed to join the contest.

The trading period dates are the time period that the contest will be active and that students can trade. Once the tournament ends you will still be able to see their trades and rankings for a period of a few months.

I: Public classroom: Anyone can join by searching for this class.

Private classroom: A password is required to join the class. The password can be anything and your students will require the password to join the contest unless they are provided the link received by you as will be seen later on.

J: The minimum stock price for buying is the lowest price they will be able to purchase. If it is set to 0.25$, students will not be able to purchase stocks with a price lower than 0.25.

Similarly the minimum short price acts the same way but when shorting stocks only. (It will not matter if short selling is disallowed below)

K: Buying on margin is essentially the possibility to take out a loan. If selected, the amount a student can buy is double. They will begin to use a loan automatically when they run out of cash in this case. Interest is charged on the loan at 8% interest. If not selected they will only be able to buy assets with cash.

Short selling is the ability to essentially take make money when the price of a stock goes down instead of going up.

Day trading allows students to trade the same security on the same day. For example if they purchase Apple stock today they will be able to sell it today as well if day trading is selected. If it is disallowed they will have to wait til the next market open (the next weekday).

L: These options are to select the type of assets they can trade.

Please note:

mutual funds only execute trades at the end of the day.

OTCBB should NOT be selected for beginner students, these are very risky stocks.

Toronto Stocks gives access to the majority of Canadian Stocks.

M: Commission is the amount of money charged every time a trade is made. Buying, selling, covering and shorting all will cost a commission. In this case the default value is 10.00 which is what you would expect in real life. (This will be in the same currency you selected earlier)

N: Position limits are the maximum of one asset you can buy. For example, of the limit is 25%, the student will only be able to buy 25% times their current portfolio value in one stock. For example if 25,000$ initial cash balance and 50% position limit for stocks. They will only be able to buy a maximum 12,500$ of Stock A.

O: This will allow students to reset their portfolio restarting as if they have a new account.

P: Click here to Create the Contest and your done!

For beginners : It is suggested to put the minimum stock price to 2.00$ and select “no” for US OTCBB stocks.

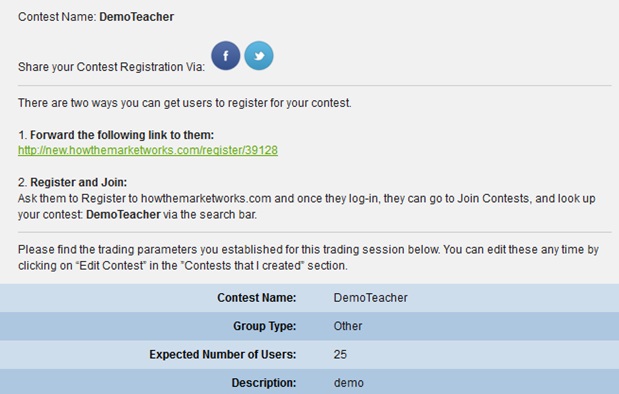

You’ve now created a new contest!

On the next page you will be able review the contest you created. If you have any issues you can see edit the contest by reading below.

- The first option allows you to copy this link and send to your students and they will automatically be registering for you contest and a new account at the same time.

- If they already have an account or you don’t want to use the registration link they can also go to Contests in the top menu bar and then join contests. As follows. (NOTE: They can only join a contest if they have registered a username already and are logged in)

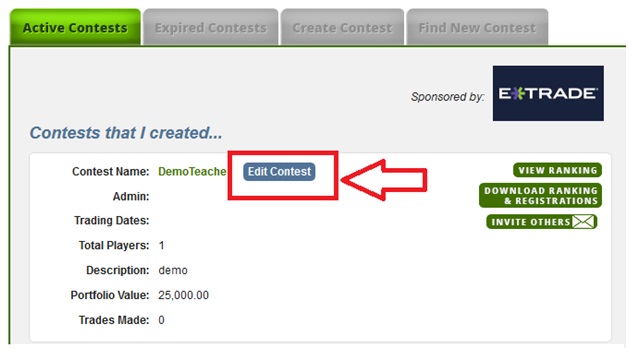

Managing Contests

Editing a Contest

The only difference between creating a new contest and editing a contest is that you will have to select your active contests.

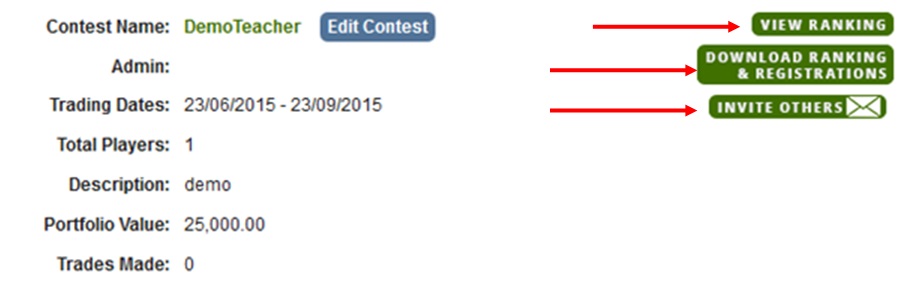

Which is seen below. Simply click on the edit contest button which will bring you to the contest form which you can edit.

It will only save after you click on Save or you can cancel making changes as well.

Contest Tools

To get information about your student or to invite others use these panels in the active contests

View rankings will allow you to see the students rankings but ONLY for those who have made their first trade in the contest.

Download rankings & registrations will download an excel file with everyone who has traded as well as the trades they have made.

Invite Other will gives you a way to invite other people to the contest.

Don’t forget, if you have any issues at all feel free to contact us!

If you’ve never heard of safety stocks or would like to know more, the information below is designed to give you some information on these relatively stable investments

Safety in a turbulent market

Though no stocks are completely immune to the daily changes in the stock market, some manage to do better than others. Some of these companies have been around for a long time and that produce everyday items that are known around the world (such as the first aid and baby care manufacturer Johnson & Johnson), and aren’t likely to encounter major scandals to bring down their prices. While these stocks aren’t known for major increases in value, they don’t perform poorly instead, they offer a slow-but-steady increase that’s much more stable than many other investment opportunities.

Safety stocks and diversification

Because of their general consistency, safety stocks are considered a must-have by many serious investors. They are great tools for diversification, allowing investors to use their stability to offset some of their more volatile investments. This effect can be increased even further by making investments in precious metals or the diamond market, both of which tend to offer a similar stability that works well with that of the safety stocks. A diverse investment portfolio with a strong base of safety stocks and precious metal and diamond investments is likely to weather even the most turbulent market with minimal long-term losses.

Even without using safety stocks for true diversification, it’s possible to use these stocks to offset higher-risk investments. When investing in high-risk stocks, a smart investor might buffer their investment with a secondary investment in one or more safety stocks which will help to minimize any losses that might occur. If the higher-risk stock performs well and is sold at a good price, then the safety stocks may either be sold or kept since they’re not likely to drop significantly in value. Should the higher-risk stock not perform well and ends up being sold low, then the value of the safety stocks as they slowly but surely show an increase will help to offset any losses.

Safety stocks and long-term investment

Obviously, safety stocks are great for long-term investments. Purchasing safety stocks over the course of several years is much more likely to show a definite improvement than other stocks that aren’t nearly as stable. When combined with precious metals or the diamond market as mentioned above, the effects can be even more noticeable due to the similar nature of the two types of investments.

Safety stocks can also be combined with bonds or other types of investments that do well in the long term, either using the stocks in smaller amounts to accentuate the earnings of the other investments or as simply another long-term investment among many. This can make safety stocks ideal for retirement plans or any other long-term financial planning.

Click Here to see all Advanced Stock Trading Articles

The world of trading and investment can be as frustrating as it can be rewarding! You need to be prepared…

Firstly, decide if you are a trader or an investor.

An investor is someone who enters the stock market inadvertently – usually via their superannuation policies. A trader is someone who makes a decision to buy and sell shares via the stock market. This can be done online or by using the services of a stock broker.

If you decide to become a trader – to win – you must have a survival strategy…

You need to study the market yourself – not just rely on ‘reading the news’, or listening to others advice and tips.

Take advantage of technology – computers, software, electronic data – all at your finger tips. Seek out charting software and appropriate internet sites – they are plentiful.

Ensure that you ‘manage’ your money and keep some in reserve.

Have the ability to quickly identify failures as well as successes.

Stock Market trading appeals to those who are a little adventurous – rather than just placing their capital into bricks and mortar.

But – be mindful that portfolio values are less stable than real estate as they are continually moving up and down.

However – investing in the Stock Market means that you are putting your money to work – be aware, and enjoy the gains!

Click Here to see all Advanced Stock Trading Articles

A trailing stop loss works similar to a normal stop loss, but the “stop point” can move depending on the highs or lows of the price since you placed your order.. The only difference being that while we calculated our stop loss from the entry price, we’re calculating our trailing stop loss from the highest price since entry. The key to the trailing stop loss is that it tries to keep the same stop rule you originally used, but also protect any future gains that you make.

The method that you use to set your trailing stop loss can vary dramatically. However, if we use the ATR method that we used to calculate our initial stop to set our trailing stop loss, we’ll have the ability to lock in the profit as the share price increases.

For example, if you bought a share of Sprint ([hq]S[/hq] at $5, and your initial stop was set at $4.90, your trailing stop would also have a value of $0.9 to have the same trigger. If, after the first day, the share price moves in your favour and moves to $5.10, you would recalculate your trailing stop loss by subtracting two times the value of the ATR from the new high price of $5.10. For simplicity, let’s assume that your stop size hasn’t changed, and is still ten cents wide. When you calculate your new trailing stop loss, by subtracting the 10 cents from $1.10, it would be set at $5.

At this point, your initial stop was at $4.90, and your trailing stop loss is now at $5, with the share price is at $5.10. Since your trailing stop loss is higher than your initial stop, the initial stop becomes obsolete, and our trailing stop loss becomes your active exit. Want to try it? [trade]S[/trade]

How much profit have you made on this trade? The share price is at $5.10 and we entered at $5. If you thought, No, I haven’t made any money, then you’d be right on track. Remember, our stop loss strategy gives the share price a little bit of room to move.

You’re not going to exit this position until the share price reverts to $5. It is important to note that when you are valuing any open position, you should always value it based on its stop loss value, since if you were to exit this share, you would wait until that price point was breached.

Let’s go back to the example. Now, what happens if the Sprint’s ([hq]S[/hq]) share price begins to fall? Let’s say that the share price falls from $5.10 down to $5.05. What does your trailing stop loss do? Would it move down also? Here’s another important point. A stop loss will never, ever move down. A trailing stop loss can only move up. This ensures you lock in profit and that you’ll also get out of the shares once they start to turn. A trailing stop loss is always calculated from the highest price since entry, so the highest price is still $5.10.

It’s not until the share price makes a new high since entry that the trailing stop loss would begin to move in your favor again. However, if you’re using the ATR method, there’s another way for our trailing stop to move up. This would occur when the volatility of a stock begins to decrease. If a share price were to begin to move sideways, the ATR value would start to drop off. This would cause the trailing stop to move up as the share price became less volatile.

The best way to understand these concepts is to print out a chart with the ATR values along the bottom. Then on the chart, identify the point where you would have received an entry signal, and mark your initial stop loss and your trailing stop loss.

As the trend progresses make sure that you recalculate the value of your stop so you can begin to get a feel for the way this method of using a stop loss works Seeing how the changes in stock price affect you trailing stop loss will give you the confidence to make them a key part of your trading system.

Click Here to see all Advanced Stock Trading Articles

How personal money management works: In the markets it`s possible to be right, and to still lose money. In fact, it`s pretty common. Traders who win on a high percentage of their trades often end up with their capital eaten away, and nothing to show for their work. They lose their gains because they don`t know how to manage their money.

Being a good manager of your own money is one of the most difficult trading skills to learn. But if you don`t use good personal money management to lock in profits, take small losses on the picks you`re wrong about, and control your use of margin, eventually you`ll lose everything, no matter how good of a trader you are. You need to make protecting your capital your first priority if you want to be successful.

As a trader, your capital is the most valuable thing you have. Without it, you can`t trade at all. For this reason, bringing in no profits on a trade is better than losing any part of your capital. If your account is intact, you can always make a profit another day. If your capital has suffered a loss, you`ll be wasting effort playing catch-up. The more you`ve lost, the longer it will take to get back to where you started from, because you`ve got more to make up for, and because you`ll have a smaller chunk of capital to work with. A smaller capital base means smaller percentage returns on profits. Making 10% on a $10,000 account earns you $1,000, but if you`ve lost half of that account and have only $5,000 left, making 10% on your money will earn you only $500. You`d have to do that twice to make the same $1,000.

Sound personal money management has two main goals: to avoid losing money, and to avoid missing profit opportunities by tying up capital in problem trades for long periods of time. Failing to avoid either of these will cost you. The first goal is straightforward. You want to preserve your capital and whatever profits you`ve accumulated. But you don`t just want to keep your capital, you want to trade with it as well, to continue to grow it and make your returns larger and larger.

Working to avoid losing those profit making opportunities isn`t quite as obvious a goal. With the second goal in mind let`s compare the outcomes of two money-management decisions. Trader A buys a stock, expecting it to go up, and finds that it doesn`t. However, he`s certain it will go up eventually, and he`s incurred a small loss, so he decides to wait it out. He ends up holding the stock for three months before finally selling it. Trader B buys the same stock at the same time as Trader A, but once he sees that it isn`t going up, he sells it at a small loss. He buys another stock and makes a 15% profit on it. His next trade loses 1%, but after that he makes 8 %, 15%, and 30% on a series of trades. Because he is growing his account, he makes these percentages on a larger and larger base of capital each time. At the end of three months, his account has grown by 48%.

Whose personal money management decision turned out to be the best? While Trader B made a nice profit, Trader A not only lost time but also never made his money back. Even if he had made his money back on that stock, it`s hard to see how this was a good use of his capital over the course of three months.

Clearly the goal of not tying up your capital in problem trades has an important impact on your profits. Practising sound personal money management will keep your capital and your profits safe. Though it is a difficult skill to learn, once you know how to practise good personal money management, you can almost guarantee that you will be a success as a trader.

Click Here to see all Advanced Stock Trading Articles

Compound Interest is an extremely important concept in any level of finance. Compound interest can make an enormous difference in the return you get from your investments. As we know, simple interest is the act of earning interest on an investment. If you earned 10% on 100 dollars you would receive 10 dollars every year. On the other hand, with compound interest, that amount grows with interest that you receive. This is true for nearly all investments nowadays, including your bank account!

If you want to see compound interest in action, check out our interactive Compound Interest Calculator, which has charts and graphs that update as you change the saving rules!

An example that is frequently used is the American Indians sale Manhattan in New York for various items worth about $16. To many that would seem like a very bad deal since $16 today is not worth much. However, more than 400 years ago that was a lot of money. If the American Indians had sold the items and invested the money at 8% compounded interest, they not only would have been able to buy back Manhattan today, but would have a very large sum of money leftover. This is the very real power of compound interest over extended periods of time. You might not have 400 years to save, but even over shorter periods of time, compound interest will add up quickly.

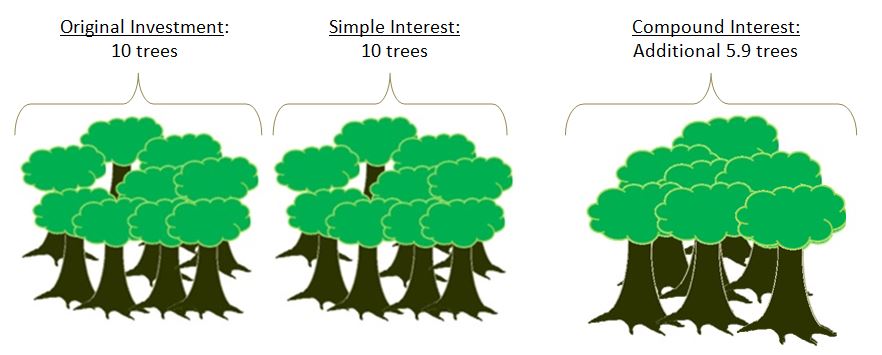

Lets look at an analogy of an planting trees that grow and produce other trees that would mimic a ten percent compounded interest. In this example, every tree will grow 10% of a new tree every year.

Year 0: You have saved some money and managed to buy 10 trees and each 10 trees make one tree.

Year 1: The next year you will have 11 trees

Year 2: The year after that 12.1 trees

Year 3: Then 13.3 trees

Year 10: After ten years you will 25.9 trees

If this had been simple interest it would have only been twenty trees.

Visually it looks something like this:

This may not seem like much but if we look at twenty five years the amount investment on compound interest vs simple interest, compound interest would get an extra 833 trees!

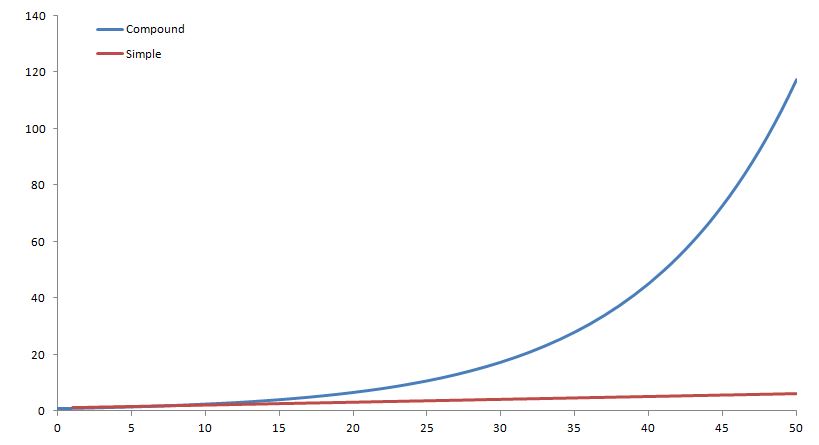

If we look at this graphically we can see the difference between the two even further.

We can see from the graph above that the compound interest curve looks a little like a hockey stick. This will be true for all compound interest curves and is called an exponential curve. From here it is apparent that after 50 years, compound interest makes a very large difference.

Calculation

The calculation of compound interest is quite simple but can get more complex when we start changing the compounding period. Here, we will look at the basics for compounding once a year and calculating our interest once a year.

A = P(1 + R)t

Example:

If we have a 5% interest and $100 investment:

Year 1: 105=100 (1+0.05)1

Year 2: 110.25=100 (1+0.05)2

Year 2: 115.76=100 (1+0.05)3

or

Year 2: 110.25=105*(1+0.05)

Year 3: 115.76=110.25*(1+0.05)

First, let me tell you that a trading plan is only useful if you follow it. Following your plan will make you successful, yet many traders circumvent the stock market lesson plans that they have carefully created. They become emotional invested in a trade, to the point where they ignore all warning signs. Remember, when the market corrects itself, which it always does, no position is immune, no matter how strongly your ego may be tied to it.

Many investors have stock market lesson plans that watch as their portfolio values are cut in half or more, yet they will still hold their positions. They may fear being left out of a big gain, or be so deep in loss that they felt they couldn’t possibly sell at that point. But even if you believe that all positions will recover from their losses, and the truth is that not all of them will, this is a terrible way to trade.

You tie up too much capital, and your rate of return plummets. Just as you shouldn’t become emotionally involved in a trade, you should also never become tied to ideas. By this I mean becoming so fond of a particular strategy or trend that you cling to it even after it has stopped working. You need to have strategies, and to have plans, but you must also be aware of the shifts and swings of the market, the beginning and the ends of trends.

The target price helps you figure out your risk to reward ratio, and it gives you an exit point in your trade. At the least, it should give you a point where you’ll reassess the trade’s ability to continue to moving upward. But your trade may never reach your target price. Many market factors can interfere with its progress, and you may have set your target higher than you should have. Since there’s no way all your trades will hit your price targets, it is a good idea to sell half your position at a more conservative target. Routinely taking profits will reward you in the long run.

There are a number of things that can interfere with a stock’s movement and force you to close your position sooner than you’d anticipated. Your stock market lesson plans should cover all of these possibilities, but here are some reasons that should always prompt you to close a position:

1. The end of a trend. All trends end some time, and you should be prepared for this.

2. The stock’s upward movement has slowed or been abruptly broken, ending its momentum.

3. The stock is approaching a major psychological barrier, perhaps reaching 100 dollars or 200 dollars a share, which should have been anticipated in your plan

4. The stock is about to reach a resistance level it has been unable to break through before.

This technical barrier should also have been anticipated in your plan.

5. A sudden market wide decline, or the threat of one, or some other serious uncertainty,

which leads to unsafe market conditions.

Exiting a losing trade is not a big deal. Ending a position whether or not the stock reaches its target price, in accordance with your stock market lesson plans, is good trading. The best traders would rather lose a small profit than take an unnecessary risk. You don’t have to win on every trade; no one does, and it’s dangerous to try. In fact, by limiting losses, a good trader can be profitable overall, and make money on only 40 percent of his trades. Cut your losses and start fresh with something else when you need to. You’ll be happier, and you’ll make much more money.

Click Here to see all Advanced Stock Trading Articles

| When you register for FREE at HowTheMarketWorks.com, you immediately get a free virtual trading account for you to practice trading. Once registered, you can then create or join as many contests as you would like.

So if you are a teacher, a professor, the leader of an investment club, or if you want to challenge for friends or co-workers, create your own custom stock market game on HowTheMarketWorks.com and then share the link for your contest. If you ever have questions, call us at 1-514-871-2222 from 9:30 am to 5:00 pm Eastern Time. Please also read our Virtual Trading FAQa to learn more about our stock game! |

Are the contests free?

Yes, HowTheMarketWorks is completely free! We are supported by the brokerage and financial services firms that advertise on our site.

Are there any prizes for winning?

Alternatively, Click Here to download a participation certificate for everyone in your class!

A few times a year we promote PUBLIC contests where we encourage users on HowTheMarketWorks to register and create another portfolio for our contests where we do give out other prizes.

How do I join a contest?

There are two ways to join a new contest, depending on whether or not you already have an account or not:

– If you already have an account, visit the Join Contests page, and search for the contest you are looking for. If it is a public contest, you can join right away. If it is a private contest, you will need to input the password the contest creator set in order to enter.

– If you do not yet have an account, the creator of the contest can give you a link that will let you register directly into their contest without looking for it in the contest page

How do I create a contest?

We have created a few videos to help you. This one shows show you to create a contest:

When you are ready to create your own contest, you simply click on the Create a Contest link and fill out the information.

How do I manage the contest I created? Can I change my contest options (stop date, balances, etc)?

If you are the creator of the contest, go to the My Contests page and find the contest you wish to edit. You can click the “Edit Contest” button to change any of the settings you had when first creating the contest.

TEACHERS: How do I sign up my classroom?

Go to the Create a Contest page and fill out the information.

– Use the Private Classroom option.

– Set a Password to share with your students.

– Set the Start / Stop Dates.

– Click the Invite button to send your students emails with the link to the contest

You will also get a confirmation email after creating your contest that will have the link you can send to your students to register them directly into your class contest.

Why are some orders delayed by 15 minutes?

This is because of stock exchange rules about the distribution of real time prices. Most of the orders are filled at real-time prices, but some of the smaller stocks are filled at 15 minute delayed pricing. However, we do provide real-time quotes on the trade page, and all orders on the US exchange will fill in real-time.

Can I view the stocks of other contestants?

If you are the contest creator, you can view all the trades and current holdings of all contest participants at any time. On the My Contests page, click “Download Rankings and Registrations”, and it will export all the current holdings, transaction histories, and account balances of everyone in your contest. We will be adding reporting for individual portfolios in the near future, which will be found on your Rankings page.

My student forgot their password. What do I do?

If you need to have a password reset, please contact our help desk and we will reset the password within one business day.

What is the longest contest I can create?

As long as you like! We support contests ranging from 1 day through 100 years.

How do I reset my contest portfolio?

Only the contest creator can reset a contest portfolio. To have your portfolio reset, have the contest creator contact our help desk. In the coming months we will also add an option for the contest creator to reset portfolios from the Rankings page.

How do I quit a contest?

At the present moment, you are not able to quit a contest. However, in the coming weeks a button will appear on the Rankings page that will allow you to quit a contest at any time. However, once you leave a contest, you will not be able to re-join later

How do I delete a contest?

If you created a contest, you may delete it at any time. Simly Edit your Contest from the My Contests page, and set the Contest End Date to any day in the past.

Please also read the HowTheMarketWorks User Guide for trading questions!

Definition

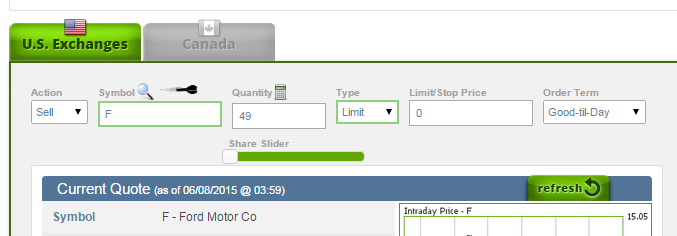

Expiration types determine how long an order will stay open without filling. Your order type is very important for limit orders, but understanding them can also remove a lot of confusion for market orders.

Details

There are many different order types, but we can focus just on a few of them to get a feel for how they work. You may have more or less depending on your brokerage.

Good Till Day

Day, or Good-til-Day, orders will expire at the end of the trading day when the markets close, (in the US, it is 4:00 pm ET). If the conditions for your order to fill are not met at the end of the trading day, the order will expire. On HowTheMarketWorks, market orders are placed as “Good Till Day” by default, with the only condition being that there is sufficient volume in the actual markets for the trade to go through.

Some brokerages allow partial-order filling for market orders, which means that your order will fill to what the volume allows until the market closes, then the remaining part of the order is cancelled at the end of the day.

If a Good Til Day order is placed after hours, it will expire at the end of the next trading day (unless it executes).

Cancel

Cancel, or Good-til-Cancelled (GTC), orders will expire only when you go and manually cancel the order. These orders never expire, meaning they are often popular for stop-loss orders or other very long-term trading strategies.

Date

Date, or Good-til-Date, orders will expire at the date you set, at the end of that trading day when the markets close (In the US, it is 4:00 pm ET). This allows you to keep an order for longer than a day, but you don’t necessarily want it to sit open forever.

An example of this is when you know a company you hold is releasing an earnings report; if the earnings are bad the price starts to really go down, you want to sell it quickly. If the price doesn’t drop then you would prefer to hold onto it. You could set your stop-loss order to expire the day after the earnings release, which would protect against losses up until that date.

More Complex Order Types

These are more complex orders; you probably will not encounter them with normal brokerage accounts (although some are becoming slightly more common). These are most often used by institutional traders, or professional traders.

Extended

Extended can mean different things depending on who is offering it; usually they are for pre- and after-market trading (for example, stay open until after the after-market trading period on this date)

Fill or Kill

This is a shorter version of “Good Till Day”, this order only stays open for a few minutes. If there is not sufficient volume in the markets to execute, it will cancel.

Immediate or Cancel

This works the same as “Fill or Kill”, except partial order fulfillment is allowed. You will buy up as much of your order as the market will sell you within a few minute (or second) window, and whatever is left is cancelled.

HowTheMarketWorks

Check out this video of using different order types on HowTheMarketWorks!

Here are some popular Finance Websites to help you get the information you need and advance your trading even further.

List of Finance Websites:

Quotes, news, tools

- Google Finance – user friendly charts, screeners, news. This is powered by Google, and allows exporting of some historical data. They even have an API if you want to integrate it with stock picking software

- Yahoo Finance – user friendly charts, screeners, news, options, bonds. Yahoo! Finance is a source we use often for some of the latest-breaking investment news stories

- Barchart – technical charts, news, futures, options, Forex

- Stockwatch – quotes and news

- Nasdaq – quotes, news, analyst ratings, lots of information

- TheGlobeandMail – quotes, charts, ratings, news

- MarketWatch – quotes, charts, news, personal finance

- Bloomberg – quotes, news

- Reuters – quotes, news

- Ino – quotes, news,futures

- Zacks – screeners, news, earnings

- The Street – quotes, cramer, news

- Wall Street Journal – quotes, news

News and Blogs

- Seeking Alpha – Contributors from around the world post news, share investing advice, and more. There are popular stock games on HowTheMarketWorks and Virtual-Stock-Exchange run by Seeking Alpha members

- Zero Hedge

- Green Faucet

- Forbes

Futures and Commodities

Brokerages

- E*TRADE

- TD Ameritrade

- Scottrade

- Schwab

- Robin Hood

- Capital One Investing

- Merill Edge

- Fidelity

- MB Trading

- Trade Station

- Options House

- Trade King

Misc

- StockTwits – heatmaps, financial social media

- FinViz – heatmaps, screeners, futures

- StockMapper – heatmaps

- Trefis – Balance Sheet breakdown

- Daily Stock Select – Backtesting, forecasts

- Stockcharts – Charts

- Fool – Personal Finance

Simvest.com Offers Fun Mode Vs Realistic Mode

Our site offers two modes for Virtual Trading: Fun Mode and Realistic Mode.

Click the Manage Portfolios tab to switch modes.

| Fun Mode | Realistic Mode | |

| Goal | Simple, convenient | More like a real brokerage |

| Free to use | 100% | 100% |

| Order Types | Market | Market, Limit, Stop Market/Limit, Trailing Stops;Read more |

| Place orders anytime | Yes | Yes |

| Orders execute | Immediately | Only when market is open See Market Hours |

| Order expirations | N / A | Several options; Read more |

| Trade indexes like $TICKIXN | Yes | No |

| Trade fractional shares | Yes | No |

| Max shares per day per stock | Unlimited | ~50% of avg. daily volume |

| Max ownership per stock | Unlimited | ~10% of outstanding shares |

| Max shares per trade | 10 Billion * For penny stocks | 1 Million |

| Real-time quotes | Delayed 15 minutes | Delayed 15 minutes |

| Short selling | Yes | Yes, above $5/share |

| Interest earned on cash | No | 1.00% Interest Rate * Paid on the 1st of the month |

| Dividends | No | Maybe later this year |

| Margin trading | No | Maybe later this year |

Note: All contests run in Realistic Mode.

We support many different order types across the system!

What Is An “Order Type”?

When you want to buy or sell a stock, the prices are always moving; the price now could be very different from the price tomorrow. Most investors are concerned with buying and selling stocks only when they are a certain price, the different “Order Types” are the different instructions you give to your broker when placing a trade on how to act based on the price of a stock, mutual fund, option, or other security.

Market Orders

What does it mean?

Placing a “Market Order” means that you want to buy the stock as soon as possible, at whatever the market price is. For example, if you wanted to buy Google (GOOG stock right now because you think the current price is as low as it will go, you would place a Market Order to try to buy it as soon as you can.

Details

Market orders are what most beginning traders use the most; you see the price, and you want to buy or sell at as close to that price as possible. However, someone still needs to “fill” your order for it to go through; just because you want to buy 50 shares of a stock does not mean that there are 50 people willing to sell them to you. This is especially true for penny stocks, which may trade only a couple times a day, or less.

For a market order, it is also possible for you to get a different price for each individual stock you buy. For example, lets say that the “last price” of a stock you want to buy is $100, and you place a market order for 50 shares.

It could be that there is only 10 shares of that stock for sale left at $100, all the other sellers are trying to sell at $120. This means that the first 10 shares you buy will be $100, and the next 40 will be at $120, giving you an average price of $116!

This will never be a problem for big companies, but if you are trading penny stocks, or any other securities with low volume (especially options), this can become a major concern.

Limit Orders

What does it mean?

A “Limit Order” is when you want to buy or sell something, but only at a “Good” price. You can determine what a “good” price is, both for buying and selling

Details

When you are buying, the limit price specifies the highest price you are willing to pay for that stock; if your limit price is already above the current price, it works like a market order

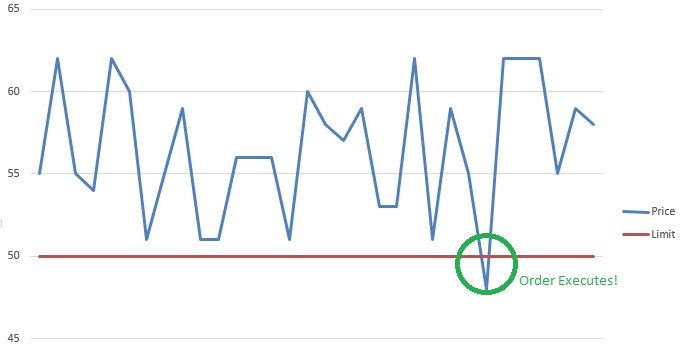

For example, lets say there is a stock you want to buy, its current price is $55. You want to buy it only if the price falls to $50 or below, so you will place a buy-limit order at $50.

Your order will stay open, and if the price falls to $50, it will execute.

For “Sell” orders, it works in the opposite direction: you specific the minimum price you want to sell it at. If the market price goes above that price, your order will execute.

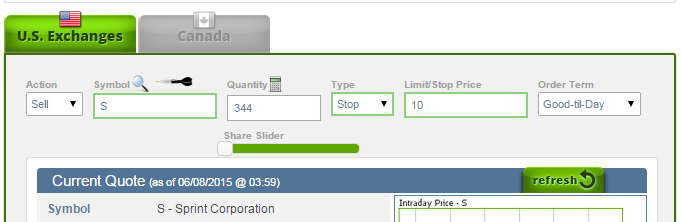

Stop Market Orders (STOP LOSS)

What does it mean?

A “Stop” order is when you want to prevent yourself from losing too much money on a position, which is why the are also called “Stop Loss” orders. For buying, you want to make sure you get it before the price goes too high and you miss out, and for selling you want to sell it before the price drops too low and you lose too much money.

Details

Stop orders work the exact opposite of limit orders, you specificy a “Bad” price and your order will execute if the price falls below that.

For buying, you would use a “Stop” order if you are thinking about buying a stock, but don’t want to buy it until the price starts to go up. In this case, you would set a “Stop” order above the market price, and as soon as the market price goes above your stop price, your order will execute.

For selling, it works as a “loss prevention”, you would set your stop price at the point where you want to sell it if the price keeps falling, because you think that if it falls that far, it will continue falling.

Trailing Stop Orders (STOP LOSS)

What does it mean?

Trailing stop orders follow the market; instead of setting a buy stop order at $50, for example, you would set a “Trailing Stop” order to execute as soon as the price goes up by $1.

Details

At first, this might sound like the same as a normal stop or limit order, but its completely different!

For example, lets say you place a “Trailing Stop” buy order for $1, on a stock with a current price of $100.

If the price falls to $95, but then raises back up to $96, your order will execute because the price went up by $1 from its lowest point since you placed your order. If you are making a long-term strategy where you think a stock is falling now, but want to make sure you buy it as soon as the price starts going back up, a trailing stop order is your best friend.

On the other side, you can use a trailing stop Sell order to make sure you automatically sell off your position if the price starts to fall, no matter how high it goes up first. Many investors prefer to use Trailing Stop Sell orders to regular Stop Sell orders so they can be sure they preserve any gains they have made.

Contest Links: Create a Contest!

Learning how to Create a Contest on HowTheMarketWorks.com is simple!

Start by logging in or creating an account.

Then you can click here or click “Create your own Contest” under the “Contests” menu at the top of the screen:

Once you are on the contest page, just give your contest a name, describe it, and set a few basic trading rules! If you aren’t sure what rules to use, we pre-populate all rules with the most popular settings!

Contest Creation

-

Contest Name

Give your contest a name! This will be handy for other people to find the contest you created.

-

Group Type

We want to know who uses HTMW! The group type lets us know where our stock game is most popular, which we keep in mind when we develop new features.

-

Expected Number of Users

This is what we use to estimate how many students are on each account (and we know how many students are actually using the site!)

-

Description

This is useful for someone searching for your contest, they can look using the contest name and know its the right one by the description.

-

Cash and Currency

It is usually recommended to use the same currency you are in to make it more realistic. Don’t worry about having to exchange money, we apply the exchange rate every time a trade is made.

Initial cash can be set between $10,000 and $500,000. -

Dates

Registration Dates: This is when your users are allowed to join the contest and can be changed at anytime. It does not affect the trading dates. We recommend opening the registration a bit earlier than the actual trading period so people can practice before the contest starts.

Trading Dates: This when trading starts and ends.

-

Tool-tips

By hovering over the little question marks “?”, text will appear. They can be very useful for finding quick information about the field you are trying to fill out.

-

Public or Private

Public contests can be joined by anyone. Private contests will prompt you to create a password in order for people to join. Note: If you are the contest creator you can see everyone’s trades regardless of whether it is private or public.

-

Minimum Price

The minimum price is the lowest price you can buy or short (if enabled). If you set your limit at $1.00 it means you cannot buy stocks with a cost of less than $1.00. We recommend that beginners have a limit of $1.00 instead of $0.25, since trading in penny stocks for a contest leaves too much up to blind luck.

-

Margin

This allows players to take a loan if they spend all of their cash equal to the amount of initial cash they had. Users will be charged 8% interest on the loan. You do not have to take out the loan, simply spend all your cash and you will start using your loan margin automatically. You can also change the interest amount by contacting support.

Not Recommended For Beginners -

Short Selling

This will allow you to short sell allowing users to profit if the stock price goes down. Unlike in real life, there are no margin requirements.

-

Day Trading

Allows users to buy and sell a given stock in the same day. If not allowed, users must wait until the next trading day to sell a stock they bought the same day. Note: this is only true for one stock, you can still buy and sell multiple different stocks in one day as long as it was not already traded that day.

-

Allowed Securities

US stocks/ETFs: Allows all the stocks on NYSE, AMEX, NASDAQ, NYSEARCA

US Mutual Funds: Allows Mutual fund trading. Note: these only trade once a day after the market close.

US OTCBB: Over the Counter Stocks. A large majority are penny stocks.

Not Recommended For Beginners.Toronto Stocks: Allows Canadian Stocks

-

Commission

Users will be charged the chosen $ amount every time a trade is made, regardless of whether it is a buy,sell, short or cover. Note:An order is not the same as a trade, if an order is made, but is cancelled or expires before it goes through, the commission is not charged.

-

Position Limit

The maximum amount of one stock(or mutual fund) you can own as a percentage of the total portfolio value. Example:With 25,000$ initial cash and 25% position limit, you can only trade $6,250 in one stock. Meaning you can’t buy more than 6,250$ of AAPL even if you had the money for it. 100% limits are Recommended for beginners. Note: If your portfolio value decreases making the limit lower than what you own in a given stock you will not be forced out of your position.

-

Resets

This allows users in your contest to reset their portfolios to the initial cash. All trades are wiped out, and they start back from the beginning.

-

Assignment

Allows the creation of an assignment to track if your students have performed certain tasks on the website. Learn more about assignments

-

Contest Creation

Click the Green Button once you’ve filled everything out and you’ve created your contest. Don’t worry, you can change everything by hitting the edit button after you’ve created it.

And thats it! You will get a confirmation page where you will find a link to give anyone to register directly in to your custom contests, or they can find it using the “Join Contest” page!